During the current fiscal year 2021-22, Pakistan’s net tax receipts will only be sufficient to cover debt payment obligations, so the country’s defence, development, subsidies, and civil government operations, including salaries and pensions, will be funded with “borrowed” funds.

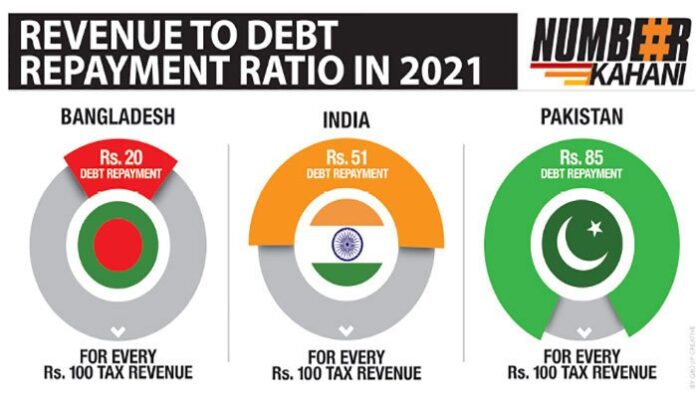

The federal government used roughly Rs85 of total net revenue receipts of Rs100 to cover debt servicing, while India’s central government spent Rs51 and Bangladesh spent around Rs20 of total collected tax and non-tax amounts of Rs100 in the previous fiscal year, 2020-21. According to famous economist Dr. Ashfaque Hassan Khan, net revenue receipts will only be enough to cover debt service bills for the current fiscal year, which ends on June 30, 2022, and all remaining spending items, including the country’s defence needs, will be fulfilled with “borrowed” money.

It is necessary to provide a fiscal position by quoting numbers from the previous fiscal year, which concluded on June 30, 2021, in order to conduct a thorough examination. The FBR collected Rs4,764 billion in fiscal year 2020-21, and after giving provinces a part of Rs2,741 billion under the National Finance Commission (NFC) Award, the net revenue receipts remained at Rs2,023 billion. The non-tax revenue collection totaled Rs1,480 billion, bringing the total collections to Rs3,503 billion for the federal government. Debt servicing was the most expensive line item on the budget, costing Rs2,749 billion, leaving the federal government with only Rs754 billion.