Payoneer (NASDAQ: PAYO), a global fintech leader empowering small and medium-sized businesses (SMBs) to expand globally, has reported record-breaking financial results for Q4 and full-year 2024. The company achieved 20% growth in revenue (excluding interest income) and delivered three consecutive quarters of positive adjusted EBITDA, further solidifying its position as a key player in the cross-border payments and commerce-enablement space.

Key Highlights from Q4 and Full-Year 2024 Results:

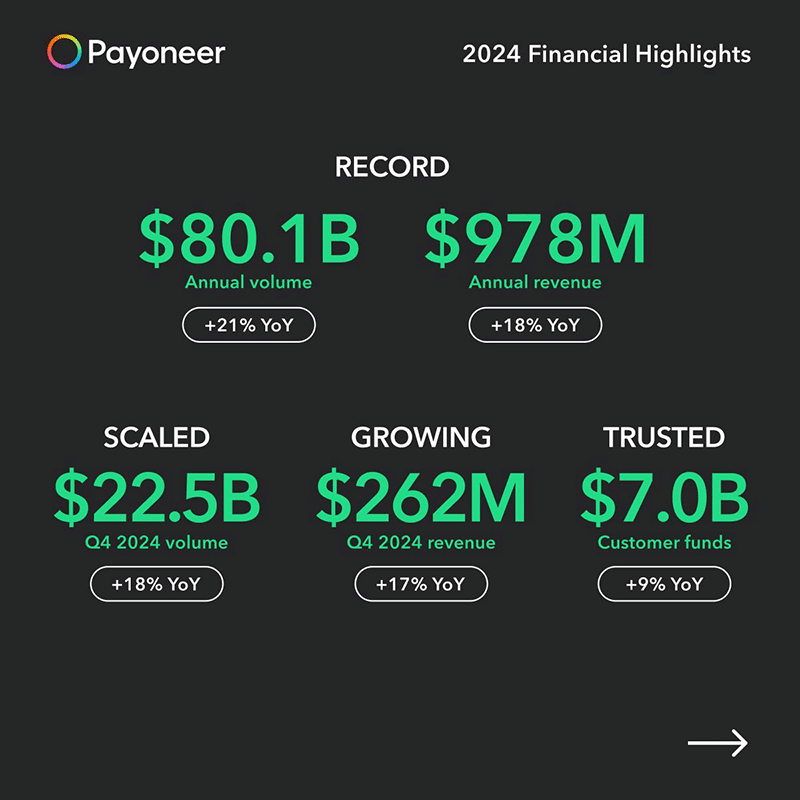

Record Revenue & Profitability: Payoneer delivered its highest-ever quarterly and annual revenue, achieving 20% growth in revenue excluding interest income.

Total Volume Growth: The company processed a record $80 billion in total payment volume, representing a 21% increase year-over-year.

B2B Expansion: B2B volume surged by 42% year-over-year, showcasing strong momentum in Payoneer’s efforts to facilitate seamless cross-border transactions for businesses worldwide.

Ideal Customer Profile (ICP) Growth: Payoneer saw an 8% increase in its active ICPs, with volume and revenue from customers transacting over $10,000 increasing by over 20% for the full year.

Strategic Expansion in China: Payoneer received regulatory approval in China to complete its acquisition of a licensed China-based payment service provider, a move expected to enhance its global reach and capabilities when finalized in the first half of 2025.

Stock Performance: Payoneer’s share price surged over 80% year-over-year, making it one of the top-performing fintech stocks in 2024.

John Caplan, CEO of Payoneer, remarked, “2024 was a defining year for Payoneer. We achieved new records for annual volume, revenue and profitability, saw exceptional volume and revenue growth with B2B SMBs, drove increased adoption of our high value products and expanded our financial stack. These achievements are proof of our scalable, increasingly profitable business model, the size of our opportunity and the strength of our execution. Looking ahead to 2025, we will focus on expanding our regulatory moat, modernizing our technology infrastructure and further enhancing our financial stack, while seeking to deliver continued strong growth and profitability.”

As Payoneer continues to expand, SMBs in Pakistan stand to benefit from seamless access to global markets, enabling them to collect payments from customers in the United States, United Kingdom, UAE, Canada, Japan, and beyond. With its consistent growth trajectory, Payoneer remains uniquely positioned to empower Pakistan’s digital economy and drive international business expansion for local entrepreneurs and enterprises.