SBP issued “Licensing and Regulatory Framework for Digital Banks” on January 03, 2022. To create awareness of this this important development in regulatory ambit, SBP organized an online event – “Digital Banks – A New Era in Banking”. The objective of the webinar was primarily to create awareness about the next generation of banks i.e. digital banks and the potential they offer for financial inclusion in the country. It was also aimed at sharing the details of digital banking framework amongst the market participants and prospective investors and to address their queries.

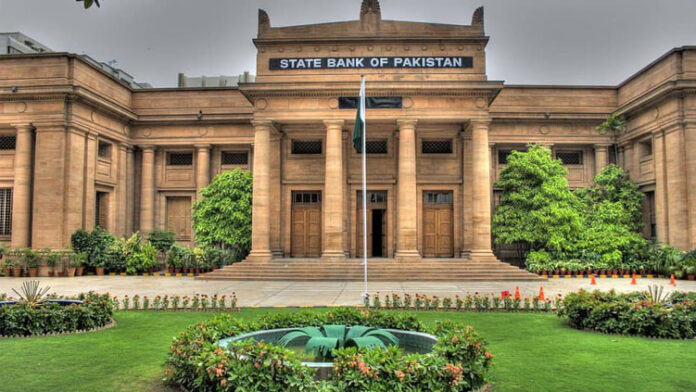

Dr. Reza Baqir, Governor State Bank of Pakistan in his keynote address highlighted the potential of digital financial services to become ubiquitous in the banking industry and its significance in terms of inclusion and innovation. Discussing the prospects of digital banks in Pakistan, he emphasized that one of the key goals of the State Bank of Pakistan was to promote inclusion, innovation, and modernization of financial sector of Pakistan. He emphasized SBP’s expectations from digital banks in promoting financial inclusion by providing affordable financial services to unserved and underserved segments of society, alongside fostering a new set of customer experience.

Dr. Baqir highlighted how digitization of financial services is picking up pace and is transforming the way banking is done for both individuals and businesses. He mentioned that Pakistan’s journey for digital financial services started in early 2000s, and since then, a number of enabling regulatory initiatives were launched, notably, Branchless Banking Regulatory Framework, Electronic Money Institutions Regulations, Roshan Digital Account, RAAST, Customers’ Digital Onboarding Framework, and Asaan Mobile Accounts etc. He added that Licensing and Regulatory Framework for Digital Banks is another milestone towards digital transformation and a major step towards revolutionizing our banking services industry.

The event was attended by prominent members of the banking community, fintechs, business fraternity and Government agencies. While giving his welcome address, Mr. Arshad Mehmood Bhatti, Executive Director, Banking Policy and Regulation Group, informed the audience that SBP will grant up to five (05) licenses for digital banks, as SBP intends to bring digital banks with strong value proposition, robust technological infrastructure, sufficient financial strength, technical expertise and effective risk management culture. He assured the market participants and potential investors that his team will remain available to provide necessary guidance in this regard.

The event also included a panel discussion moderated by Mr. Nadeem Hussain, founder Planet-N along with Mr. Muhammad Aurangzeb, Chairman Pakistan Banks’ Association, Ms. Tania Aidrus, former Executive of Google and Special Assistant to PM, Mr. Qasif Shahid, CEO & Co-Founder of M/s Finja and Mr. Muhammad Akhtar Javed, Director Banking Policy & Regulations Department of SBP as panelists.

The panelist had different rounds of questions which not only covered the real potential of digital banks in terms of addressing the financial needs of a common man but it also brought further clarity on various aspects of this important regulatory initiative. The panel also touched upon the possible benefits and compelling reasons for existing banks and MFBs to apply for digital banks’ license and highlighted the relevant challenges faced by various digital banks across the globe. The panelists were of the view that digital banks would offer a faster, cheaper and more efficient solution for meeting the financial requirements of unserved and underserved segments of the society, in particular and welcomed SBP’s landmark initiative. The panel was confident that digital banks will become an essential part of the financial ecosystem, enhancing market efficiencies, providing access to a wider range of financial services, and thereby, advancing the broader agenda of financial inclusion.