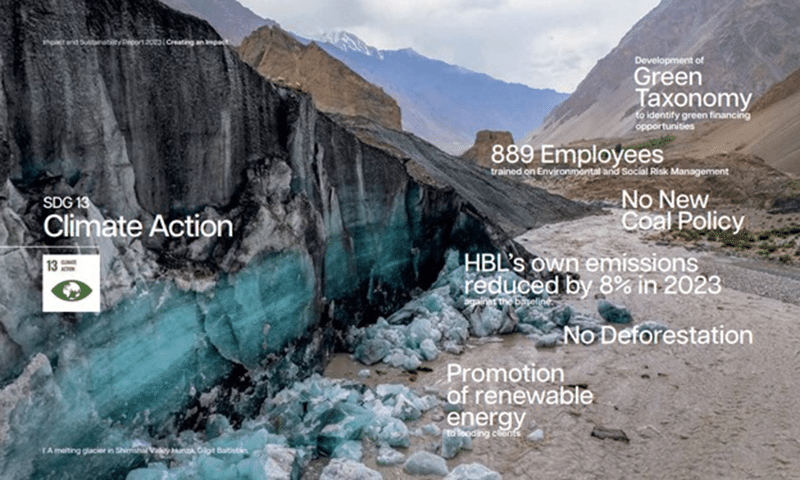

HBL aims to achieving Net-Zero by 2030 and stresses on Financial Inclusion

Upholding the values of the Aga Khan Development Network (AKDN), HBL continues to redefine its role beyond that of a traditional financial institution. The Bank has reaffirmed its commitment to fostering positive change through climate action, financial inclusion, and poverty alleviation, as showcased in its recently launched Impact & Sustainability Report 2023.

The report highlights HBL’s remarkable progress in aligning profitability with long-term impact & sustainability, emphasizing its dedication to achieving net-zero emissions by 2030. Among the Bank’s key milestones in 2023 were solarizing 235 premises, investing Rs 36 billion in renewable energy projects producing over 3,700 MW electricity, and expanding initiatives to promote diversity, equity, and inclusion across its operations.

Driving Sustainability and Economic Inclusion

In his remarks, Sultan Ali Allana, Chairman – HBL emphasized the Bank’s unwavering commitment to sustainable development “For two decades, we have consistently seized opportunities to promote sustainable development and foster prosperity in the country. Building on the ethos of Aga Khan Fund for Economic Development (AKFED), we seek to enrich the lives of those we serve. As financial literacy and inclusion remain our directional vectors, we are cognizant of the need to constantly innovate and leverage technology.”.

HBL’s inclusive approach has extended banking services to over 36 million individuals across Pakistan, including segments previously considered un-bankable. Its SME, Agri, and Microfinance arms have played a pivotal role in ensuring accessibility to financial resources for underserved communities.

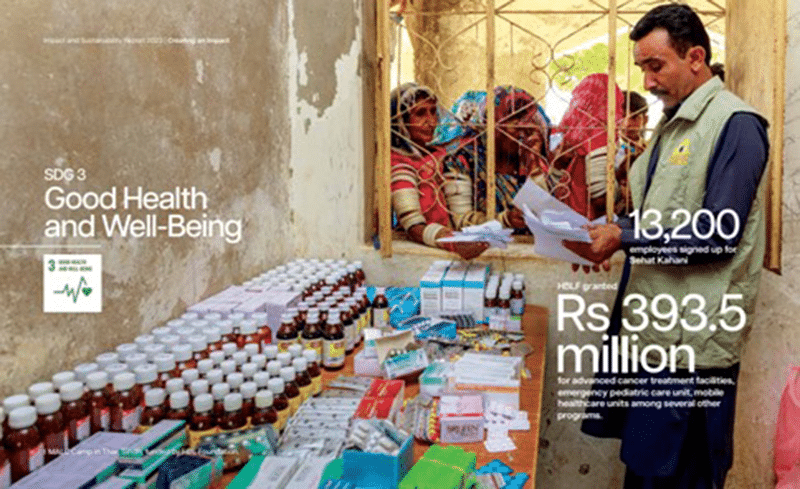

In 2023, the HBL Board increased the Bank’s contribution to the HBL Foundation from 1% to 1.5% of post-tax profits. This enhancement enabled the Foundation to expand its reach in critical areas, including healthcare, education, and community development. With direct contributions surpassing Rs 3 billion, the Foundation has positively impacted nearly 10 million lives across Pakistan.

Key Achievements in 2023

The Impact & Sustainability Report 2023 documents several notable accomplishments:

- Solarization of 204 branches, 31 offsite ATMs, and 60 HBL Microfinance Bank branches, reducing over 500 metric tons of carbon emissions.

- Investment of Rs 36 billion in renewable energy projects, including solar-powered tubewells and biogas plants, generating over 3,700 MW electricity.

- HBL Foundation allocated Rs 82 million to educational infrastructure, benefiting over 18,000 students.

- Vocational training programs supported by HBL Foundation for 11,500 individuals, enabling sustainable livelihoods.

- Rs 100 billion disbursed to 345,000 farmers through HBL Microfinance Bank and HBL Agri, bolstering agricultural productivity and food security.

- Introduction of HBL Zarai Services Limited, Pakistan’s first agricultural extension services subsidiary, to support small and medium-scale farmers.

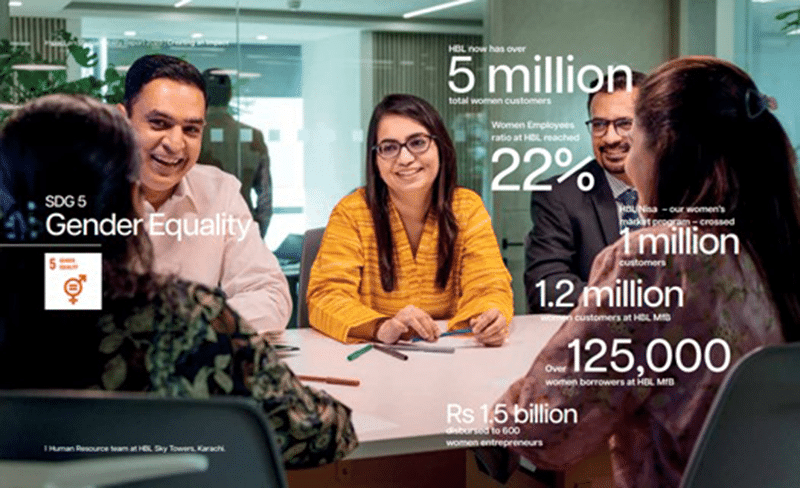

- Rs 1.5 billion in financing for 600 women entrepreneurs, advancing economic participation.

- Expansion of SME lending to over Rs 100 billion, focusing on small businesses, women entrepreneurs, and freelancers.

Focus on Financial Literacy & Inclusion

HBL has emerged as a leader in promoting financial inclusion through innovative solutions such as HBL Konnect, which has brought millions, particularly women, into the formal financial sector. The platform continues to empower individuals and small businesses by providing accessible and tailored banking solutions. The Bank has also made financial literacy a part of its core strategy and is taking National Financial Literacy Program to the very grassroots of the communities they serve.

Investing in Renewable Energy and Social Development

The Bank’s commitment to sustainability is evident in its substantial investments in renewable energy projects, including community-based solar and biogas initiatives. These efforts have significantly reduced carbon emissions while ensuring energy access for rural communities.

In 2023 HBL Foundation has made meaningful contributions of Rs 515 million to healthcare and education, enhancing infrastructure to support better learning environments for students and providing advanced healthcare services to underserved populations.

Sustainability as a Core Value

HBL’s internal operations reflect its dedication to sustainability, with eco-friendly initiatives such as branch solarization and green infrastructure investments, the Bank is aiming to achievenet-zero emissions by 2030 and underscores its leadership in climate action.

A Catalyst for Sustainable Development

Through its integrated and multi-pronged approach to sustainability, HBL has solidified its position as a catalyst for economic, social, and environmental progress in Pakistan. The Impact & Sustainability Report 2023 provides a comprehensive overview of the Bank’s achievements and its alignment with the United Nations’ Sustainable Development Goals (SDGs) and Global Reporting Initiative (GRI) standards.

HBL invites stakeholders and the public to explore the report and learn how the Bank is driving meaningful change. The full report is available at www.hbl.com/sustainability.

With its unwavering commitment to innovation, inclusion, and sustainability, HBL continues to shape a brighter future for Pakistan, ensuring its impact extends far beyond banking.