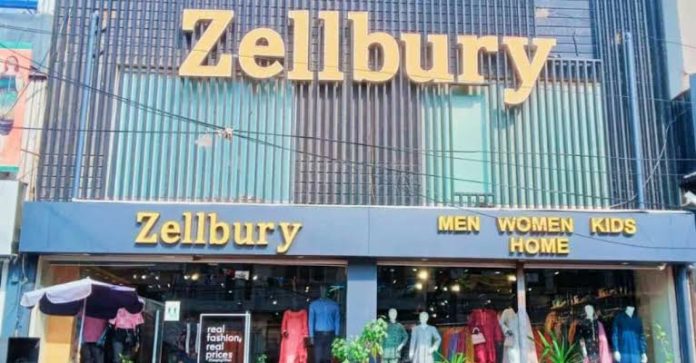

The Large Taxpayers Office (LTO) Karachi has taken action against a Zelbury outlet in KDA Market, Gulshan-e-Iqbal, by sealing the store. This step was taken because the outlet was found issuing sales tax invoices that were not properly verified. The decision to seal the store was made under the directives of the Chief Commissioner of Inland Revenue as part of a broader effort to crack down on businesses that are not following tax regulations.

As per the rules set by the Federal Board of Revenue (FBR), all Tier-1 retailers must issue invoices using a Point-of-Sale (POS) Integrated System. This system helps ensure that sales records are properly documented for tax purposes. However, during routine inspections, tax authorities discovered that the Zelbury outlet was issuing multiple invoices that did not comply with these regulations. Since this was a violation of tax laws, legal action was taken against the store under the Sales Tax Act, 1990.

The outlet will remain closed until further notice as the authorities continue to implement strict tax compliance measures. The FBR is actively working to ensure that all businesses follow the correct invoicing procedures and maintain transparency in their sales records. Retailers are being advised to comply with tax laws to avoid fines, legal action, and the risk of their businesses being sealed. This recent action is a strong reminder that businesses must adhere to regulations to operate smoothly without facing interruptions.