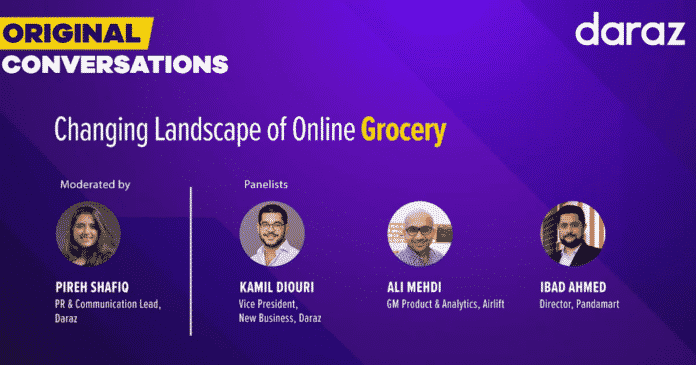

Daraz recently had a panel discussion with two of the corporate giants Foodpanda and Airlift in order to discuss the insights of online grocery shopping in Pakistan. This discussion was another “Episode of the Original Conversation with Daraz” that was organized by Daraz.

The special guests, Kamil Diouri, Vice President New Businesses at Daraz who primarily supervise the grocery business DMart, Ali Mehdi Rizvi, GM Product & Analytics at Airlift Technologies and Ibad Ahmed, Director Pandamart at Foodpanda joined the session in order to discuss the changing landscape of eGrocery and challenges our market faces while working towards sustainability of businesses.

As we all know that dMart by Daraz, PandaMart by Foodpanda, and the online grocery delivery services of Airlift have created a huge shift in the consumer buying behavior of Pakistanis for online grocery shopping and it has created a need for all to get groceries delivered during the COVID-19 pandemic. These three important stakeholders in the online grocery industry of Pakistan have tremendously taken the advantage of eGrocery during the time of the pandemic.

Before starting the conversation regarding eGrocery or online shopping in the FMCG industry, a little context regarding post-COVID-19 was shared; consumers are making new and different choices that have turned into a shift in consumer buying behavior.

However, as per the research, the consumers are exploring alternative sale standards when they are shopping for groceries online and home delivery service.

Generally, there has been a huge shift in consumer behavior and buying patterns. According to research and a joint report by PWC, the statistics show that Asian consumers are set to expand their food budget to over $8 trillion over the next decade.

Moreover, China is playing a vital and significant role in this market already and a lot of its consumers are coming from the Asian markets to China but it is also important to know that Asia, India, and other regions of southeast Asia and South Asia are also going to be seeing a growth in the food expanding patterns.

Specifically talking about Pakistan or Asia, all three giants stakeholders with a contribution to the online grocery delivery are doing a tremendous job by catering to all the essential needs of consumers.

The conversation among all three giants was based on a very interesting question and answer session; however, all the guests participated to give an overall general understanding of different aspects of eGrocery in Pakistan.

The first question that was asked was,

How big do you people think is the eGrocery or FMCG market? The size of the market and how do you measure it?

In order to answer the first question, the very first guest Ali Mehdi Rizvi stated that,

$150 billion total investment market for grocery is there in the entire regional market of Pakistan. At this stage, the boundaries between eGrocery or normal grocery shopping are shifting so rapidly especially since the COVID-19. So, whatever estimation we did today is rapidly changing the consumer buying trends.

However, in the coming months from now, e-commerce or eGrocery will capture more markets. 50 billion+ dollar grocery market is present in the region where eGrocery is the subset of that.

Daraz is focusing on same-day delivery or instant deliveries now where you compete with the neighborhood corner store just like what Airlift and Pandamart are also doing. But the major focus of Daraz is on the next-day delivery that comes in e-commerce but when we talk about delivering in 20-30 minutes, then the delivery is the really close with the competitor selling offline at the nearest store, and Airlift and Foodpanda are focusing on it.

Moreover, according to another guest, Ibad Ahmed from PandMart,

Market size at the time of pandemic is like whatever is been sold offline has 100% potential to sell online, so, size here is what we are specifically measuring. Important point is that there is no conversion here, the flexible model is been offered and we see what consumers are enjoying is the true mentality. It means that the current grocery system is evolving and the consumers do not have the access to have grocery after 11 or 11:30 at the night but our operations are there for 24 hours delivery.

He further states that need has been created now because people now know that they can get the grocery at night. From infants diapers to milk many essential items you can get at any time when running out of time.

Meanwhile, Kamil Diouri from Daraz stated that,

People’s mentality is changing where they are coming more towards online. What we focus on is who we all together can bring the best for consumers in terms of delivering groceries as individually we all are doing it and to bring more consumers to shop online collaborative actions can be made.

What we focus on and dealt with is the routine restocks. The stock and the re-stoke of the grocery supplies and pantry items have made it easy for consumers to order online and get the specific item. Daraz offers to have bigger purchases or larger basket size that is more towards to e-commerce. But what we are doing is to focus on same-day delivery or next-day delivery. We do 30 minutes delivery

The conversation continued with the next question,

Do you people think that consumers of Pakistan are adapting or have adapted this change post-COVID-19? Or they have accepted eGrocery as a primary channel to them?

While catering to the question, Ali Mehdi said that there are different momentums and consumers are shifting. Initially what we were expecting was that people would not trust them to purchase the fresh grocery items online but soon after the initiative started a surprising reaction came as people started to buy the things online. So this transition of traditional customers coming towards online was amazing.

As per Ibad there is no one consumer persona, as it is very wide and interesting to see this fast adoption of online grocery purchases. Initially, the trials done by PandaMart were the successful ones where they started generating to offer the eGrocery service. However, the trust was built due to good service and reliance.

Great potential for eGrocery industry has been observed in Pakistan. Somehow people try the services due to COVID-19 precaution but once they get satisfied with the speedy services and quick order and payment methods. They irreversibly started to have their trust in the services for more orders.

Trust is the key challenge which we catch initially online, as per Kamil Diouri, the FMCG purchases offline are what people consume every day and these were under-presented online before but these things are essential and now we are selling them online.

The convenience aspect of grocery online delivery is really important. If the customer is getting the same thing order with on-time delivery then they trust the service again. People see during the pandemic period that purchasing online is safer than purchasing offline during the pandemic period and that is why they continue with online shopping for FMCG products.

E-commerce penetration is very low as we are still covering a small market, there is a lot to do more for online and this has made us more optimistic, said Kamil.

Are Pakistanis accepting the fact that online shopping is the next big thing in the future after the pandemic? Will this shift be a smooth one in Pakistan?

You need to give people the right choice of product with right prices and the product needs to be convenient, these are the 3 basic things that are big and will make this a smooth trend. Convenience matters either you buy online or offline, like in a foreign country, offline consumers were shifting towards the online and vice versa, this shared view was enlightened by all the guests during the session.

What’s better in our country than in other countries? Where do we rank?

Pakistan is moving quickly as compare to Singapore as per Ali. In delivery facilities and online eGrocery we are facilitating rapidly and effectively by the services. Pakistan is on an accelerated path with great potential.

Brand royalty matters in Pakistan. If one is loyal to one brand in Pakistan they go to the same brand again. The ranking is not important but Pakistan has an emerging economy as in quick commerce. Our percentage is much higher in this adaption of eGrocery as compare to some other developed countries in groceries delivery. Pakistan is a large country in terms of geographical perspective. However, it has a promising market.

How merchants and sellers are responding to eGrocey?

PandaMart has 2 models, one is where you work with big brands and the other one is where you work with the local retailers. The delivery giant is providing an amazing opportunity and facility to the retailers who do not have any e-com facility now to sell online. Investments are done and these 3 significant stakeholders are bringing customers to those also.

Foodpanda manages the brand’s products from the supplier side and manages to deliver groceries to the consumer. They are not working as an intermediary between grocery retailers and consumers. More efficiency, reliability, and control of the supply chain in real-time is what they are getting by following this strategy. The mismatch is lower because the products that are shown are all available by Foodpanda.

However, Daraz adds intermediaries, wholesalers, and retailers in DMart and allows them to have a good commission of their products.

Airlift growth is tremendous, an exponential curve with high and high growth rates is recorded and expecting to continue to grow in the future. So the response from the seller or merchant side is also amazing to sell the products online.

Another interesting point was highlighted during the conversation that stated, All the giants are working to digitalize the eco-system. App experience matters a lot for consumers and the variety and range of products. Quality and accuracy of product rank much higher by the consumer site for Foodpanda and other grocery delivery services.

Daraz tries to simplify the navigation and ordering procedure in order to attract consumers to have a large basket and order more items in large quantities at once. A very simple, easy, and fast-to-order cart system has made things really simple for consumers to shop as they can order just with a single click.

In the FMCG category, Daraz has observed that for dMart Karachi, Lahore and Rawalpindi are the main cities where the highest number of orders is recorded. In Karachi, Gulshan-e-Iqbal is the area with higher orders for groceries. All product categories including the small home electronic appliances and cosmetics also have a great response when Foodpanda added it to the grocery list. 1.1 Million Makeup item products have already been sold at Daraz online in 2021 even higher than grocery items.

Conclusion

eGrocery is getting more investment because of the digitization in each field. It is becoming a sustainable industry to invest in Pakistan. All the 3 corporate giants are working to maintain their speed and quality delivery of products in order to grab more consumers to trust online shopping for groceries in Pakistan.