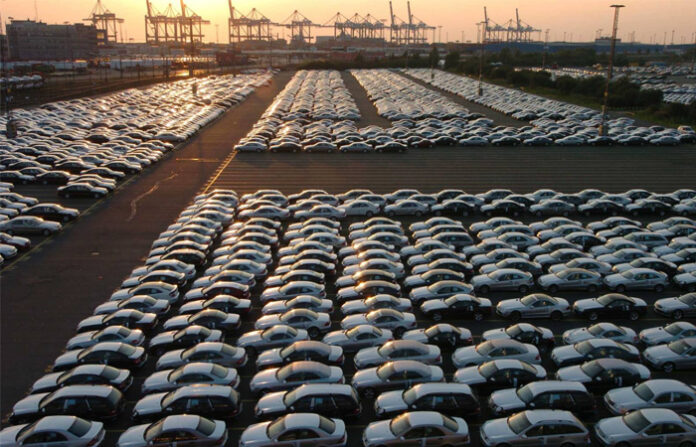

Government Tax Ombudsman (FTO) has coordinated FBR to speed up the sale of a significant number of non-cleared abandoned vehicles at Karachi Port, which were imported infringing upon SRO gave by the Ministry of Commerce.

The subject vehicles were imported under Personal Baggage, Transfer of Residence, or under Gift Schemes. As indicated by the Customs Act, if merchandise are not cleared from the port inside twenty days of appearance, they should be eliminated from the port and sold in the sale.

Government Tax Ombudsman’s Own Motion choice expresses that inability to opportune organizing a closeout of vehicles lying un-cleared at first sight is a fundamental issue of maladministration, and apparently FBR had neglected to set up a framework whereby vehicles cleared from the port are not ideal recorded in the Auction Schedule.

Postponement in the closeout would make the majority of these vehicles unserviceable because of rusting of bodies, running down of tires and batteries, pilferage of parts, and so forth, making blockage at Ports.

After the inception of the Own Motion examination, the concerned office sold 100 67 (167) vehicles and sought after the check of the Proceed Realization Certificate (PRC). In any case, more than 500 vehicles are as yet anticipating closeout.

It was additionally seen during the Own movement examination that few purported proficient bidders bought countless vehicles routinely and afterward sold the equivalent for an enormous benefit in the open market. It was seen that 62 bidders bought 167 vehicles sold during the period from July to November 2020, while 20 bidders bought 117 vehicles.

An examination of information mirrors that a few bidders had often taken an interest in closeouts, along these lines, projecting genuine questions on the straightforwardness of the sale procedures.

FBR had as of late concocted another “web based offering strategy” to buy products carefully from the Customs Department. In any case, it has not yet been executed because of the E-Auction module being worked on. In such manner, Federal Tax Ombudsman has prescribed FBR to guarantee the looking at of the proposition of building up an E-Auction module under the WeBOC programming to assist removal of un-cleared transfers.

FBR has been additionally prescribed to guarantee the usage of the E-Auction Rules informed vide SRO 1174(I)/2020 dated 26.10.2020. FTO office has prescribed FBR to guarantee the accessibility of the information identifying with bidders who took an interest in closeouts on standard premise and offering it to the separate IRS field arrangements.

It is normal that after execution of the E-Auction module, the products ready available to be purchased would be discarded immediately, and the mafia of expert bidders would be tended to, bringing about an improvement in income acknowledgment.