Bank Alfalah, a leading commercial bank in Pakistan and the International Finance Corporation (IFC) formalised a Green Banking Advisory Agreement. This agreement underscores Bank Alfalah’s dedication to fostering sustainable and accountable green banking practices. It follows the Bank’s successful adoption of the State Bank of Pakistan’s (SBP) Environmental and Social Risk Management (ESRM) framework, aligning with the Green Banking Guidelines introduced in October 2017.

The collaboration with IFC will encompass several key initiatives. Through this engagement, IFC will leverage its global expertise in supporting Bank Alfalah in developing a green banking roadmap and own-impact measurement capabilities and exploring avenues for sustainable financing. Additionally, the partnership will empower Bank Alfalah to explore avenues in sustainable finance, leveraging IFC’s global network.

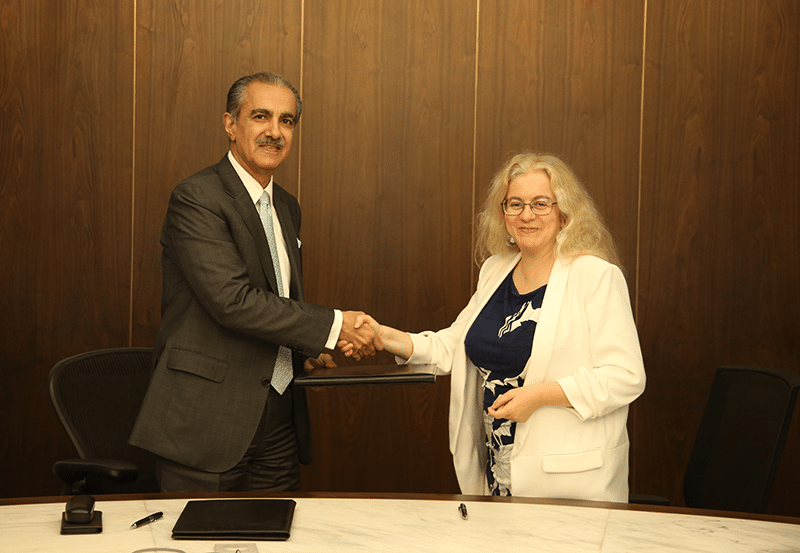

Expressing commitment to advancing sustainable development in Pakistan, Atif Bajwa, the President and CEO of Bank Alfalah, stated, “Bank Alfalah is committed to playing a leading role in promoting sustainable development and looking forward to embarking upon the journey towards green banking. This partnership with IFC will reinforce our green banking capabilities, contributing to a greener future for the nation.”

Hela Cheikhrouhou, IFC’s Regional Vice President for the Middle East, Central Asia, Türkiye, Afghanistan, and Pakistan, commented, “IFC is pleased to partner with Bank Alfalah to support its ambitious green banking agenda. With this engagement, we hope to highlight the potential of green banking in Pakistan and help encourage greater climate financing led by the country’s private sector.”

Bank Alfalah’s decision to engage IFC as its green banking advisor stemmed from various factors, including IFC’s extensive track record in shaping green banking business models and its adeptness in policy development, including collaborations with SBP.