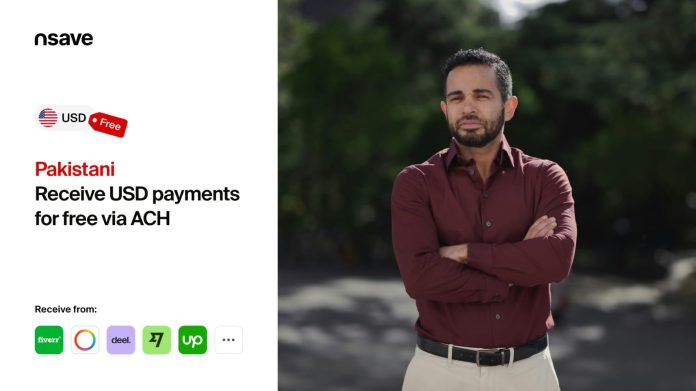

Pakistan’s digital workforce is booming, from solo freelancers and game studios to call centers and software houses. Yet getting paid from abroad can still mean unpredictable fees, FX losses, and delays. That’s where nsave comes in.

This article explains how nsave.com helps Pakistani professionals receive international payments faster, safer, and with more control, so you can focus on shipping work, not chasing invoices.

What is nsave?

nsave is a global account solution designed for remote workers and export-oriented teams from Pakistan. You can receive payments in USD/GBP, hold balances, withdraw to PKR, invest and spend internationally — all with clear pricing and responsive support.

At a glance:

Receive via standard rails (e.g., ACH / Wire / IBAN)Hold & manage funds in USD/GBPWithdraw to Pakistani banks and popular local methods for $1 and at the best ratesInvest in US stocks and ETFs for $0 and no minimumsSpend globally with an international card at 0% transaction fees for USD, GBP and EURFast signup with CNIC, passport, or driving licenseIn-app statements & invoices for clean recordsTransparent pricing, no hidden costsLocal-first support that actually repliesMany users see nsave as a practical alternative to stitching together multiple wallets, remittance tools, and exchange steps.

Why this matters for Pakistani talent

- Keep more of what you earn

- Cross-border payments often leak value through layered fees and weak FX. nsave focuses on fair, upfront costs and competitive conversion so more money reaches your account.

- Fewer moving parts

- With nsave, receiving, holding, converting, and withdrawing live in one place. Less friction. Fewer delays.

- Professional client experience

- Get official account details (where supported) and in-app statements/invoices. Clients pay you like any vendor; reconciliation takes minutes.

- Local, responsive help

- Payment issues are time-sensitive. nsave support is built around Pakistan’s remote-work realities.

Who benefits (and how)

Freelancers & Agencies

- Direct client payments over standard banking rails (bypass fees from intermediaries)

- Multi-currency holding: keep USD/GBP until you’re ready to convert

- Clean pricing to avoid awkward surprises

- Connect Upwork or Fiverr for better payout rates to Pakistan

- Game Developers & Studios

- Publisher/platform payouts without bottlenecks

- Contractor payouts directly from balances Cash-flow control: hold currency and convert strategically when needed

Call Centers & BPOs

- Recurring retainers from US/UK/EU clients

- Centralized treasury: manage inflows in one dashboard; withdraw to PKR for payroll

- Audit-friendly statements and trails

- Software Houses & Product Teams

- Project-based billing across multiple clients/currencies

- Vendor & direct payments from balances

- Board-ready reporting with clean exports

How nsave reduces friction

Simple onboarding

Sign up with CNIC, passport, or driving license. Open your account in a1-2 days.

Client-friendly receiving

Share the banking details clients already understand (e.g., routing/IBAN).

Fair conversion & easy withdrawals

Convert USD/GBP when you choose, then withdraw to PKR into your bank or supported local rails.

Built-in documentation

Statements help you close books faster and stay compliant.

Pricing & limits

Free account with no chargesReceive for free in USD from anywhere in the world Transparent transaction fees shown in-app before you confirmNo hidden chargesNo limits Note: Available features, rails, and updates can vary by region and profile. Always check the latest details on the nsave app.

Getting started in 3 steps

Create your account at nsave.com (use CNIC, passport, or driving license).Add client-receiving details from the app to your invoice or contract.Receive → Hold (USD/GBP) → Convert → Withdraw PKR—all from one place.

Written by: Jan Sher | Lets Outsource | letsoutsource.co.uk