Financial inclusion is often framed as a milestone in economic development, but real progress lies beyond simply bringing individuals into the formal banking fold. Pakistan witnessed a 35% growth in retail digital transactions and an 85% annual surge in e-wallet users in FY24, with 64% of the population having access to banking services as of 2023, but these numbers alone do not equate to true financial empowerment. The real challenge is ensuring that people are not just account holders but active and engaged participants in the financial ecosystem; managing money effectively, making informed financial decisions and investments, and leveraging banking services to improve their day-to-day lives.

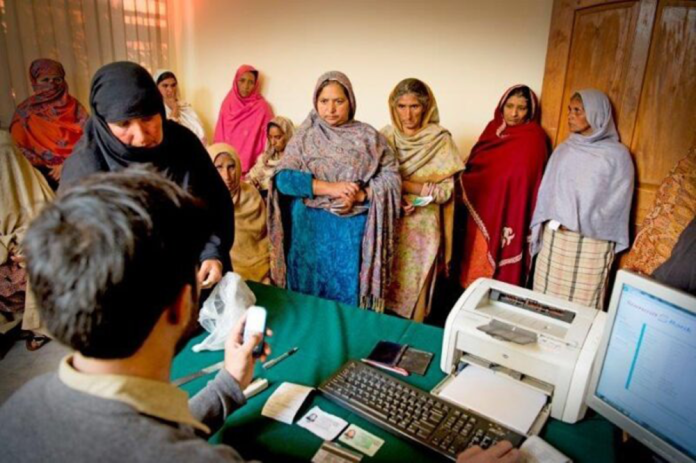

Despite the strides in digital banking, a large population of Pakistani adults remains unbanked, with women and rural populations particularly affected. A significant barrier is the perception that banking is complex, costly, or irrelevant to everyday needs. This perception is often compounded by deep-rooted socio-economic challenges such as limited financial literacy and access to basic infrastructure like reliable internet, which disproportionately affect rural and lower-income communities.While financial institutions have made progress in expanding access, the next phase requires a more personalized approach; one that not only expands access but also enhances usability – provides relevant tools, and overall, builds trust in the system. The State Bank of Pakistan aims to increase financial inclusion to 75% and reduce the gender gap to 25% by 2028, reflecting a strong national commitment to addressing these disparities.

A key issue is that access does not always mean usage; the impact of this 65% inclusion rate has not necessarily yet translated into meaningful impact on the economy as anticipated benefits are yet to be seen. Many open accounts for pensions or salaries but do not actively engage with banking services any further. This stems from poor digital experiences – a lack of user-friendly interfaces, low attention to detail on the quality of customer experience and limited guidance. These are exacerbated by inadequate customer support, leaving a large segment dissatisfied and financially underserved, despite being counted as financially included. Small businesses and informal sector workers also struggle with limited access to credit and capital, preventing them from fully integrating into the formal economy. The increasing poverty rate, which rose to 25.3% in 2024 – up by 7% from previous years – further aggravates these challenges, as economic hardship limits individuals’ ability to save, invest, or participate meaningfully in financial services.

Another challenge is digital dormancy – where users disengage due to poor experiences and revert to cash transactions. App ratings may be high, yet user reviews reveal major frustrations, from unresolved service issues to inadequate support. This highlights a gap between digital access and actual satisfaction.

This is where AI and better digital banking experiences can drive real change. AI enables automations, smarter decision-making, and provides personalised insights. Agentic AI takes this further by offering recommendations, setting financial goals, and automating actions to enhance user experience. Traditionally, only high-net-worth individuals benefited from personalized banking through dedicated relationship managers, while most customers have navigated services alone. AI democratizes financial guidance, offering real-time advice, seamless support, spending insights, and credit access tailored to individual needs. Instead of offering one-size-fits-all solutions, banks can leverage AI-driven models to provide real-time financial advice, spending insights, micro-investment opportunities, and credit accessibility based on individual needs – services that are simplified and made accessible to every stratum of society. This shift from transactional banking to proactive financial management is where the real potential of financial inclusion and true accessibility lies.

For example, AI can detect irregular spending patterns and offer budgeting assistance. It can also re-engage dormant users through personalized nudges and better-designed digital platforms. AI can analyze a small business’s cash flow to recommend optimal credit options. Women can particularly benefit from AI-driven financial education and microfinance solutions tailored to their specific needs. This technology ensures that financial empowerment is not limited by socio-economic status but is instead driven by data, accessibility, and a user-friendly experience.

However, technology alone is not the solution. The success of AI-driven financial inclusion depends on trust, transparency, and responsible data usage. A purely digital approach risks alienating segments of the population that are hesitant to engage with AI-driven banking due to lack of financial literacy or digital access. A hybrid approach – combining AI with human support and financial education – must accompany technological innovation to ensure solutions are simple, ethical, and inclusive.

Mashreq recognizes these challenges and, as it launches its operations in Pakistan, is committed to enhancing customer engagement, not just providing access. True to its vision of being a ‘Bank for All’, Mashreq is introducing customer-first, AI-powered banking solutions designed to improve digital experiences and ensure customers fully benefit from financial services. The bank’s commitment to financial inclusion is reflected not just in offering access, but in providing tools and guidance that promote active engagement with financial services and benefiting from it. From AI-driven financial advisory tools and real-time transaction insights to hyper-personalized digital banking experiences, Mashreq aims to ensure that all customers – regardless of income level – receive the support they need to thrive financially.

Pakistan is at a critical economic inflection point. The infrastructure for financial inclusion is expanding, digital banking adoption is rising, and fintech innovation is accelerating. The real test lies in whether these advancements drive active financial participation and real empowerment. Banks must go beyond offering access and actively help individuals grow their financial confidence, secure their assets, and build long-term economic resilience. AI is not just a tool for automation – it is a catalyst for enhanced digital engagement, reduced dormancy, and bridging the gaps between financial inclusion, access, and well-being.

This insightful opinion piece is written by Muhammad Hamayun Sajjad, CEO of Mashreq Pakistan.