The provincial finance ministry of Punjab launches the epay app to simplify the public to government and business to government connections. The finance ministry of Punjab launched this app in collaboration with the Punjab technology board and the central bank.

ePay app brings together twelve tax/levies and four departments inside on platform. The app enables the online payment of duties in just a solo click. It permits the public to repay their token tax, registration of business fees, sales tax on services and facilities, and property tax.

Some additional taxes can also pay through the ePay app. The other taxes are car registration and cotton fee—infrastructure development tax, fard fee, transfer of motor cars tax, and e- stamping.

The ePay facility permits the consumers to simplify their taxes ultimately with OTC, ATM, and internet banking. The challan generates as soon as the payment occurs. This service makes it more convenient to pay taxes with just a single click. According to the function of this app, about 12 levies can pay when using the ePay app.

The Purpose Of This App

The purpose of introducing the ePay app is to make it stress-free for the government of Punjab to collect revenue in preparing taxes .ePay app shows how Pakistan and its government are quickly converting themselves into incorporating financial technology (Fintech). Pakistan’s first-ever digital tax aggregator is working for its user to pay taxes with just a single click.

The ePay app connects all registered banks and the state bank of Pakistan through the 1-link connectivity. The application will permit the users to pay fourteen of their taxes through the three payment approaches or the alternative Delivery Channels (ADCS).

By using The Epay app, the public will no longer have to visit the government branches and wait in long queues to pay the taxes to the government. Technology has made everything easy and hassles accessible for its people.

Modes Of Payment Available?

ePay Punjab govt Pakistan offers three unique payment methods as Alternative delivery channels.

- Internet banking’

- mobile banking

- ATMS

Public also can use the OTC the over the counter banking transactions to pay their dues by physically visiting their nearest bank branch.

How To Use Epay App?

Below is the method that tells how to use the ePay Punjab app to pay the user’s duties digitally.

Step 1: Download The App

Consumers can download the ePay application from the app store or the google play store for the IOS or Android version.

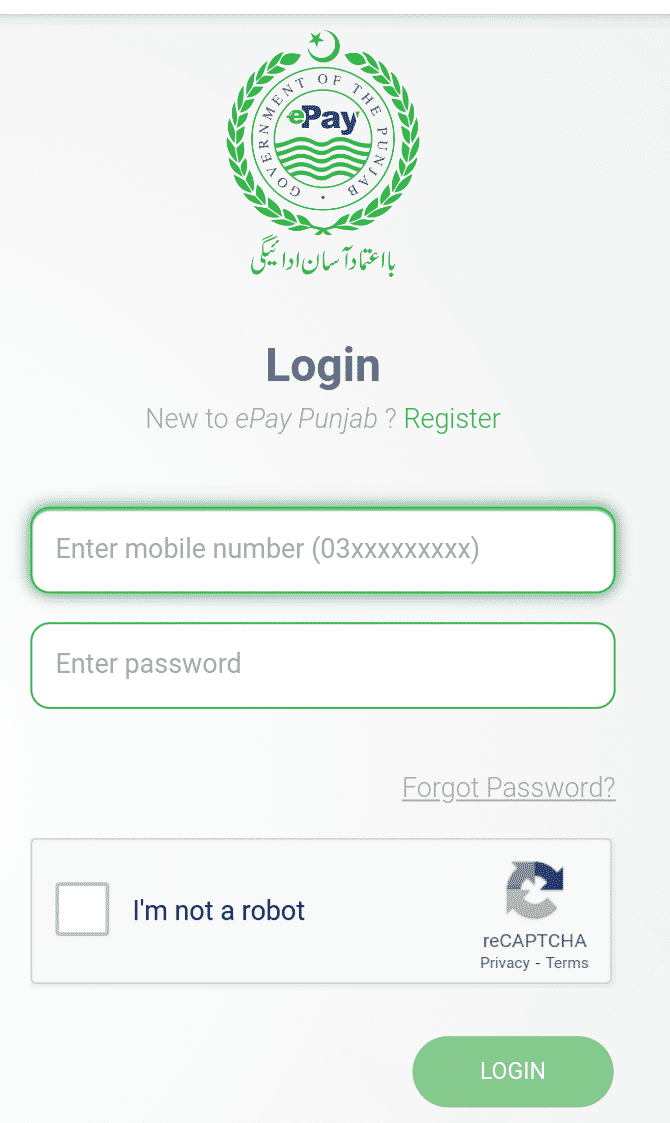

Step 2: Create The Account

Once an individual opens the app, they need to enter all the required details to create an account on the app. The components comprise the name, email address, mobile phone number, and CNIC number.

Step 3: Get The OTP

An OTP is a single click password provided to the user while making an account. The OTP is received through email or on the mobile number. When paying taxes digitally, the individual will need the OTP to log into the app effectively.

Step 4: Choosing The Correct Tax

Once the person logs in to the app, they must choose the correct department for the duty/tax they want to pay and select the correct tax category.

Step 5: Add The Details

Users of the app must provide relevant details. The user must provide personal information according to the taxes paid when paying taxes. It will show that the ePay application can display the data on the screen, comprising the tax they need to pay.

Step 6: Generate Challan

Once the verification is correct of all the details, the users should select the “Generate Challan” option to get the different 17- digit payment slip identification (PSID) numbers and its expiry date. Users can find the directions for every payment method on a similar display screen. The app will notify the individuals if the tax has already been paid.

Step 7: Pay The Dues

Individuals can use their nearest ATM Branch, interbank funds transfer (IBFT), or else 1-link member bank branches to repay their taxes using their PSID. Individuals should pay the due taxes before the PSID expires. If the person didn’t pay the taxes before the PSID expires, they would need to generate the new one by singing the same process again.

The plus point of this app is that the ePay Punjab app is in both Urdu and English. They can use the same process as above to produce the challan conveniently.

Why Is Epay App Popular?

The ePay Punjab App was an enormous achievement for the Punjab government, gathering closely PKR 500 million in its first 100 days. In March 2020, above PKR 1 billion was composed in taxation proceeds by the government of Punjab after enabling the inhabitants with this application.

The PITB also plans to consider several other payment channels in the application. The different channels include Debit/Credit card payments, mobile wallets, payments through TELCO Agent Networks, and direct debits from bank accounts.