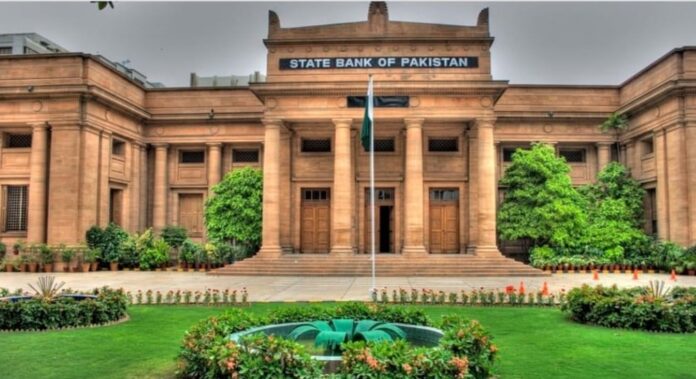

Detailed guidelines for digitizing the collection of taxes and duties was released by the State Bank on Thursday.

The central bank said there were complaints and concerns from tax payers about low awareness of the Alternate Distribution Channels (ADC) and Over-the-Counter (OTC) system among banks’ field workers.

The SBP instructed banks to ensure that their branches have a fully functioning OTC system integrated with 1Link for collecting government taxes and duties by issuing the guidelines. The branch workers should have a complete understanding of the scheme and should encourage the payment of taxes by tax payers, added SBP.

“While we appreciate the effective role and contribution of banks in making this initiative a huge success, there are still complaints and concerns from taxpayers about the low awareness of ADC, particularly the OTC mechanism, among banks’ field staff,” the central bank said. It advised banks, with immediate priority, to take steps to digitize the collection of taxes and duties.

Custom duty depends on the rate of exchange. Thus, there may be instances where the taxpayer produces Payment Slip ID (PSID) on one day and approaches the bank for payment on another day, the amount of duty reflected on the PSID may vary from the amount that appears on the terminal of the bank, said the central bank.

“In such situations, where the value of the cheque offered is smaller, the banks shall accept the additional amount in cash or cheque, in accordance with the convenience of the taxpayer. In the event that the value of the cheque is greater than the customs duty on the terminal of the bank, the excess amount will be credited to the bank in the taxpayer’s account,” the SBP added.

Banks can ensure that all of their branches recognize taxes and duties through the ADC mechanism and that their customers in every branch of their bank will pay taxes. Banks will send their customers an SMS or email message telling them that by sending a cheque, they can pay their taxes and customs duties through the internet, mobile banking, ATMs or any branch of their bank.