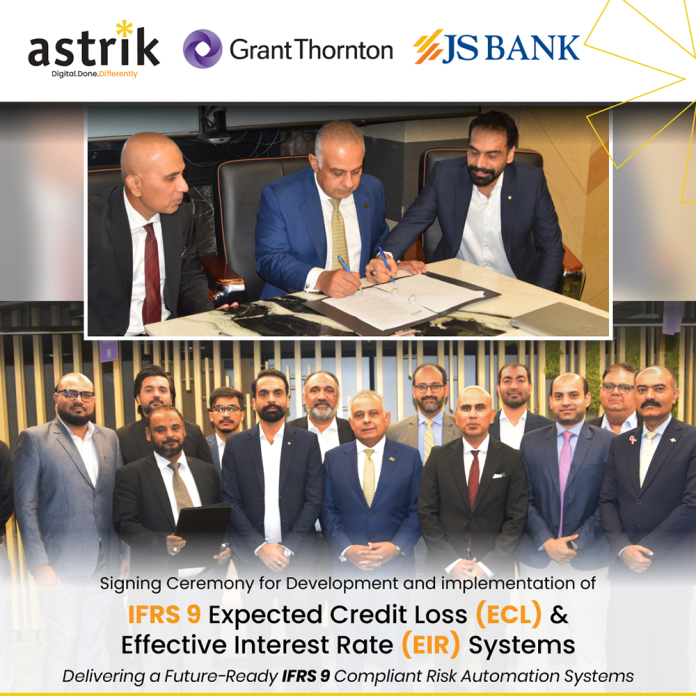

Astrik, in partnership with Grant Thornton, has officially signed an engagement letter with JS Bank to develop and implement a comprehensive IFRS 9–compliant Expected Credit Loss (ECL) and Effective Interest Rate (EIR) automation system. The signing ceremony took place at JS Bank’s head office in Karachi, marking a major milestone in Astrik’s continued efforts to lead financial digital transformation initiatives across Pakistan’s banking sector.

In attendance were Basir Shamsie, President & CEO JS Bank; Adeel Ehtesham, CFO JS Bank; Noman Soomro, Chief of Staff JS Bank along with the senior management of JS Bank; Khurram Jameel, Partner Grant Thornton along with other senior GT team members; and Shahnawaz Abro, Founder & CEO Astrik, accompanied by the Astrik product development team.

The collaboration brings together Astrik’s deep technological expertise and Grant Thornton’s technical experience to deliver a robust, enterprise-grade solution that will automate JS Bank’s IFRS 9 ECL and EIR computation processes. The system will integrate several reporting modules within a unified, auditable framework, replacing manual spreadsheets with a fully automated, secure, and regulatory-compliant platform.

Speaking at the ceremony, Basir Shamsie, President & CEO JS Bank, stated that “this system will enhance the accuracy of our IFRS 9 reporting while strengthening our overall risk management and data-driven decision-making capabilities.”

Khurram Jameel, Partner at Grant Thornton, noted that “our partnership with Astrik and JS Bank demonstrates how strategic collaboration between financial and technology experts can set new standards for compliance automation in the finance industry.”

Shahnawaz Abro, Founder & CEO of Astrik, added that “Astrik’s mission has always been to bridge technology and compliance through intelligent automation. This project is a testament to how we’re helping financial institutions achieve not just regulatory efficiency, but analytical depth and governance transparency.”

The newly deployed ECL & EIR automation system will form the cornerstone of JS Bank’s credit risk infrastructure, featuring real-time computation, configurable scenario testing, and a full audit trail of model assumptions, data, and results. Built for scalability and transparency, the platform aligns with international best practices, ensuring both internal governance and external regulatory readiness.

The engagement reinforces Astrik’s growing role as a key technology enabler for Pakistan’s financial institutions and highlights its commitment to advancing intelligent automation across the banking landscape.