The Ehsaas Program is an initiative of the Pakistani government to help neglected populations rise beyond their circumstances. It has seven clearly defined objectives, which are providing safety nets and access to healthcare.

They are also providing livelihood and digitalization possibilities. As well as scholarships, education incentives, and eliminating poverty are all examples of what is being done.

If you want to start a business, go to school, or gain a new skill, Ehsaas has a variety of options for you to choose from. According to the Government of Pakistan, there are 134 policies, initiatives, and projects operating under the Ehsaas Program.

The most well-known are the Ehsaas Aamdan Program, Ehsaas Kafalat Program, Ehsaas Scholarships, and Ehsaas Interest-Free Loans.

In this article, we will discuss Ehsaas Loan Program 2022, its procedure. And how to Apply for it, its eligibility criteria and many more. So, if you want to know about it, read the article till end.

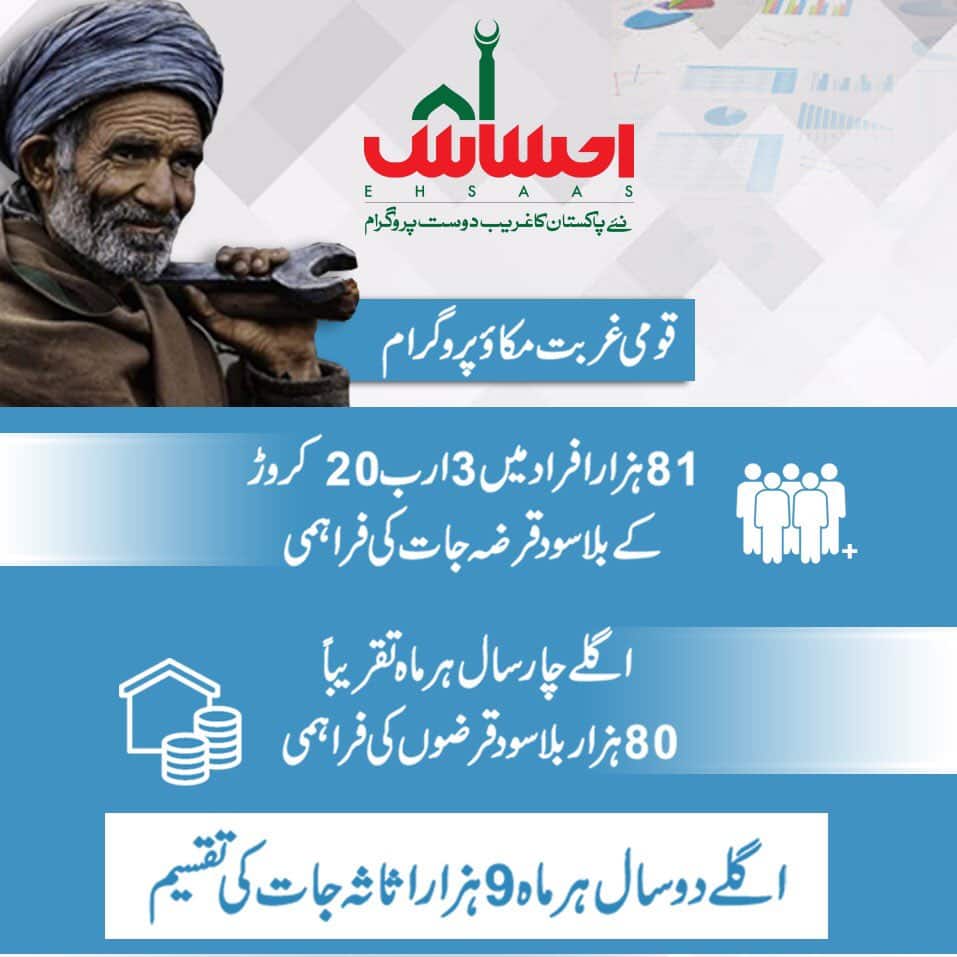

Ehsaas Loan Program 2022

In an announcement made by the Government of Pakistan’s Cabinet Secretariat, Ehsaas interest-free loan program (a type of loan that does not charge interest) will be implemented through the Ehsaas kafalat program until 2022.

Female candidates will be eligible for a 50 percent discount on the Ehsaas free loan. Financial inclusion and mainstreaming of marginalized segments of society. Particularly skilled youth, women, people with special abilities, transgender people. Also, beneficiaries of the BISP, Zakat, and Baitul Mal programmes,are priorities for the project.

Through Ehsaas loan scheme, every month, PPAF and its partners will disburse 80,000 in loans through 1110 loan centers throughout the country.

You can apply for an Ehsaas Interest Free Loan either through a written application or through an oral request. Also, you can do Ehsaas program loan scheme to apply online.

Following the receipt of this formal information, they will provide you with an application form, as well as a business plan template. The final and most important step is to submit your application along with the completed required documents.

Features of ehsaas loan scheme:

The program’s most notable features are:

• Interest-free loans are available to persons with a poverty score of over 40.

• Federal and state government funding.

• A loan of PKR 20,000 to PKR 75,000 is available.

• Women will receive 50% of all loans.

• They will give Special consideration to candidates from underserved groups. Such as skilled young, women, people with disabilities. As well as transgender people, Benazir Income Support Program, Zakat, and Bait-ul-Maal recipients.

• Every month, 1100 lending centers across Pakistan disburse 80,000 loans.

Ehsaas Interest Free Loan eligibility criteria

Eligibility criteria of this scheme/program are to follow:

- Minimum interest-free loan amounts vary between Rs20,000 and Rs75,000.

- Maximum interest-free loan amounts range between Rs75,000 and Rs200,000.

- Average loan amounts range between Rs30,000 and Rs400,000.

- Pakistani citizens with a valid CNIC are eligible to apply.

- And Pakistani citizens, who are between the ages of 18 and 60 are also eligible.

What is the best place to apply?

The interest-free loan is being given through a network of 22 partner groups in rural areas, urban areas, and small town. If you search online, you will get information about districts, lending centers. As well as about the names of partner organizations, focal individuals, and contact information.

All you have to do is type in the information you are looking for and it will appear. Like type in the phrases “List of Partner Organizations in EHSAAS Loan scheme” or “List of Loan Centers across Pakistan in EHSAAS Loan scheme” into Google to find the information you’re looking for.

Ehsaas Interest Free Loan Online Apply

As we know, 22 partner organizations (POs) of Pakistan Poverty Alleviation (PPAF) in rural areas are working. And Akhuwat branch offices in cities and towns are implementing the interest-free loan program. They have loan centers in 100 districts across the country.

Apart from this, one can also apply online. Ehsaas loan program online registration form can be found at www.ppaf.org.pk/NPGI.html. Potential borrowers can find information about their district, loan centers, names of incorporating Partner Organizations (POs). As well as about eligibility criteria for borrowers in the country can also be found there.

Loan Form Application Process

- Locate your nearest Loan Center. Make a note of the contact information for the Focal Person and Loan Center (search through the name of your District, Tehsil, or Union Council in the Search Bar).

- For more information, contact your local Loan Center.

- If you meet the requirements, a loan officer will complete your loan application form.

- The concerned personnel will pay a visit to your home or neighborhood in order to verify your information.

- If they approve your application, the loan officer will notify you.

- Assuming that there are no objections, it will process the loan in approximately 2-4 weeks.

- Also, you will receive your interest-free loan cheque at a time that has been previously agreed upon with the loan officer.

Preparation of Business Ehsaas Loan Plan:

Preparation of a Business Ehsaas Loan Plan includes the following steps:

• Gather basic information about the business that is being started

• Determine the reasons for starting the business.

• Find out production and sales targets.

• Develop a marketing strategy.

• Measure business expenses.

• Determine cost estimates for the proposed business.

• See financial resources.

• Establish profit estimates.

Ehsaas Loan Scheme Beneficiary Appraisal Process

The Beneficiary Appraisal Process for the Ehsaas Loan Scheme is as follows:

• Appraisal of the social environment

• Appraisal of the economic environment

Ehsaas Loan Program Approval Process:

The following steps are required for approval of the Ehssas Loan Program:

• Review by the Loan Center

• Recommendation by the Loan Center

• Submission of selected cases to the PO head office

Beneficiary Disbursement for the Interest-Free Loan Scheme:

The following are the manner in which they compensate the beneficiaries of the Interest Free Loan Program:

- Acceptance of suggested cases.

- They issue orders with the borrowers’ names and CNICs.

- Or they issue a PIN number for an electronic transfer that is validated by the bank using the borrowers’ original CNIC.

- Disbursement of funds at the Loan Center

Wrapping Up:

Ehsaas is an actual word that denotes compassion. This is the most recent endeavor by the government of Pakistan. Its aim is to assist people in making their lives easier and better by providing them with financial help.

Our discussion covered a wide range of topics. Starting from free education to wealth-creating assets. As well as the eligibility requirements, application process, and all other aspects of the main part of ehsaas program, i.e. ehsaas interest free loans project.

If you find this article useful, do share it with your family and friends.