EOBI Employment advanced age Benefit foundation is heavily influenced by the Ministry of abroad Pakistanis, and HR improvement is an administration organization for government representatives. It framed EOBI in 1976 for the public authority workers to give a benefit at their advanced age.

How To Apply For EOBI Pension

In this program, a registered employee contributes some part of their monthly salary during the period of their employment. The government sets the percentage for each employee, and they return this money at their old age as a pension in their retirement.

When an individual is enrolled in EOBI, he stays a piece until he leaves the work and joins another business. EOBI guaranteed the representative that their cash is saved and will help in their advanced age period.

The benefits are typically presented at 60 years old and following 15 to 20 years of administration, and that representative who doesn’t work because of ailment and cases an annuity. This foundation guarantees administration for those who do government occupations in Pakistan.

- This plan is worked under the Employees’ Old-Age Benefits Act, 1976, and covers representatives working in modern, business, and different associations. The Employees Old-Age benefits foundation (EOBI) works with the arrangement of this advantage by playing out the accompanying capacities.

- Identification and Registration of Institutions as well as Businesses.

- Documents and Recording of Assured individuals

- Group of Contributions

- EOB Fund Management

- The facility of Assistances according to Laws

The EOBI remains the Government organization that works under the Ministry of Overseas Pakistanis and Human Resource Development. EOBI was framed in 1976, to give annuity, advanced age advantages, and social protection to enlisted representatives.

The enlisted representative and the business of the enrolled individual need to contribute some level of compensation to EOBI during the time of insurable work. Businesses need to pay 5% of the base wages set by the public authority. Then again, the guaranteed representative needs to pay 1% of the base wages.

Eligibility Criteria

EOBI has qualification models for government workers to guarantee benefits from the public authority. Hence, know qualification measures before applying for benefits in EOBI.

- All organizations, rather than industry, can add to this plan except representatives of the state, police faculty, military, neighborhood bodies, and other nearby specialists.

- The organization has over five workers who can enroll their representatives for an annuity.

- The individual should be an administration worker, since private-area representatives are not qualified for benefits.

Advantages of EOBI

Above we examine How to Apply for EOBI Pension and presently in the accompanying, you’ll have its advantages. Business advanced age benefits establishments give a few advantages to safeguarded or enlisted workers at their advanced age. These are the accompanying advantages of EOBI to government representatives.

The public authority of Pakistan likewise gives assets to EOBI. It likewise puts resources into productive tasks to create pay which is used for giving annuity to the safeguarded people. The base annuity of a safeguarded individual is Rs. 6500.

Exceptional Associate to PM for Out of the country Pakistanis and Human Resource Development, Zulfiqar Bukhari declared last year that base benefits presented by EOBI will be expanded from 6500 to 8500 Pkr.

Advanced (old) age benefits

EOBI offers benefits to representatives at their advanced age, which is beneficial for them. The representatives who complete their 15-year administration and age limit are qualified for benefits. An individual gets an annuity after retirement and within a half year of asserting the benefits.

Deficiency benefits

If the representative is debilitated for a brief time frame or for all time, he is given shortcoming benefits. They began these benefits within a half year of the case dependent on a clinical report. Notwithstanding, on the off chance that the representative cripples for a lifetime, they convert these shortcoming benefits into a lifetime deficiency annuity for a worker.

Survivor’s Annuity

Survivor’s annuity is given to the representative’s folks and widow after his demise. According to the EOBI rule, the matured guardians and widows are qualified for a survivor annuity.

The guardians take the benefits for around five years, and the widow takes it for a lifetime. For instance, if the representative completes three years of work, the widow gives lifetime benefits. Regardless of whether the widow gets a subsequent marriage, they will give benefits to their youngsters’ lifetime.

Advanced Age Award

Advanced age awards are for the individuals who complete their administrations and get resigned yet don’t meet the benefits prerequisites. This award pays in a solitary portion and contains a month’s normal wages duplicated by their long stretches of government work in Pakistan.

What is The EOBI Verification Check Online

Similar to many other sectors, the management has newly digitalized the EOBI organization portal for residents. With the help of this platform, older people can collect their EOBI pension payments. It is important to note that the retirement age of women is 55 years old and the retirement age of men is 60 years old. Individuals can also do EOBI verification check online by CNIC.

To claim the Eobi pension payments, individuals would have to follow the following steps:

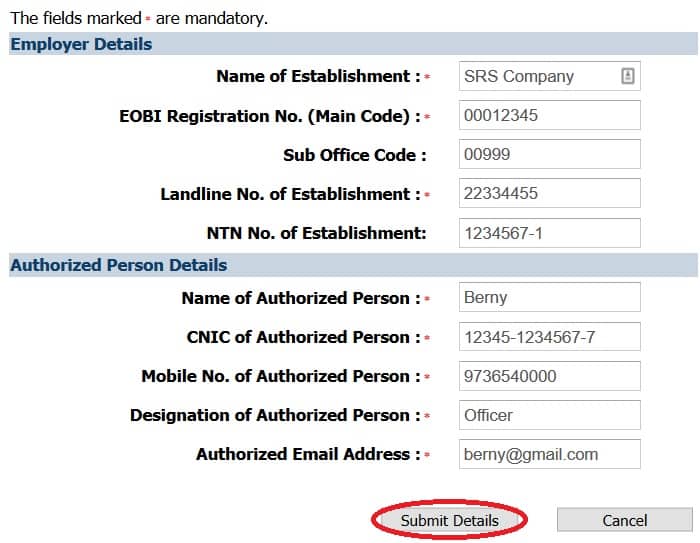

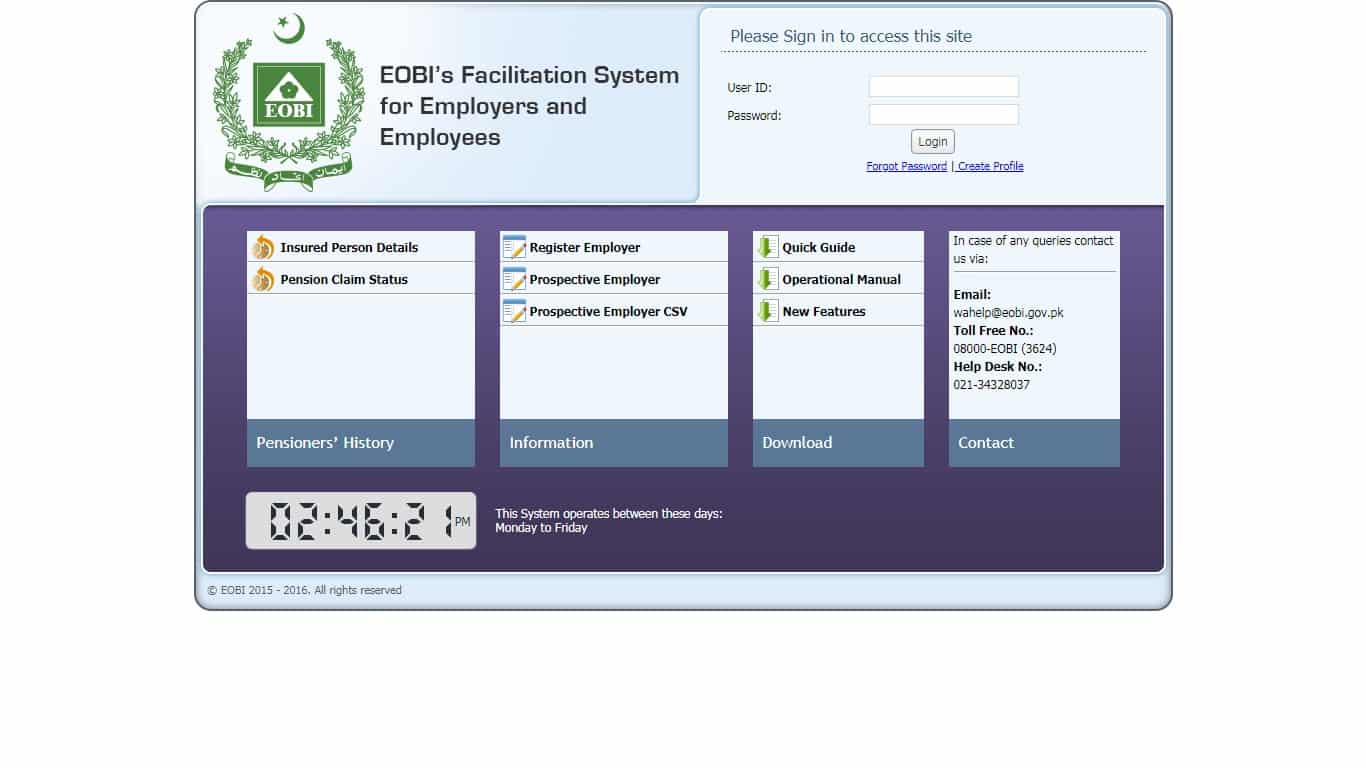

- The person has to visit the website that is www.eobi.gov.pk and do EOBI login.

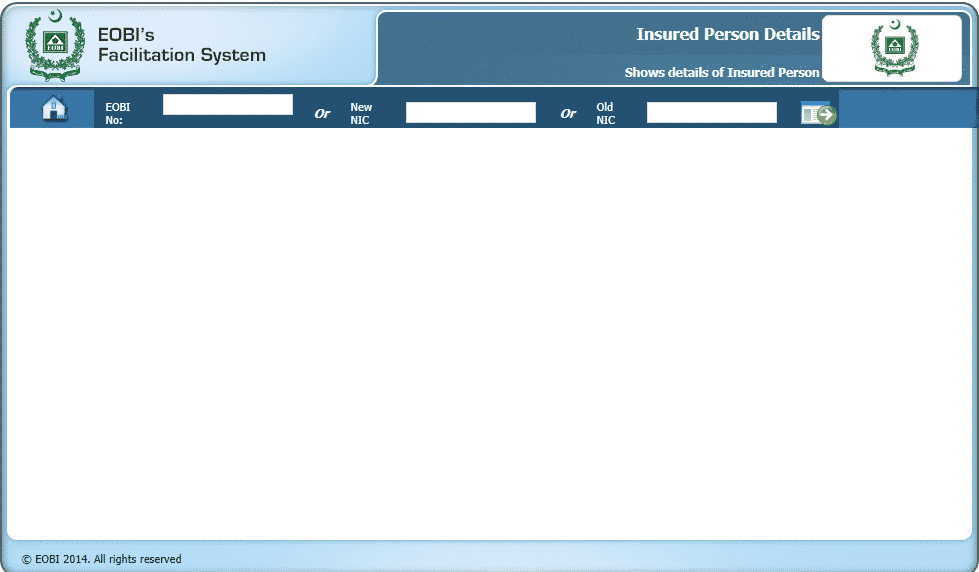

- Then the person has to click on the “individual information” and then through CNIC they have to check EOBI registration number.

- In the online database, you can see the potential pensioners’ names.

- As soon as you found your details online, you can submit the documentation for the claim.

- The documents can be sent to the eobi facilitation system which is the closest to your area

- As soon as the EOBI management authenticates your documents, you will receive a pension claim form

- Fill the form and submit it to the nearest EOB office.

- Now, the Eobi management will start claiming the process of pension and will grant the pension after receiving the form.

- Now the pension will be granted as soon as possible

- As soon as the pension is approved, a pension book or card will be given or issued within 30 days

What are the documents required for the EOBI ?

Below are the mentioned documents which are required from the individual to claim the EOBI Pension. You need to send these documents to the Office of Director General (Operations), 3rd Floor, EOBI House (Ex Awami Markaz), Main Shahrah-e-Faisal, Karachi.

Documents for insured individuals who are alive:

- Registration card of EBI P1-03

- Certificate of employment

- Copy of CNIC

Documents of insured individuals who are deceased

- Registration card of EBI P1-03

- Certificate of employment

- Copy of CNIC

- Nikah Nama of the Spouse

- Proof of relationship with the deceased

- Death certificate which is issued by Nadra

Company Accountability For EOBI Pension Payments

- The company stands guaranteed to compensation of five percent of least possible period scale remuneration professed by the administration for every single wage earner one or the other stable otherwise predetermined.

- The company is Accountable to decrease by one percent involvement of the least possible period scale remuneration from wage earner earnings besides credit inappropriate method.

- The company may expedite EOBI and workers for issuance of EOBI Identification card.

- The company may preserve the involvement declarations, periodic as well as per annum, besides being responsible for the aspect to EOBI constituent part.

- The company is Accountable to keep up the records besides illustration to EOBI allowed on request