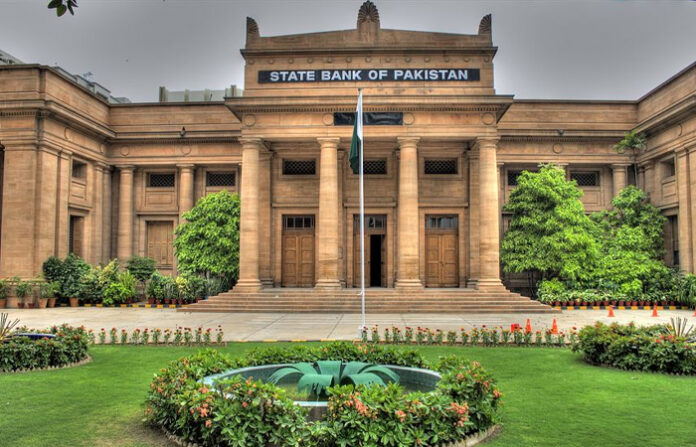

A world-class payment system called ‘Raast’ is all set to be launched by the State Bank of Pakistan (SBP), which will be a major leap in the digitization of the financial process of the country.

The development was announced by the Deputy Governor SBP, Sima Kamil while lecture a personal media outlet, she said that the financial institution from Monday 11th January, 2021. “From Monday onwards, the financial institution will initiate a replacement payment system called ‘Raast’, as we believe this a right way forward for the country,” said Kamil.

Deputy Governor SBP said that despite the supply of 160 million mobile phones, our digital economic participation is extremely limited, as people believe cash for payments. She informed that under the new system, the financial institution aims to scale back the quantity of cash-based transactions, as variety of social issues arise thanks to the prevalent system.

Kamil shared that within the initiative , instant credit of dividends from listed companies to shareholders are going to be initiated. “In subsequent phase, which will take variety of months the payment system would digitize the payments made to government employees in wages and pension, this is able to be fast, free and safe,” she said.

Earlier, Governor SBP Reza Baqir briefed the forum about the many progress made since the last stakeholder’s consultative meeting and therefore the important steps taken by SBP to facilitate digital payments.

He said that the event of Pakistan’s Instant Payments System project powered by SBP together with its partners has progressed significantly and therefore the Prime Minister of Pakistan will soon launch the completion of its first phase. This phase will enable instant transfer of dividend payments directly into the bank accounts of investors by Central Depository Company (CDC).

Talking about the scope of ‘Rast’ payment system, Kamil informed that within the next phase the upcoming payment system would digitize the BISP and Ehsaas payments by June. “Some 16 million women would be facilitated with this technique ,” she said.

Kamil informed that the upcoming payment system has been implemented in advanced countries i.e. UK and Australia.

The SBP Deputy Governor announced that ‘Person-to-Person’ payments would begin after June and a common man could make payments via QR codes by December.