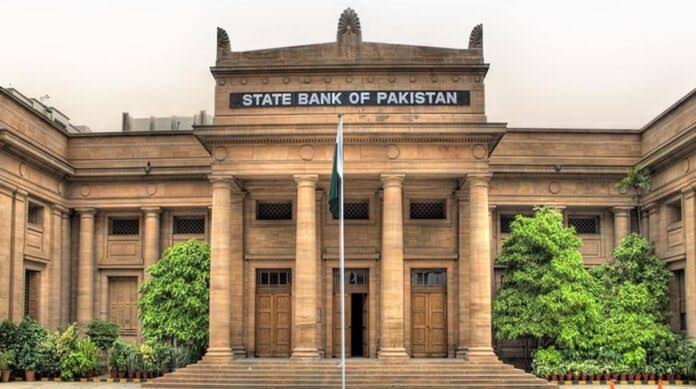

The State Bank of Pakistan (SBP) has introduced a new housing finance program, “Mera Ghar Mera Aashiyana”, to make home ownership easier for citizens across the country. The scheme is specially designed for people purchasing or building their first house, flat or plot.

Loans Up to Rs 3.5 Million

Under the program, applicants can secure loans ranging between Rs. 2 million and Rs. 3.5 million. Financing is divided into two tiers: Tier 1 (T1) up to Rs. 2 million, and Tier 2 (T2) above Rs. 2 million and up to Rs. 3.5 million. The loan repayment period can extend to 20 years giving borrowers long-term flexibility.

Subsidized Markup for 10 Years

The SBP has announced fixed rates for the first 10 years of financing: 5% for loans up to Rs. 2 million and 8% for loans up to Rs 3.5 million. After the subsidy period, standard market rates will apply. Loans will be priced at KIBOR + 3%, ensuring competitive market alignment.

Eligibility and Conditions

To qualify, applicants must be Pakistani citizens holding a valid CNIC and should not already own a house in their name. Financing will be allowed for the purchase of a house or flat, construction of a house on an existing plot, or purchase of a plot with construction of a house. The scheme covers houses up to 5 marla and flats up to 1360 square feet.

No Extra Charges

Borrowers will benefit from no processing fees and no prepayment penalties. The Loan-to-Value (LTV) ratio is set at 90:10, meaning banks will provide 90% financing while applicants contribute 10% equity.

Available Nationwide

All commercial banks, Islamic banks, microfinance institutions and the House Building Finance Corporation (HBFC) will offer financing under the scheme. A risk coverage of 10% on the loan portfolio will also be provided to encourage wider participation.

With a total allocation of Rs 72 billion already approved for subsidized housing in the current fiscal year, the SBP initiative is expected to help thousands of first-time buyers enter the property market. The program not only addresses housing needs but also supports the government’s vision of financial inclusion and affordable housing for all.