In a first-of-its-kind innovation, a Karachi wedding this weekend introduced digital salami through the State Bank of Pakistan’s Raast QR system, turning a centuries-old cultural tradition into a modern, cashless experience.

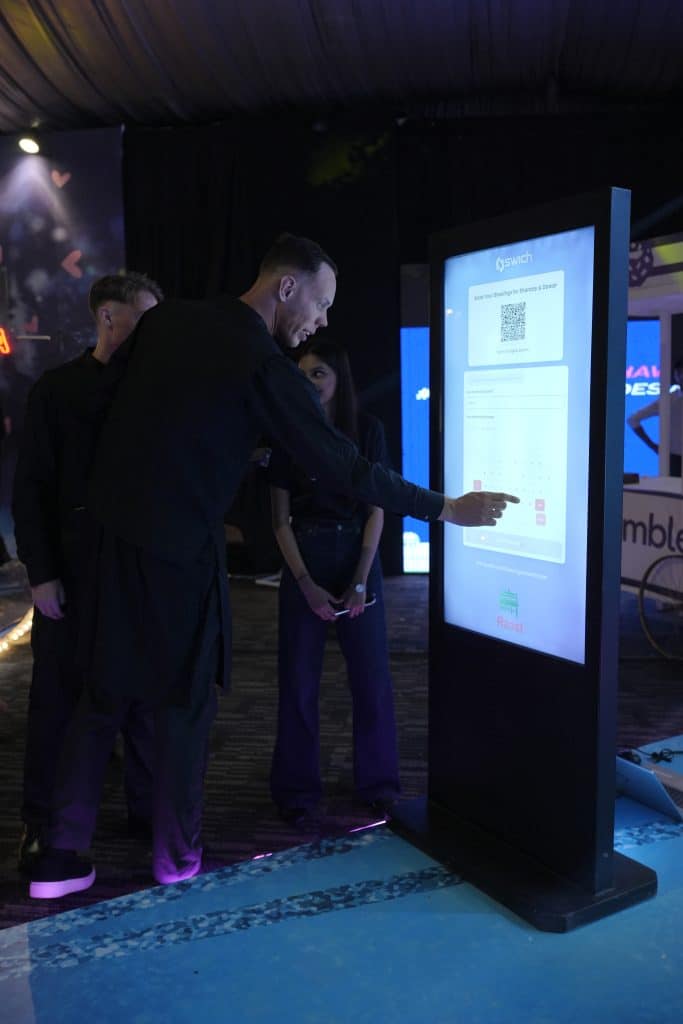

Guests were invited to bless the newlyweds not with cash-filled envelopes, but by scanning a Raast QR placed by fintech company Swich. The small, elegantly designed QR at the entrance caught the eye of every guest walking in.

For decades, “salami,” the cherished practice of giving money to the bride and groom as a token of blessing, has been deeply woven into South Asian wedding culture. While the tradition holds sentimental value, it has long carried practical inconveniences: guests scrambling for cash, envelopes forgotten at home, and couples sorting piles of money the next day.

But the winds of change are here. The Karachi wedding experiment, enabled by Swich’s digital payments technology, fused tradition with innovation, echoing a broader global movement toward cashless events. Countries like India and Singapore have already normalized QR-enabled wedding gifting through platforms such as Paytm and PayNow, allowing seamless digital transfers as part of the celebration.

In Pakistan, the rise of digital payment platforms and the launch of Raast, a State Bank initiative enabling instant, zero-cost transfers, has paved the way for new social use cases. With smartphone penetration crossing 52% and cashless retail payments steadily growing, experts believe weddings could become the next frontier for digital adoption.

Guests at the Karachi event were intrigued, even amused, by the novelty. Many called it a “relief from the envelope hunt,” while others saw it as “the future of gifting.” One guest noted, “I hope more weddings start using this. It saves us time, makes things safer, and the couple gets the blessings instantly.”

As Pakistan accelerates its digital payments journey, this wedding might just mark the start of a new tradition, where blessings travel at the speed of a QR scan.