The public authority of Pakistan charges custom obligation against imported merchandise, and customs duty additionally applies to imported vehicles. Customs obligation is a wellspring of government pay. Each state sets its standard concerning custom obligations.

Custom debt relies on the model, motor power, and model sort (fuel or border) in Pakistan’s vehicles. Custom requirements on different merchandise depend upon the weight and worth of the items. Customs duty on cars relies upon the vehicle you need to import. The public authority has given help with the import of hybrid cars.

The public authority has given a half markdown on the traditional obligation of hybrid vehicles. This article will provide you with brief insights regarding import obligations on cars in Pakistan and how to work out customs obligations on cars in Pakistan.

It applies to refer here that there is no alleviation in customs obligation for any individual. Even government authorities also pay customs duty on vehicles. Just the person with disabilities can get duty accessible imported cars. This article will tell us about what is custom duty and other topics relating to it.

Custom Duty In Pakistan

After knowing every fundamental, you need to consider the following basics before buying a car. Initially, it would help if you enrolled yourself for customs with the Federal Board of Revenue (FBR). You can download the application structure from Web-Based One custom (WeBOC). After filling out the form, submit the form to the agent accumulator WeBOC User-ID Section with every one of the payable accounts.

Personal appearance, digital picture, and thumb impression of the candidate are required. If the application is acknowledged, the candidate is given a Log-in and password against a User-ID so they can get to the Custom Portal and do the method.

Rules Of Vehicle Import

A person should know how to pay customs duty on cars, and also minor details must be noted by the person. Anybody can import new or used vehicles openly in Pakistan against the instalment of customs obligations and duties after following a particular method set by the public authority of Pakistan under the Import Policy Order. Pakistani occupants and Pakistanis living abroad and dual nationals can likewise import vehicles in Pakistan.

Old and used vehicles are imported under the three schemes below:

- Gift conspire

- Individual stuff

- Transfer of residence

Custom duty on cars in Pakistan continues under every one import plan. There is no change in the sum to be paid against a vehicle. Non-buy individuals from Pakistani nationals living abroad are not qualified to import if they have imported, got, or gifted a car in the beyond two years.

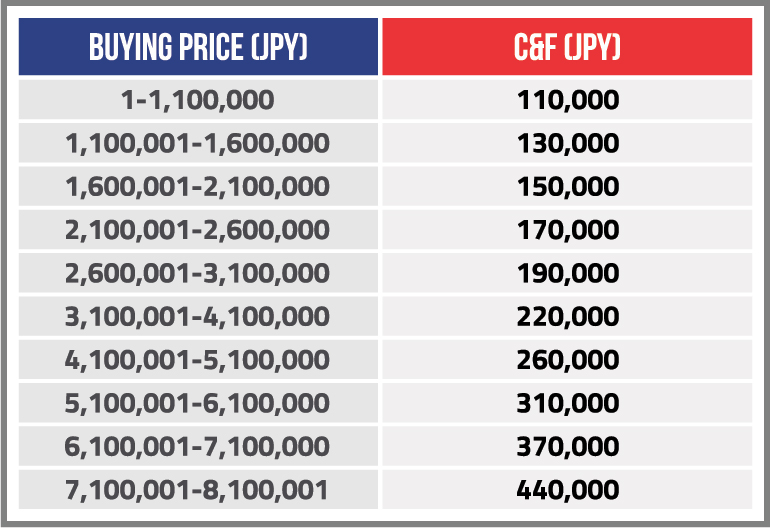

Custom Charges

The expenses and obligations on vehicles don’t concern the item’s weight and worth. However, customs on vehicles change from cars to cars since all automobiles are not something similar. They fluctuate regarding measuring type and motor displacing, which causes them unique and various measures of taxes to must be paid against them.

There is no alleviation or exclusion for any individual on import of vehicles. The charges of custom obligation don’t continue as before and vary with the advancements in the International money rate, at the point when USD’s (United States Dollar. The custom duties also change on the estimated amount of imported vehicles. Hence, the duty is not final; individuals may pay higher or lower prices according to the exchange rate fluctuation,

What Is Cars Custom Duty?

Customs duty is a sum that ought to pay to make your vehicle lawful. Whether the car is used or new, the custom obligation is mandatory. Without paying custom obligations, nobody can get a car from the port. If any individual proposes a dark method for bringing in a vehicle, they will confront severe activity from specialists. The vehicle’s custom obligation is relied upon:

- Motor power

- Vehicle type (a crossover of gas)

- Vehicle inauguration

You can look at any vehicle’s custom duty by giving this data. The custom duty sum can be up or down because it relies upon the dollar rate.

Import Duty Of Cars In Pakistan

The following cc cars explain how custom duty fluctuates according to motor power

- For 660cc to 800cc, custom will be something very similar

- From 801cc to 1000cc, the custom obligation will be equivalent

- For 1001 to 1300cc, the custom obligation will be something similar

- From 1301cc to1500cc custom, the obligation will be charged the equivalent

- For 1501cc to 1600cc, the custom obligation will be something similar

- From 101cc to 1800cc, there is no change of custom obligation

The Government excluded half off on import of HYBRID vehicle up to 1800cc or more 1800cc to 2500cc there is 25% help by the public authority for hybrid vehicle import. Fusion vehicles are made with electric motor power and are superb for eco-friendliness.

Pakistan comes in a nation where the import of oil is exceptionally high. Hybrid automobiles are productive for mileage, which is great for the climate. At the global level, automakers consider electric vehicles the eventual fate of the auto business and centre on it.

How To Calculate Custom Duty Of Vehicles

You can compute custom obligations with no one else. You ought to be familiar with the vehicle year, motor limit, and model sort (half and half or fuel) for estimation. Remember that custom obligation determines the current dollar rate, and it very well might be changed when you pay our vehicle’s style.

There are open workplaces accessible in Karachi for paying the traditional obligation. Specialists won’t ever permit you to take off without paying duty and charges on imported vehicles.

Custom Duty On Electric Cars

Under the approach, the Government imposed customs obligations on importing electric vehicles, which decreased to 10% from 25%. In contrast, customs obligation on significant portions of electric vehicle cruisers, three-wheelers, and heavy business vehicles at 1%.

Car Custom Duty Calculator

1. Find the Dollar worth of your vehicle.

2. then the amount multiplies by the current exchange scale used by the traditions

3. Then, multiply it by the level of duty to be paid (35%).

4. Multiply the complete surface duty by 138.

5. Add it up with transportation and terminal charges.

Conclusion

Pakistan has the advantage of its Southern attitude on the planet, which can interface it to a few areas of the earth through the Arabian Sea. The ports of Pakistan have empowered the exchange of a few items throughout the country. The custom duty approach is gainful for the monetary security of the country. Alongside economic soundness, bringing in merchandise can make various items accessible to people.

Individuals of Pakistan import cars from various nations. Notwithstanding, to achieve this, they need to pay customs obligations. Installing customs obligations and bringing in vehicles is complicated for some individuals.

Pakistan’s vehicle import rules are incredibly severe, and the public authority has made used vehicle import rules strict about strengthening the offer of locally assembled vehicles.