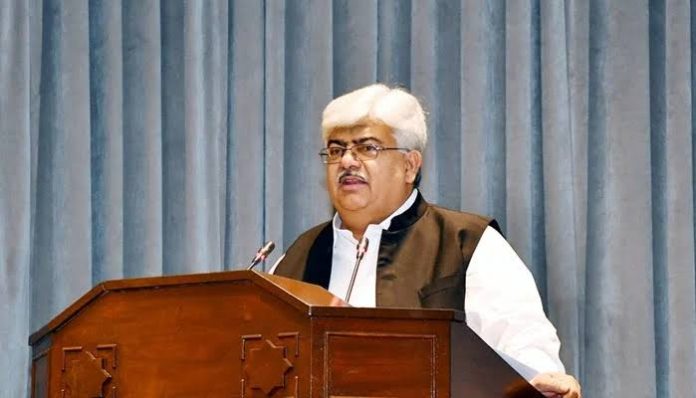

In a recent update to the National Assembly’s Standing Committee on Finance, Chairman of the Federal Board of Revenue (FBR), Rashid Langrial, shared some alarming details about tax collection and hidden wealth in Pakistan. He revealed that out of a population of around 250 million people, only 12 individuals have officially declared assets worth more than Rs. 10 billion. This points to a serious issue of underreported wealth and tax evasion across the country.

Langrial gave an example of Islamabad’s F-6 area—an upscale neighborhood where many people own expensive properties, but their declared income does not match their lifestyle. He said this shows how widespread the problem of hidden wealth really is. He also mentioned that sugar mills have been involved in tax evasion by selling products with unstamped packaging, which avoids taxes. The FBR reportedly has video evidence of this illegal practice.

In addition to discussing tax matters, Langrial addressed changes in the government’s policy regarding Special Economic Zones (SEZs). Under conditions set by the International Monetary Fund (IMF), no new SEZs will receive tax exemptions. Current SEZs that already enjoy tax benefits will lose them by the year 2035. This move is part of a broader effort to reform Pakistan’s tax system and improve revenue collection.

Another important update is related to the property sector. People who want to buy property in Pakistan will now be required to prove that their declared income matches the amount they are investing. This step is meant to reduce the flow of black money into the real estate market and promote financial transparency.

Finally, due to rising tensions between Iran and Israel, there are growing concerns about possible increases in global oil prices. In response, the government of Pakistan has formed a high-level committee to monitor the situation and manage any potential impact on the country’s economy. This committee will help ensure that Pakistan is prepared if oil prices rise suddenly due to the conflict.