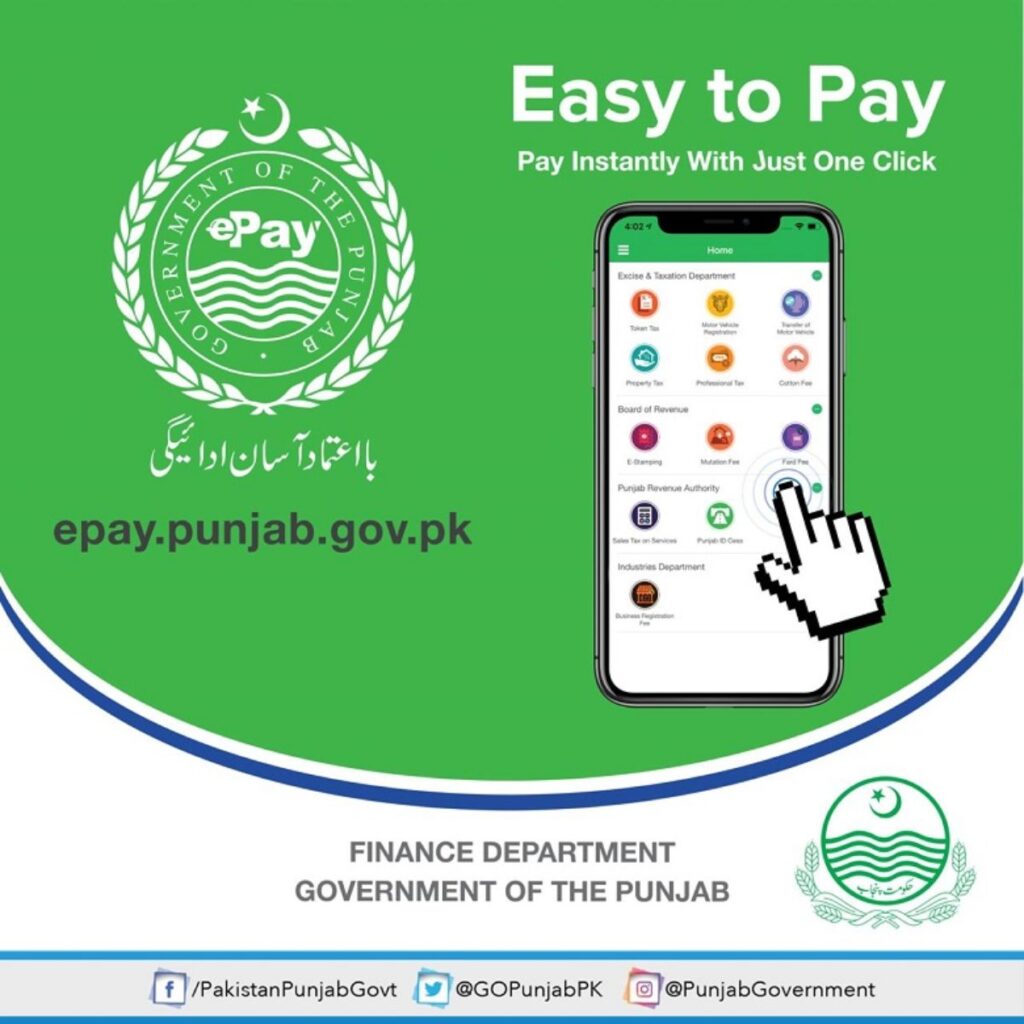

The purpose of e-pay Punjab is to improve the financial inclusion rate in the Province. The Punjab Finance Department and the Punjab Information Technology Board are working together. It enables the management of both business-to-government (B2G) and person-to-government (P2G) payments. From e pay Punjab

This system is linked to both the State Bank of Pakistan and all other banks in Pakistan via the 1-Link network. The system was introduced in the financial year 19-20. With the establishment of ePay Punjab, an online tax collecting medium, individuals have been able to pay their taxes using a variety of electronic payment channels, bringing the total number of taxes in the Punjab area to 24 and incorporating 11 different departments.

Complete Guide to Paying Vehicle Tax online

Paying Vehicle Token Tax in Punjab has become much simpler and easier. The government of Punjab has provided its citizens with the online facility to pay the vehicle Token Tax. By following the below-mentioned rules, the citizens of Punjab can pay vehicle tax.

Step 1: Install the App

The first step to paying vehicle taxes is downloading the e-pay Punjab application. Through the app, one can easily pay all their due taxes. The app can be easily installed through an app store or play store.

Step 2: Get Registered

Select a service you would like to avail of, register by filling out the credential form and enjoy the services.

Step 3: Generate Payment Slip ID (PSID) or Challan form.

Pay the required amount by entering a 17-digit PSID number. The payment can be made through the internet/mobile banking app, ATM, Telco Network Agents, Over the Counter, or via Mobile Wallet.

Payment Medium

After registering on the e-pay Punjab application, a unique PSID number will be accessed. The PSID number will be different for every citizen as well as for every transaction. The PSID number is acceptable to make payment through the following mediums.

- Mobile Banking Apps

- Internet Banking

- TELCOs Agent Network

- Over-the-counter (OTC)

The main motive behind taking this initiative is to provide the citizens of Pakistan with the convenience to pay their taxes, exercise transparency, make improvements, innovation, and integrity in the paying methods, and benefit the individuals.

Token Tax Calculator

The app will automatically calculate the tax you must pay for a certain car. The tax rate is different for locally manufactured cars and imported cars.

On the other hand, if you need information on how much tax is applicable on a certain vehicle, you can get information from the Excise and Taxation Department Website. There you can see the list of vehicles and the applicable tax rates on certain vehicles.

E-pay Punjab Services

Following are some of the services that can be performed using the e-pay Punjab app.

- You can pay vehicle token tax and register new vehicles online. Moreover, you can transfer the vehicle from your name to someone else’s in case of selling the vehicle. The whole process has become hassle-free and convenient because of a single application.

- Other taxes that can be paid via e-pay Punjab are as follows

- Property Tax and Professional Tax

- Cotton fee, Farad Fee, and Mutation fee

- E-stamping

- Sales tax on Services

- Route Permit and Traffic Challan

Procedure to Pay Motor Vehicle Taxes in Sindh

Following are the methods you can follow to pay your taxes to the excise and Taxation department in Sindh.

- The first is to visit the 3rd floor of the Civic Centre in Gulshan-e Iqbal, Karachi. From there, you can pay your taxes.

- Or Else, you can also pay yours through any nearest national bank of Pakistan (NBOP) that accepts motor vehicle taxes.