KARACHI: On Monday, the central bank held the benchmark interest rate unchanged at 7% while viewing growth and inflation expectations as well-anchored, while COVID-19 continues to pose challenges to the economic outlook.

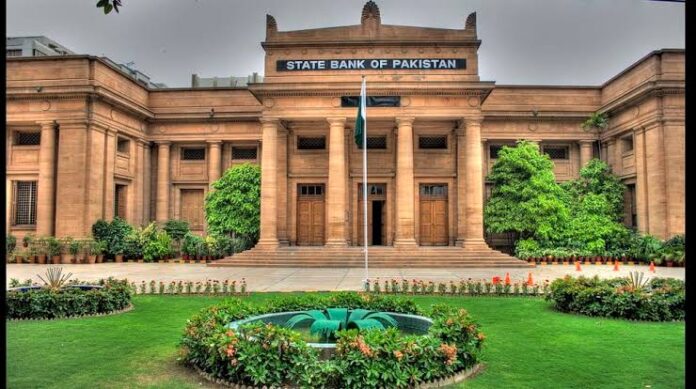

“The monetary policy committee decided to take care of the policy rate at 7 percent,” the depository financial institution of Pakistan (SBP) said during a statement. “[S]ince the last meeting in September, the domestic recovery has gradually gained traction, in line with expectations for growth of slightly above 2 percent in FY21, and business sentiment has improved further.”

Though inflation numbers are on the upper side primarily thanks to increases in food prices, these supply-side pressures are likely to be temporary and average inflation is predicted to fall within the previously announced range of 7-9 percent for FY21.

The SBP said after falling sharply since January, headline inflation has remained on the brink of 9 percent during the last two months, primarily driven by sharp increases in selected food items thanks to supply-side issues. Core inflation has been relatively moderate and stable, in line with subdued underlying demand within the economy, it said.

The SBP’s decision was according the market expectation because the SBP already delivered rate cuts of 625 basis points between March and June to bolster economy severely hit by lockdown associated with coronavirus.

SBP told analysts it followed a proactive approach and tried to stay an accommodative policy stance with real interest rates being slightly negative on a forward basis. “Being data dependent and forward looking, SBP reiterated its stance on acting consistent with the changing dynamics of the economy, as and when needed,” brokerage Arif Habib Limited said during a flash note on analyst briefing. “At the instant, the first focus of SBP is on the expansion of the economy followed by other indicators like external account and overall financial stability.”

The SBP said the prevailing stance of monetary policy is acceptable to support the nascent recovery and inflation expectations well-anchored. “The lagged effects of the many fiscal, monetary and credit stimulus injected during the pandemic should still prop up growth in coming quarters,” said the SBP.

Recent data suggest an extra strengthening and broadening of the recovery observed since July, led by construction and manufacturing. Sales of fast paced commodity rebounded in FY21 Q1, average sales volumes of petroleum products and automobiles have surpassed their pre-Covid levels of FY20, and cement sales are at an all-time high.

“The recovery was being supported by stimulus provided by the govt , the round of policy rate cuts and therefore the SBP’s timely measures to mitigate the impact of the COVID pandemic,” said the SBP.

The SBP said external sector continues to strengthen, with the present account in FY21 Q1 recording the primary quarterly surplus in additional than five years. After remaining in positive territory for all four months of this financial year , the cumulative accounting through October reached a surplus of $1.2 billion against a deficit of $1.4 billion within the same period last year. This turnaround was supported by an improvement within the balance of trade and record remittances. Exports have recovered to their pre-COVID monthly level of around $2 billion in September and October, with the strongest recovery in textiles, rice, cement, chemicals, and pharmaceuticals. Remittances recorded strong growth of 26.5 percent during July-October, primarily thanks to orderly rate of exchange conditions, supportive policy measures taken by the govt and SBP, travel restrictions, and increased use of formal channels. Meanwhile, subdued domestic demand and low global oil prices have kept imports in restraint .

“The sizable accounting surplus and improving outlook and sentiment for the economy have supported a 3½ percent appreciation within the rupee since [September] and further strengthened external buffers, with SBP’s exchange reserves increasing to $12.9 billion, their highest level since February 2018,” said the SBP.

“However, the upper overall deficit thanks to larger domestic interest payments should taper because the benefits of recent rate of interest cuts filter through. PSDP-releases, which are a crucial stimulant of economic activity, recorded a rise of 12.8 percent during the primary four months of this year,” it said. “On the revenue side, despite a fast-tracking of refunds to assist businesses during the pandemic, FBR tax collections continued to record positive growth, at 4.5 percent in July-October, to return in on the brink of target levels.”

Although credit growth in the private sector is moderate year-on-year, the SBP said that its month-on-month momentum is reverting to pre-Covid patterns. “With higher risk aversion on the part of commercial banks, SBP’s temporary and targeted refinancing schemes introduced following the Covid-19 shock have supported the expansion of credit to the private sector.”