Public data from the Pakistan Automotive Manufacturers Association showed an 80% year-on-year decline in sales of locally assembled new light vehicles, amounting to only 4,463 units in April 2023. Consequently, cumulative sales for the year dropped by 66.5%, reaching a mere 30,753 units. Scanning the headlines of news articles available online, terms such as “shutdown” and “halt” dominate the discourse on Pakistan’s automotive industry.

“Starting this year, Pakistan has encountered unprecedented challenges, not only in the automotive industry but across various sectors. Many import-dependent industries and manufacturing sectors are grappling with production shutdowns and halts—a phenomenon that has become a normality.” explained Shi Qingke, the vice president of Great Wall Motors, “We have also encountered car parts shortages, similar to most of other automotive companies. However, the problem has been considerably mitigated, and we have no issues with the supply chain.” Shi stated with confidence.

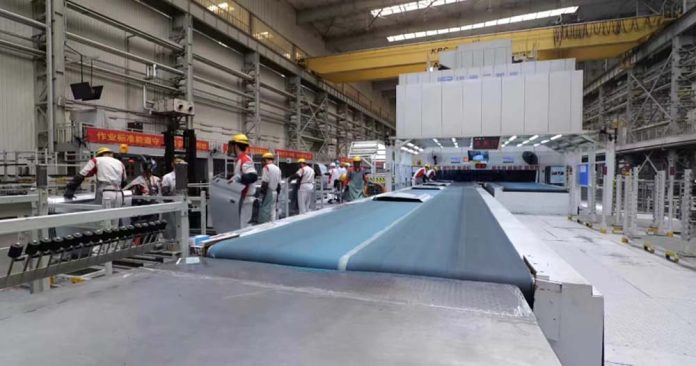

Last year on September 1st, in an event held in Lahore, Great Wall Motors (GWM)’s first factory in Pakistan has officially commenced production, with an annual production capacity of 20,000 units. Adding to the excitement, on November17th, the GWM Haval H6 HEV made its official debut in Lahore. This news sent shockwaves through the industry as it signifies several groundbreaking achievements, notably being the “first locally assembled new energy hybrid model” in Pakistan.

“Great Wall Motors is the first brand to achieve local assembly of hybrid vehicles in Pakistan, surpassing even Japanese brands, which have been deeply rooted in Pakistan for over 30 years,” Shi shared. He further stated, “Moving forward, GWM will progressively introduce plug-in hybrids and fully electric models, bringing the latest in new energy technology to Pakistan and facilitating the country’s transition from traditional fuel-powered vehicles to new energy vehicles.”

Since the implantation of China-Pakistan Economic Corridor, Pakistan, with its immense market potential and economic vitality driven by a population of 220 million, has attracted the attention of numerous foreign investors. With the continuous improvement of infrastructure, Chinese automotive companies have not only provided a wider range of products for Pakistani consumers but have also established assembly plants in Pakistan, ambitiously striving to become industry leaders despite the economic turbulences.

“Pakistan, the world’s fifth most populous country, has a vehicle ownership rate of less than 20 per 1,000 people. In contrast, China reached a rate of 230 vehicles per 1,000 people in 2022. This demonstrates that Pakistan holds unlimited market potential,” said Shi Qingke, Vice President of Great Wall Motors Group, in an interview.

“Currently we are over booking,” Mian Muhammad Ali Hameed, COO of Sazgar Engineering Works Limited, GWM’s partner in Pakistan, shared his insights.

“The auto sector in Pakistan was dominated by Japanese vehicles. Unfortunately, the vehicles brought by them were outdated models.” Faced with the dominance of Japanese brands in the light vehicle sector, some Pakistani local manufacturers have been seeking breakthroughs. “The world is shifting towards new energy sources, and I believe Pakistan will catch up. Our partner (GWM) has a strong presence in the new energy sector, which is why we chose to collaborate and jointly explore the new energy market.” Moreover, Hameed said that Great Wall Motors’ extensive experience in developing and manufacturing right-hand-drive vehicles across various countries facilitated its entry into the Pakistani market without significant obstacles.

“By establishing the assembly plant in Pakistan, we addressed a significant employment concern for our local population, employing thousands of people. More importantly, our future efforts will center on achieving localized manufacturing of specific car parts, lowering import costs and better serving Pakistani consumers. At the same time, this will usher in a technological revolution in Pakistan’s automotive manufacturing industry,” Hameed explained.

Latest data revealed that the GWM Haval ranked fifth among foreign vehicle brands, with 857 units sold in first 4 months, securing a market share of 2.8% and SUV segment share of 12.5%. From January to April, though the overall market fell by 49% month on month, GWM increased by 94% month on month.