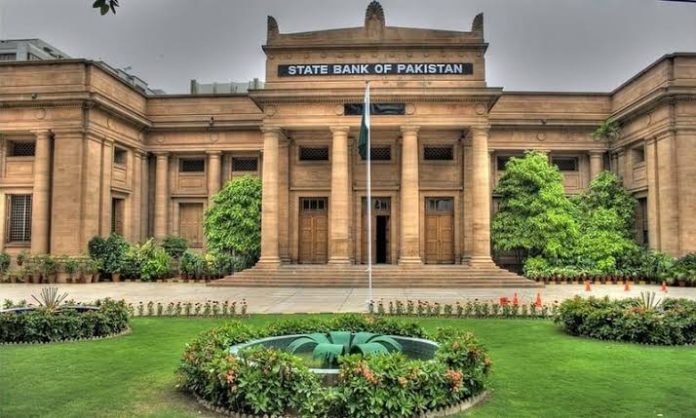

The State Bank of Pakistan (SBP) has shared its plan to bring virtual assets into the legal financial system and to launch a digital rupee backed by the central bank. This major step was announced by SBP Deputy Governor Dr. Inayat Hussain during a briefing to the Senate Finance Committee.

He confirmed that the earlier advisory which labeled cryptocurrency as “illegal” will soon be withdrawn. This change will open the door for a proper and regulated framework for digital assets in Pakistan.

To manage this new system, the government will introduce the Virtual Asset Bill 2025. The bill will also establish a new body called the Virtual Asset Regulatory Authority (VARA).

This authority will be responsible for granting licenses, regulating activities, and keeping track of all transactions involving virtual assets.

Under the new rules, virtual assets will be allowed to move and be exchanged within Pakistan. However, they will not be usable for buying goods, services, or for making investments outside the regulated network.

This restriction is being put in place to maintain compliance, ensure safety, and protect consumers from potential risks.

Pakistanis are already heavily involved in the cryptocurrency world, with reports estimating investments of around $21 billion. This highlights the urgent need for a legal framework that provides both structure and security.

The SBP is currently working with different technology partners to develop the digital rupee. Once launched, this digital currency will provide a safe and reliable way for people to use virtual assets while staying within a legal and regulated environment.