“To my way of thinking, the most critical area of financial cooperation under CPEC moving forward must be the development of robust cross-border financing mechanisms, including RMB-PKR settlement frameworks, syndicated lending structures, and project-specific risk mitigation tools such as guarantees and insurance.”

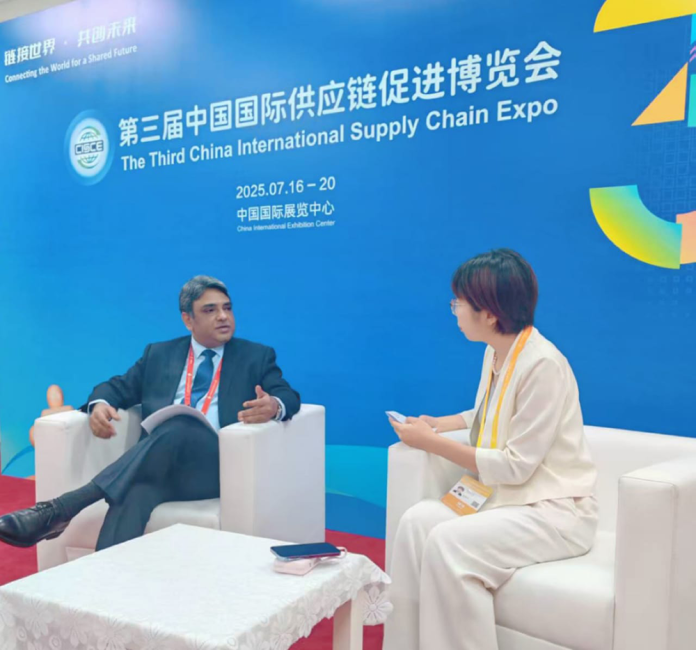

During the 3rd China International Supply Chain Expo (CISCE), Chief Representative, National Bank of Pakistan (NBP) Beijing Office, Shiakh Muhammad Shariq, told in an exclusive interview.

The reporter learned that since its establishment in 1981, the NBP Beijing Office has provided localized financial services to various Chinese companies investing in Pakistan, especially in key sectors like infrastructure, energy, and telecom under CPEC.

“Especially in Gwadar Port, we’ve supported banking arrangements for port operations, freezone development, and logistics projects, ensuring smooth financial coordination for Chinese enterprises,” the Chief Representative emphasized.

He added that Chinese companies expanding into Pakistan also face challenges related to regulatory compliance, banking procedures, tax structures, and local operational risks. Differences in legal frameworks, approval timelines, and repatriation of funds can also pose hurdles. “Thus, to address these issues, localized financial support, advisory services, and close coordination with regulators are essential. we assist them by providing on-ground guidance, facilitating smooth banking transactions, and helping navigate legal and compliance matters to ensure business continuity and confidence.”

“Through years of efforts, we are actively working to support cross-border e-commerce between China and Pakistan, facilitating cooperation through payment solutions, trade finance, and regulatory alignment.” Mr Shariq told. “For instance, through our collaboration with UnionPay International, we help enable smoother digital transactions for Chinese businesses operating in Pakistan. NBP also engages in cross-border e-commerce initiatives to support payment collection, trade settlement, and financial infrastructure that benefit major platforms indirectly. As e-commerce continues to grow, we see strong potential for deeper integration in areas such as RMB settlement, digital wallets, and online escrow services.”

For decades, China’s series of measures to continue to expand opening up in the financial sector have also had a significant impact on NBP’s business in China. The Chief Representative believes that China’s continued financial opening-up reflects a clear commitment to deeper global integration and high-standard development. “Since NBP established its presence in China, we’ve witnessed significant policy advancements from easier market access and improved regulatory transparency to the promotion of cross-border payment system and RMB internationalization. These measures have not only enhanced the operating environment for foreign financial institutions but also created new pathways for cooperation, especially under the CPEC.”

As for the supply Chain Expo, Mr. Shariq introduced his in-depth insights into the chain. He emphasized that with the development of CPEC and deepening financial cooperation, the two countries are witnessing the emergence of a “financial chain” that complements physical trade routes, in which includes coordinated banking networks, cross-border payment systems, trade finance, and investment facilitation-all of which strengthen the resilience and efficiency of bilateral supply chains.

“To play a greater role globally, both countries can focus on digitalizing financial infrastructure, promoting local currency settlements (like RMB-PKR), and developing joint financing platforms for cross-border projects. By aligning regulatory standards and expanding financial connectivity under initiatives like CISCE, China and Pakistan can become vital enablers of more secure, diversified, and inclusive global supply chains-particularly for developing economies.”