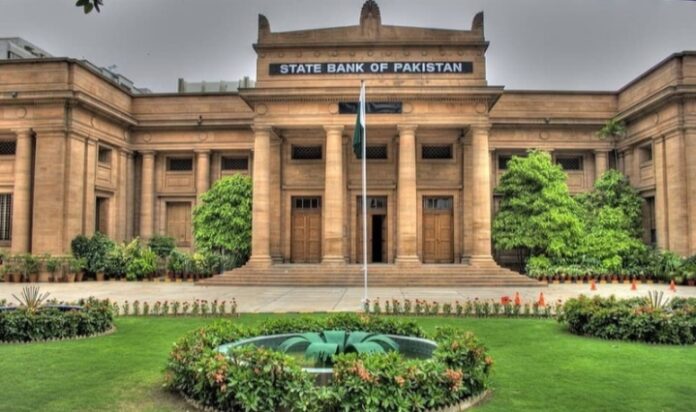

Shortage of US dollars dive the rupee to the highest since 1998, SBP has demoralised interbank trading, as per sources.

In contemplation to control the fall of rupee against US dollar, the central bank with its limited powers under IMF agreement recommended commercial banks to manage importer payment requests from their income such as exporters payments and remittances.

Pakistani rupee fell for approximately 8% last week, the biggest drop in last twenty years. As Pakistan’s foreign exchange reserve stand below $10 billion.

Moreover, SBP Acting Governor Murtaza Syed told that Pakistan will easily meet its financial needs with an IMF bailout on track.

The thing which is notable that SBP didn’t reply to an email seeking comment.

It was noted that some commercial banks were looking for permission from SBP and giving US dollars at a premium which cause the raising price for their clients, as per sources confirmation.

On July 20, commercial banks provided dollars for energy firms at the rate of Rs238 and 242, about 8% higher than the official closing of the day.

Further Raheel Ahmed, chief executive officer at VN Lakhani and Co, a Karachi-based steel importer said that banks who were previously releasing the payments of overseas clients in a day are now taking more time for approximately more than a week.

In July 21, Finance Minister Miftah Ismail said that Pakistan has seen payment pressure against dollar because of energy payments. This would be reverted by increasing supplyore than its demand in next month.