Today a basic refrigerator costs Rs.50,000, a basic smart phone Rs.35,000, a basic LED TV Rs.35,000, a basic motorbike Rs.90,000 – CAN A COMMON PAKISTANI AFFORD ANY OF THIS? WHAT DOES HE/SHE DO? LIVE WITHOUT BASIC THINGS IN LIFE? OR GO TO A LOAN SHARK?

Established in Karachi in November 2021, Qist Bazaar is at the top of its BNPL game, providing consumer discretionary goods TO THE COMMON KARACHITE, with NO REQUIREMENT OF bank accounts or debit/credit cards.

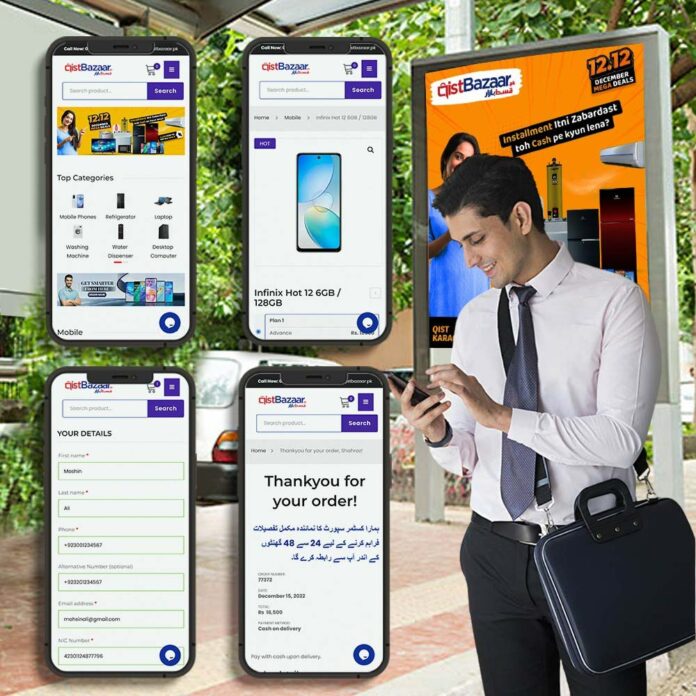

Qistbazaar.pk has a simple, user-friendly interface with a 4-click order process, at-home verification and delivery and instalment payments accepted through Easy Paisa / Jazz Cash. This allows a consumer a sense of dignity and the privacy that they deserve.

Its 14000 clients (acquired in the first year of operations) include everybody from domestic helpers to people who work at banks. From a techy youngster who wants to buy a laptop on instalment for his side gig to a middle-aged Naan shop worker who wants a mobile to call his family, Qist Bazaar provides something for everyone with 350+ products and over 1400+ payment plan options.

Qist Bazaar is one of the few licensed operators (NBFC – Non-Banking Financial Corporation) out there and works in a Shariah Compliant manner with its formal application of Shariah compliance already having been submitted to the SECP.

With plans to expand to Hyderabad soon and to other major cities across Pakistan in the near future, Qist Bazaar is aiming to become a household name for electronic necessities on deferred payments, bringing FinTech to the mass market – a market that consists of a population of 230 million of which 70% is unbanked and with zero credit score.

At a recent Tech conference, the co-founder Arif Lakhani had this to say about why BNPL and why now:

“If my bun kebab wala wants to buy a fridge today, there is not a single place that he can go and buy one. He has no credit or salary slip…that is where Qist Bazaar comes in. It is for everyone but mainly the forgotten 80-90%.”

Suraiya Ishaque, VP of Growth added: “We have data of over 275k+ Karachiites who, at one point or the other in the last two decades have bought products from us or have given a guarantee for someone who has bought from us. We have trackable information through their CNICs of their payment histories, thus we are in a much better position to credit score a BNPL buyer compared to anyone else out there.”

Arif elaborated: “Buying electronics on instalments was introduced by us in the late 80’s and ever since, this business has mushroomed all over the country, yet it’s still a cottage industry. With the help of technology, we are looking into revolutionizing the whole concept. Offering a BNPL customer the convenience of ordering and receiving a product from the comfort of his or her home, we are moving away from the stereotype of a typical ‘Qiston wali Dukaan’ where a consumer has to go through leaps and bounds to get a chosen product on instalments”

Qistbazaar.pk has grown to over 125 men and women. Its portfolio of brands includes mobile phones such as Samsung, Oppo, Infinix, Tecno, and Vivo – brands that are affordable and appeal to the mass market. Haier and Dawlance are the most sought-after electronics brands, as was evident by the popularity of these stalls at the Qist Bazaar Instalment bonanza at the Expo Centre in Karachi on October 1st and 2nd 2022 – the two-day event was attended by over 30,000 Karachiites who were eager to book their items on a BNPL plan of their choice.

Talking about upcoming plans, Head of Marketing, Nasir Sheikh commented: “Our focus is now on corporate partnerships with companies and/or industrial factories who have 100+ employees, we want to offer deals to this sector, especially to those blue-collar employees who are ineligible for micro finance elsewhere”.