Nvidia experienced a major loss on Monday, with its market value dropping by $600 billion, the largest one-day drop in U.S. history. The company’s stock fell by 17%, closing at $118.58. This sharp decline was caused by concerns over rising competition from China’s DeepSeek AI.

DeepSeek has created a low-cost, open-source AI model that uses Nvidia’s H800 chips. This has led to worries that demand for Nvidia’s GPUs might drop. However, many analysts believe that the growth of AI will increase the need for computing power, which should actually drive demand for Nvidia’s products.

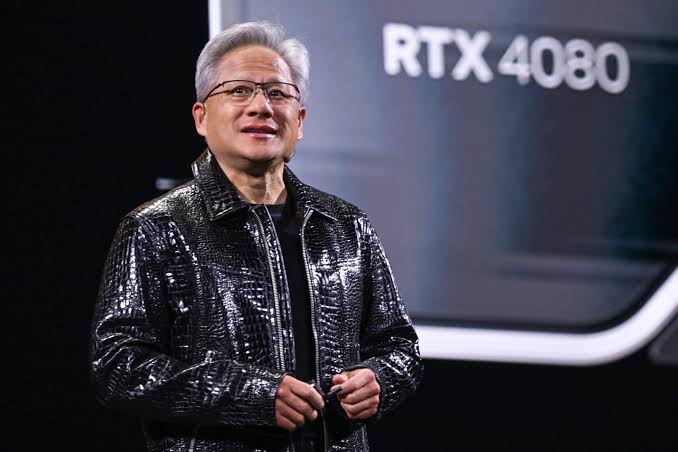

Despite this, Nvidia’s stock drop triggered sell-offs across other tech companies, including Broadcom, which dropped 17%, Oracle down 14%, and data center firms like Dell. Nvidia’s CEO, Jensen Huang, also saw his personal wealth fall by $21 billion.

In a surprising twist, DeepSeek’s app is now the most downloaded in the U.S., surpassing ChatGPT. This highlights China’s growing influence in the AI space. As competition in AI heats up, the U.S. must remain alert to preserve its leadership in this rapidly advancing field.

This situation shows how quickly the tech landscape can change, with new players like DeepSeek challenging established companies. While Nvidia’s stock may recover, the shift in AI competition is a wake-up call for the U.S. tech industry to stay ahead in innovation.