Digital banking platforms have revolutionized financial services, offering convenience and speed to millions. However, recent complaints from SadaPay users raise concerns about the platform’s reliability, customer service, and security protocols.

Transactions Gone Wrong

One user expressed frustration after a failed transaction showed an obscure code instead of the recipient’s account title. Despite repeated attempts to contact support through the app and helpline, the issue remains unresolved. The customer, disillusioned with the lack of assistance, has threatened to close their account if the matter isn’t addressed promptly.

Blocked Accounts and Delayed Transfers

Another user shared a distressing experience where their spouse’s SadaPay account was blocked, leaving PKR 80,000 in savings inaccessible. Despite providing the necessary details for transferring the funds to an alternate account nearly two months ago, they have yet to receive the amount or any update from SadaPay.

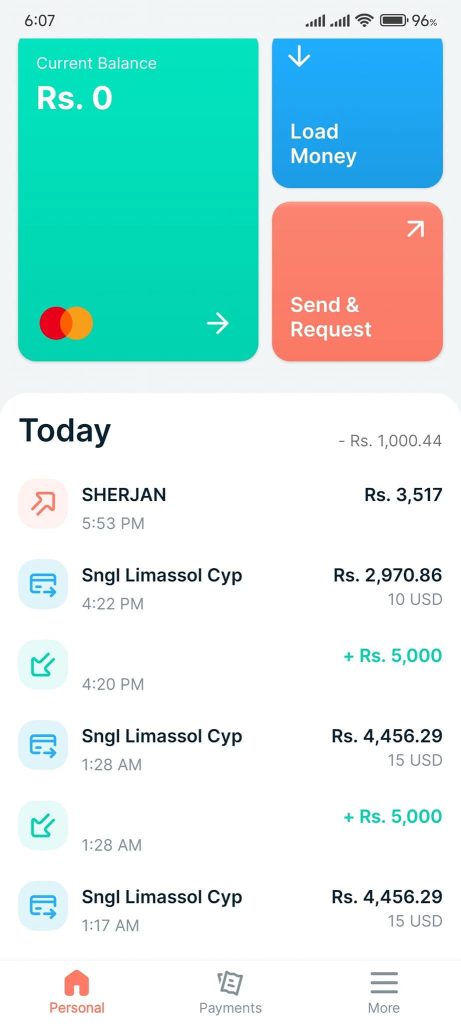

Suspected Banking Scam

More alarming are reports of unauthorized deductions from user accounts. A businessman claimed that small amounts ranging from $10 to $25 started disappearing from his SadaPay account since December 2. Initially attributing these discrepancies to business expenses, the user discovered that the deducted amounts didn’t match his actual transactions, including Facebook Ads payments.

By the time the issue was identified, the individual had lost over PKR 180,000. The user has since frozen their virtual card but is left uncertain about the recovery of their funds, labeling this situation a potential “banking scam.”

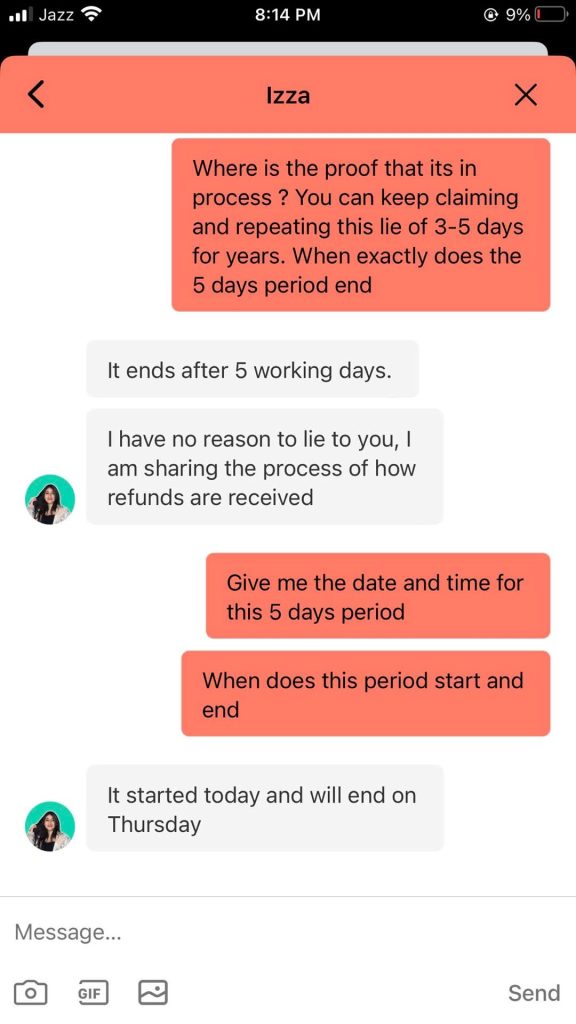

Refund Chaos

Another complaint highlighted the platform’s inefficiency in processing refunds. After canceling a test booking and being assured of a refund within 24 hours, the customer was told by SadaPay’s support team that it would take 3–5 business days. Five working days later, the refund transaction still doesn’t appear in the app, despite receiving a notification claiming the refund had been processed.

Users Question SadaPay’s Credibility

These complaints point to broader issues with SadaPay’s service. Many users have expressed dissatisfaction with the apparent lack of transparency and delayed responses to critical matters. The absence of a readily available chat support feature and slow helpline responses have further fueled frustrations.

A Call for Improved Banking Standards

While digital banking platforms like SadaPay have been hailed as the future of financial services, these incidents highlight the need for robust customer service, transparent refund processes, and stronger security measures. Until such concerns are addressed, users may think twice before trusting their savings to digital-first banks.

SadaPay has yet to issue an official response to these allegations. Customers, meanwhile, continue to demand accountability and solutions.