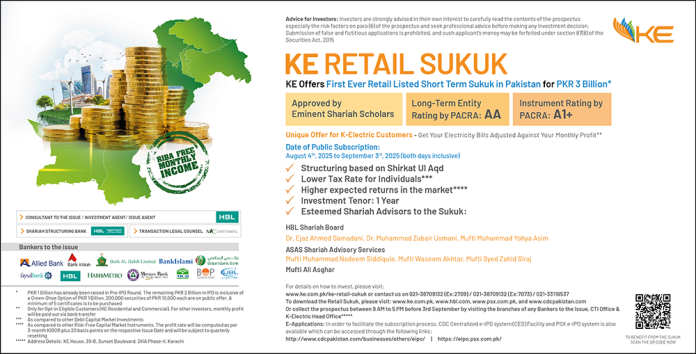

In times of rising inflation and significant power sector challenges, there is a need for stronger financial standing. In an attempt to introduce new investment avenues for the general public, K-Electric has come up with an innovative initiative of launching a publicly listed Sukuk. This is an Islamic financial instrument that allows investors to earn returns without engaging in conventional interest-based transactions.

As an alternative to traditional bonds, the Sukuk offers both institutional and primarily retail investors an ethical and structured way to support economic growth while ensuring stable returns. K-Electric is launching this short-term Sukuk which can be a potential game-changer. Not only does it provide liquidity to the energy company but also offers its customers and largely investors an opportunity to participate in the distribution operations of the organisation.

Retail Sukuk introduces a unique feature of bill prepayment, enabling K-Electric Residential and Commercial customers to reduce their monthly electricity bills by having their sukuk profits adjusted against them. Traditionally, power sector companies in Pakistan have depended on government subsidies and external loans, an unsustainable option in the long run. Sukuk provides an independent source of funding, fostering general public participation.

Pakistan’s power sector struggles with liquidity shortages, outdated infrastructure, and an overreliance on government-backed loans. Sukuk financing provides an effective mechanism for energy companies to raise capital without adding to circular debt.

Energy companies often face cash flow constraints due to delayed payments and high operational costs. Sukuks can help bridge this gap by allowing direct participation from investors—both institutional and retail—who invest in short-term and long-term Islamic instruments. These funds can then be used to enhance the power supply chain, invest in new infrastructure, and improve overall efficiency.

K-Electric has played a pivotal role in utilizing Sukuks as a medium for raising financing for working capital and infrastructure improvements. Since 2022, the company has issued 33 short-term privately placed Sukuk instruments, successfully raising over PKR 172 billion through these offerings. This demonstrates the viability and scalability of this financial model in addressing power sector challenges. Opening short term sukuks for public investments can definitely change the game.

The increasing adoption of Sukuk signals a positive shift towards sustainable and responsible financing in Pakistan’s power industry. With regulatory support and market confidence, Sukuks can improve energy sector efficiency by ensuring adequate liquidity for power companies.

By leveraging Shariah-compliant financial instruments like Sukuks, Pakistan’s power sector can overcome key financial challenges, ensuring reliable energy access and long-term economic stability. With continued innovation and strategic adoption, Sukuk will play a critical role in shaping the future of energy financing in the country.

By Hadia Arif