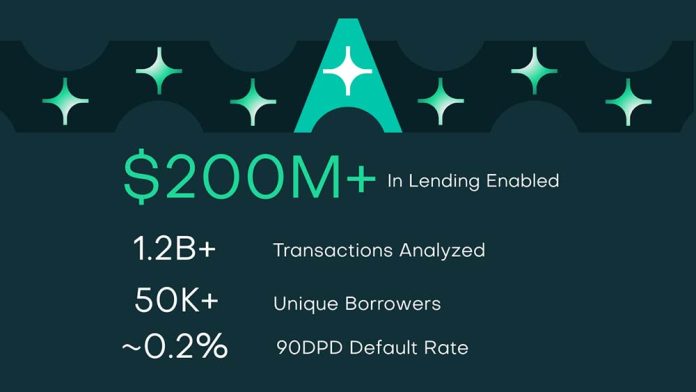

AdalFi crosses $200M+ in partner lending with 0.2% defaults. Its AI model has processed 1.2B+ transactions, evaluated 30M+ borrowers, and learns from 50K+ repayments monthly as it expands internationally.

Every startup wants compounding advantage. AdalFi is an example from Pakistan’s fintech scene where product momentum and disciplined risk move together. The company confirms more than $200M in lending through banking partners with defaults at 0.2%. Its AI model has processed 1.2B+ transactions and evaluated 30M+ borrowers. The model learns from 50K+ repayments each month, turning outcomes into better selection. That flywheel is how local tech becomes regional infrastructure.

AdalFi’s product is a full-loop system. The team calls it the AdalFi Lending Loop — Assess → Activate → Disburse → Optimize — and it is designed so every loan makes the next one smarter. The Assess layer runs on the AdalFi Analytical Architecture, which ingests core, open banking and bureau data to generate explainable, policy-aligned scores. Because it continuously refreshes the deposit base, banks can keep pre-approved pools warm and ready.

Activation converts eligibility into action. Personalized, event-driven outreach runs across SMS, email, push, in-app and agent-led channels. The system uses behavioral signals to time messages and unify CRM workflows so prospects move through the funnel without manual handoffs.

Disbursement is where speed matters. For prequalified profiles the journey is designed to complete in under a minute with SDKs and APIs embedded in mobile, web and branch. Pre-integrations with Oracle FLEXCUBE, Temenos and Symbols help banks launch quickly without multi-quarter build cycles.

Optimization makes the loop compound. Portfolio signals on balances, income stability and repayment performance feed back into the scoring environment. Early warnings trigger targeted engagement to protect portfolio health before issues escalate.

The learning engine runs on two loops. The inner loop learns on-prem at each bank from daily transactions and outcomes. The outer loop shares anonymized model performance updates across partners, drawing on patterns from more than 50K repayment events monthly without sharing raw data. That approach balances learning with privacy and makes each deployment better than the last.

Startups care about time to value. AdalFi lays out a 12-week blueprint from concept to launch with structured milestones for model testing, policy setup, journey design, integrations and campaign activation. Teams move to production in weeks, which is crucial when budgets and stakeholder patience are finite.

Leadership is scaling with the product. Recent senior additions — Ian Read heading Credit Excellence, Emre Unlusoy leading MEA sales — strengthen governance and go-to-market as the company expands abroad. For Pakistan’s startup community, AdalFi’s trajectory shows how a clear system design can scale from early traction to regional impact.

Explore the platform at AdalFi.