“The excitement in Saudi is something you can feel on-ground…everyone can see where Saudi is going and everyone wants to be part of that action, everyone wants to grab that value…People think it’s a goldrush here,” says Omar Parvez Khan, Co-Founder of Metric App.

His words resonate with the growing buzz among Pakistani startups eyeing the Kingdom of Saudi Arabia (KSA) as their next frontier. The allure is undeniable, but what exactly makes KSA such a promising market, and how can startups navigate the complexities of scaling there?

If you’re a Pakistani founder with proven traction in your local market and are now ready for regional expansion, i2i’s Scale to KSA track is your gateway to success. Apply here!

A Fertile Ground for Growth:

Saudi Arabia’s economic landscape is undergoing a remarkable transformation. The Kingdom boasts one of the highest technology spends in the MENA region, fueled by a large domestic market and a youthful, tech-savvy population, with over 60% under 35. This demographic dividend, coupled with a national push for digital transformation, is creating a fertile ground for tech-based startups.

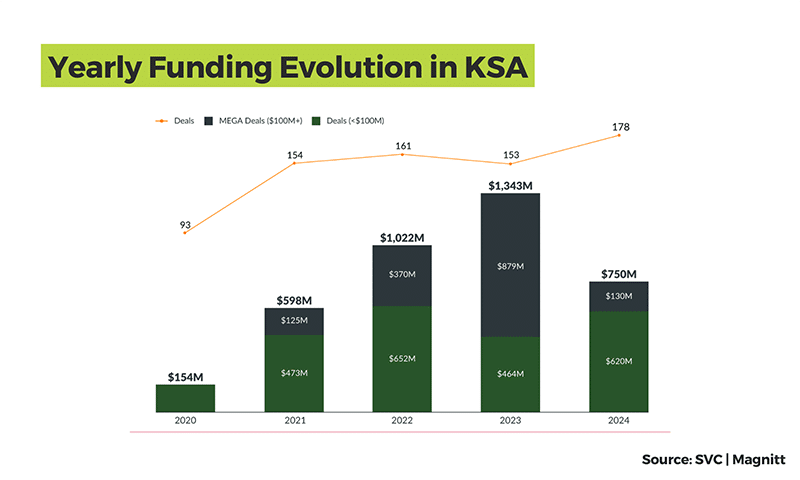

The Saudi Arabian funding ecosystem is rapidly maturing, attracting substantial venture capital. The Kingdom has solidified its position as a leading investment destination in the MENAPT region, with $750 million raised across 178 deals in 2024 alone. Initiatives like Waad and Aramco Ventures are injecting significant capital into the market, providing startups with ample opportunities to secure funding and fuel their growth.

This rapid growth is enabled by The Kingdom’s Vision 2030; a cornerstone of its economic diversification strategy, aiming to reduce reliance on oil and build resilience to oil shocks. This ambitious plan is attracting top talent, increasing global investments, and improving the business environment through relaxed regulations and the creation of special economic zones. Key targets include increasing non-oil exports, boosting private sector contribution to GDP, and enhancing SME participation (evident in the registration of over 1.27+ million SMEs in 2023 alone).

Saudi Arabia’s commitment to technological advancement is evident in its global innovation ranking of 47 out of 132 countries. This is considerably higher than Pakistan’s ranking of 91, further highlighting the disparity in innovation between the two countries.

Navigating KSA’s Business Setup:

Scaling to KSA presents a unique set of challenges, requiring careful planning and execution.

Legal and Regulatory Hurdles: Obtaining a MISA license, while essential, involves significant costs (approximated at SAR 10,000 for the first year, which increases to SAR 60,000 in subsequent years, and an annual license fee of SAR 2,000 per year up to a maximum of five years). Joint ventures with Saudi national companies offer an alternative but can hinder brand recognition. Compliance with Saudization regulations is complex and varies depending on the MISA license type. Generally, Saudization requires a minimum 30% of all employees to be Saudi nationals, with certain roles (such as Senior HR Manager, Personnel Specialist, Recruitment Clerk, Government Relations Officer, Director of Labour Affairs, and more) reserved exclusively for Saudi nationals. Navigating the intricate legal and regulatory landscape demands expert guidance.

Operational Challenges: Setting up banking accounts in KSA can be a significant hurdle. Building a robust local network is crucial. Government portal management (ranging from investment and commerce regulations with MISA, to managing labor and taxation aspects with the Ministry of Labor, and ensuring product safety and municipal compliance with Mudad) ,and the renewal of MISA licenses, Commercial Registrations, and Iqamas, are all further operational hurdles founders face.

Forming Partnerships: Muhammad Taimoor Ali, COO at Bookme, advises “You need to first evaluate if this Saudi opportunity is worth putting in all this cost and focus. You need to test your hypothesis. Try to engage channel partnerships because distribution is going to be a challenge with high CPC and high CAC.” He highlights that Bookme’s success stemmed from early app integrations with 20+ banks and fintechs. However, Pakistani founders often struggle as KSA has highly localized B2B networks, and tapping into these and negotiating deals online is a major struggle.

Market and Cultural Adaptation: Deep localization is crucial. Mian Muhammad Awais, Co-Founder of PayPeople, highlights the need for ensuring products and experiences are not just translated to Arabic, but culturally relevant. Understanding the specific market needs is essential. Building trust and relationships, which is a key component of business in KSA, requires time and cultural sensitivity.

People Infrastructure: Building a strong local team is paramount. Finding the right leadership with deep market knowledge and Arabic fluency, especially a General Manager who can navigate regulatory approvals and build local partnerships, is essential. However, tapping into this talent pool for experienced Arabic-speaking professionals can be difficult for newcomers. Building local credibility requires hiring Saudi-based team members with strong industry connections.

Strategic Solutions and Support:

Overcoming these challenges requires a strategic approach. Wahaj Ahmed, Co-Founder of Retailo Technologies, advises founders to “forget what you know and think like an analyst,” emphasizing the need for data-driven decision-making and expert guidance. Mentorship from founders who have successfully scaled to KSA is invaluable.

Similarly, navigating the complexities of product localization, strategic partnerships, client acquisition, and crafting an effective Go-To-Market (GTM) strategy for the KSA market demands access to a robust network of experts with proven growth experience in the region. i2iScale offers value here by providing founders with invaluable mentorship from individuals who have successfully scaled businesses within KSA.

Muhammad Awais recommends hiring a business setup firm or consultant to navigate the initial complexities of registration and compliance.

Lastly, to scale to KSA, Syed Sair Ali, Co-Founder of Blinkco.io, advises an on-ground presence, signaling commitment to investors and clients.

Your Gateway to KSA Success:

If you’re a Pakistani founder with proven traction in your local market and are now ready for regional expansion, i2i’s Scale to KSA track is your gateway to success.

Our bespoke 3-month accelerator program offers:

- 1:1 mentorship: Gain personalized guidance from founders who have successfully scaled to KSA.

- Valuable connections: Access a network of founders, investors, accelerators and partners.

- Discounted setup support: Streamline your market entry with expert assistance.

We understand the unique challenges faced by startups scaling to KSA. That’s why we’ve partnered with Blossom Accelerator to provide select startups with a free MISA license and discounted access to essential services, including document preparation, company formation, banking introductions, and legal support

To address the high costs of scaling, i2i’s partners at MOITT have launched the BridgeStart Pakistan program which helps founders access international accelerators by covering program and living expenses, easing the financial burden. For founders struggling to access KSA based accelerators, i2i leverages its KSA partner network to provide tailored guidance.

i2iScale is a free, fully remote program supported by the Visa Foundation, designed to equip you with the knowledge, resources, and connections you need to thrive in KSA.

Don’t miss this opportunity! Apply for i2i’s Scale to KSA track by March 17th and embark on your journey to the Saudi gold rush: https://forms.gle/YeRHgi7TULfTAVaP8

Written By: Laiba Ahmed, Invest2Innovate