“China’s CPEC has dragged Pakistan into a quagmire of debt,” recently, such a cliché has flooded with Western media discourse, one more time, making someone question this flagship project under the Belt and Road framework.

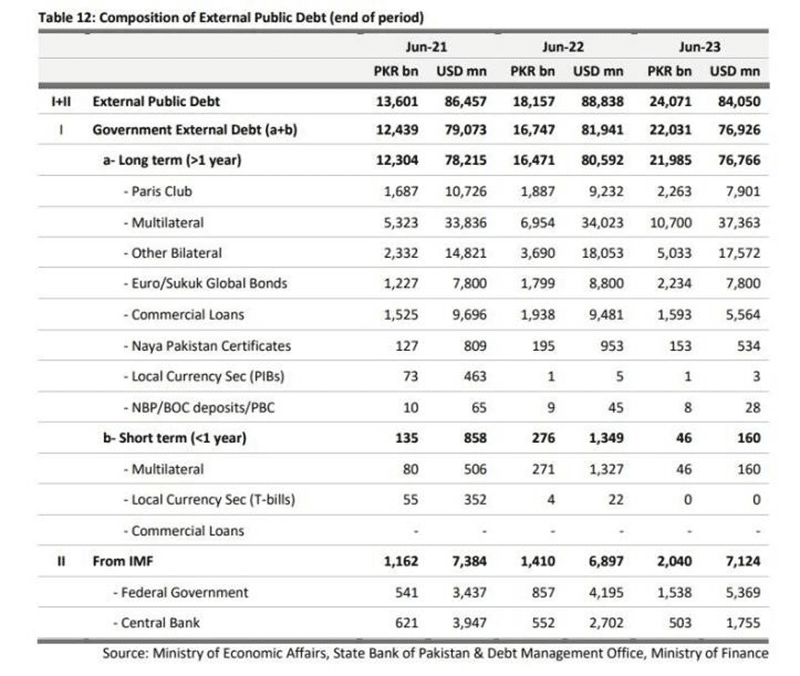

Pakistan’s external public debt was recorded at USD 84.1 billion at end June 2023. The External Debt to GDP ratio grew from 16.65 percent in FY17 to 26.02 percent by FY23, resulting in higher USD denominated debt burden.

Objectively, the debt crisis in Pakistan could be attributed to many factors, including the Ukraine conflict, the United States Federal Reserve raising interest rates, as well as Pakistan’s own economic problems. One of the primary reasons for Pakistan’s external borrowing has been the necessity to bridge the trade deficit, import essential goods, and fund significant infrastructure projects.

However, can CPEC be accused of being a “debt trap” for Pakistan? To assess debt sustainability of a country, the general benchmark for emerging countries is 70 percent for the debt to GDP ratio. Pakistan’s debt to GDP ratio stood at 72 percent in FY23, slightly above the recommended benchmark. Moreover, its interest to GDP ratio stood at 6.9 percent while interest to revenue stood at 61 percent in FY23. CPEC spurred economic growth, but the external shocks have created an unfavorable environment to repay USD hedged fixed loans.

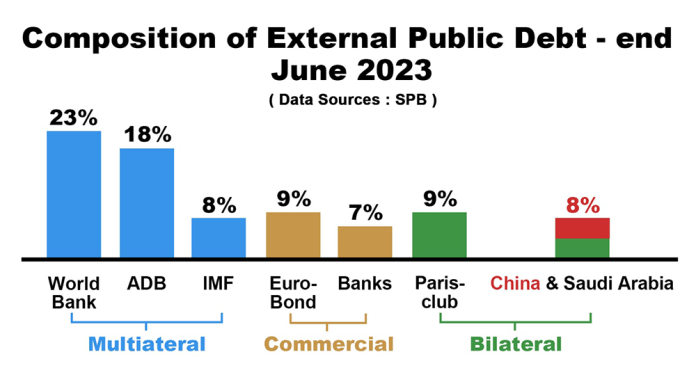

Further analyzing SBP’s data, it is not difficult for anyone to find out that loans from multilateral development partners (including IMF) and bilateral countries constitute 53 percent and 22 percent, respectively. Up to June 30, Pakistan’s debt from the Paris Club, IMF and other international multilateral institutions reached USD 52.4 billion. It is equally obvious that bilateral deposits (China and Saudi Arabia) accounts for only 8 percent. These loans are short-term in nature (1-year) and are obtained for balance of payment as well as budgetary support.

“The debt problems of countries along the Belt and Road, including Pakistan, are not caused by massive infrastructure construction as Western media have slandered, and Chinese companies’ investment in construction is not just contracting projects, but the sharing of funds, technology and management experience,” Ren Haiping, Deputy Head of Department of Strategic Research, China Center for International Economic Exchanges (CCIEE), pointed out. “The debt ratio of many European countries is as high as 60 percent, and they have not yet completely emerged from the European debt crisis, restricted by a 3 percent deficit ratio and a 60 percent debt warning line. In addition, the debt generated by the joint construction of CPEC and other BRI projects is used for development rather than consumption, it will eventually enhance economic strength, which is completely different from the debt of Western countries that is entirely used for consumption.”

“Construction projects under the BRI framework, including CPEC, are joint invested and constructed by Chinese enterprises and countries along the route, rather than pure debt. Confusing investment and debt should be a misunderstanding. In fact, part of the reason for the high debt in developing countries is the decline in commodity prices in recent years. In addition, the Fed’s interest rate hikes have led to higher interest rates and a strengthening of the U.S. dollar, which in turn has led to reduced income generation and prominent debt in some developing countries including Pakistan,” Ren stressed.

Despite certain contradictory narratives emerging from some western media regarding CPEC being a debt trap, China has made consistent efforts to demonstrate support and keenness in improving the economic conditions of Pakistan by granting multiple rollovers. China has fulfilled its commitments to Pakistan so far, including refinancing commercial loans and rolling over SAFE deposits.

“Multiple highway construction programmes are progressing on schedule. Power plants that have entered commercial operation provide nearly one-third of Pakistan’s national electricity demand, having changed the situation of power shortage in Pakistan,” China’s National Development and Reform Commission (NDRC) noted in a CPEC update in May. “Besides, the Gwadar port has made great progress in creating a regional logistics hub and industrial base. In addition, the construction of the first phase of the Rashakai Special Economic Zone has been completed and achieved positive results in business attraction,” the NDRC further stated. So far, this unprecedented economic zoning has created almost 236,000 jobs, 155,000 of which for Pakistani workers, as a roll booster.

Non-interference in the internal affairs of sovereign countries has always been one of the basic principles of China’s foreign policy because of which China has so far avoided intervening in any of Pakistan’s internal affairs or influencing its economic policies, despite being latter’s largest single lender. conversely, Western multilateral financial institutions, especially the IMF and the World Bank, have repeatedly intervened and tried to fully dominate Islamabad’s fiscal policy.

Likewise, creditor countries in the Paris Club, especially the United States, France, Germany and Japan to whom Pakistan owes USD 8.5 billion, often use public opinion to exaggerate the “China debt trap” argument, but actually, countless examples have repeatedly sounded alarm bells around the world – it is the very countries themselves that often use influence to achieve geopolitical goals, even use “long-arm jurisdiction” and dazzling financial reaping methods to drag developing countries into the “middle-income trap,” in other words, the real TRAP.