Motor transport management information system (MMIS) Punjab, developed by the Punjab Excise and taxation department, is an online verification and registration system allowing users to check their vehicle details.

The verification and registration process are simple and require basic information about the vehicle, like the license plate number.

MTMIS Punjab vehicle verification has proved to be very beneficial as it avoids the probability of fraud or scam during vehicle buying or selling. The system provides all the information and status of the vehicle. The system also prevents any probability of legal issues. Moreover, the MTMIS Punjab also provides a complete record of the taxes, making you pass any unpaid tax. It also makes you aware of any fines or charges still on the vehicle. The system provides details about cars as well as bikes.

Online Vehicle Verification Guide

Given below is the complete guide to MTMIS Punjab online vehicle verification.

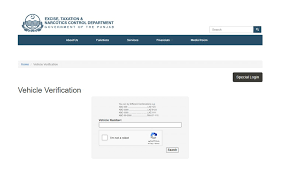

Step 1: Visit the Official website

Open the official website of MTMIS Punjab (https://mtmis.excise.punjab.gov.pk/)

Step 2: Registration number

The next step is to enter the vehicle’s Registration number of the one you want to access the information.

Step 3: Captcha

Solve the captcha given.

Step 4: Search vehicle

Now click on the option of search vehicle.

Step 5: Vehicle Information

A table will appear on your screen with all the vehicle details, including its Registration system, Registration date, Engine number, Chassis number, manufacturing year, Token tax paid, color, and vehicle price.

Another table will also appear showing the details of the Owner. The information provided is the name of the Owner, Father’s name, and city. However, the details of the Owner provided are of the time when the vehicle was transferred. Hence, the table shows the details of all the previous owners.

The table also shows the payment details with the correct amount and date. With vehicle application tracking, you can check the Application Type, the status of the application, date of challan paid, and inspection date.

Reloading the page can alter these details in case of wrong information.

This online MTMIS Punjab vehicle verification checking is not available in other provinces. People have liked this online application, which proved useful for them.

Required documents

The documents required for the MTMIS Punjab vehicle verification are the following.

- The Registration book of the vehicle.

- The License plate number of the vehicle.

- Token tax record and the Return file.

- The Sale receipts.

- Delivery letter.

- Sale invoice.

Vehicle Verification Online Smartphone App

Incorporated Pakistan Technologies Smartphone app can also do the vehicle verification. Download the app from Appstore. However, this app can also be used for vehicle verification from other provinces, along with the MTMIS Punjab verification system.

The app also reveals the history of the car with all the details. There are many sections of the app as it allows the verification of vehicles from all the provinces. You can select Punjab from the options for MTMIS Punjab.

Given below is the step-by-step guideline for vehicle verification by INCPak.

- Download the app from the App store for free. The app is only available for android phones.

- Register by filling in the relevant information if you have never used the app before.

- If you already have an account, you can log in.

- Enter the vehicle registration number for which you want the information.

- The screen will show two tables displaying information about the Owner and the vehicle.

- Protect yourself from any fraud or scam with this online vehicle verification method.

Contact Punjab Government

The users can contact the Punjab Government if they face any issues with MTMIS Punjab. Suppose you find any fraudulent activity by the Owner of the vehicle or want to complain about the taxes not being paid by the Owner. In that case, you can contact the Excise, Taxation, and Narcotics Control Department of Punjab.

Do not make any payment or contract with the Owner if you find something scam till the Government solves the issue and passes the vehicle status to ‘safe to buy.

With MTMIS Punjab Online vehicle verification, the citizens can check the details of all the motor vehicles registered in Punjab Province, including private cars, commercial cars, bikes, busses, semi-trucks, and tractors.

The users can also check other important vehicle details with the MTMIS Punjab Online verification system. The status of the Vehicle’s smart card can also be checked. Moreover, the availability status of the vehicle can be accessed as well. The important vehicle details include Vehicle’s make, vehicle model, Registration number, Owner’s name, and token tax information.

The Excise and SRU departments are developing the third phase of the Transport Sahulat Program by launching Automated Registration Card (ARC). There will not be a need for any paper-based Registration of your vehicle.

The article concludes everything you need to know about the MTMIS Punjab online verification and vehicle checking. Keep yourself protected from any frauds or scams with this online verification system.