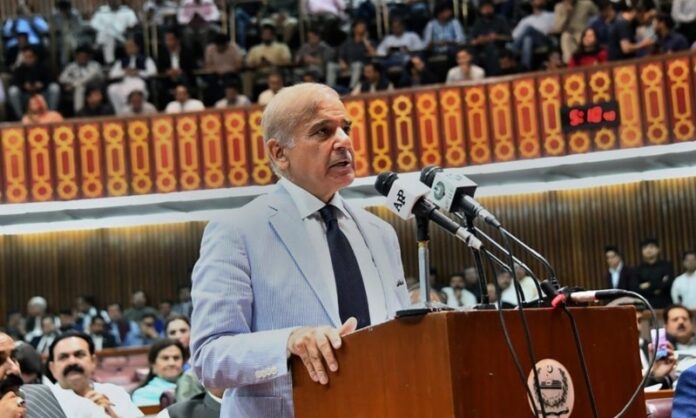

The Prime Minister Shehbaz Sharif-led federal cabinet on Tuesday approved the imposition of a 25 percent sales tax on luxury items, fulfilling another condition set by the International Monetary Fund (IMF) for the revival of the $7 billion Extended Fund Facility (EFF), which has been stalled for months.

The cabinet approved a 25 percent general sales tax (GST) on luxury items through a circulation summary. The formal notification will be issued by the Federal Board of Revenue in the coming days. The summary approval was taken from the circulation for the notification of 25 percent ST from the federal cabinet.

Now the Federal Board of Revenue (FBR) will issue a notification, and the new rate will be effective from March 1.

The items on which 25 percent GST was imposed included aerated water and juices, imported cars, mobile phones, cat and dog food, sanitary and bathroom wares, carpets (excluding Afghanistan), chandeliers and lighting devices or equipment, chocolates, cigarettes, confectionary items, corn flakes, etc., cosmetics, shaving items, tissue papers, crockery, decoration/ornamental devices, doors and window frames, fish, footwear, fruits and dry fruits, furniture, home appliances (CBU), luxury leather jackets and apparel, mattress and sleeping bags, frozen or processed meat, mobile phone (CBU), musical instruments, arms and ammunition, shampoos, sun glasses, tomato ketchup and sauces, travelling bags and suitcases.

Also, the federal government imposed a 25 percent GST levy on locally produced luxury automobiles with displacements of 1,400 cc and higher.

By increasing the GST rate to 25% for a four-month period, the FBR expects to raise an additional Rs 15 billion in taxes.