The world is seeing rapid digitization across all sectors, be it consumer products, e-commerce, or financial. Pakistan’s digital landscape has seen a similar growth in the past decade. According to stats, with a population of over 220 million, Pakistan has over 170 million mobile connections and over 60 million internet users.

This adaption of digitalization can also be observed in the financial sector of Pakistan. According to a report published by the Data portal in Jan 2021, over 70 million people have made digitally enabled payment transactions from 2020 till 2021, which has been a growth of almost 27% since last year.

The growth can also be seen in mobile communication applications like WhatsApp. WhatsApp has remained the most used and downloaded application in Pakistan for the last few years.

Realizing the convenience and high usage of the application, NBP Funds have recently pioneered in launching the first-ever transactions through WhatsApp in their official WhatsApp Self Service Portal. Approved by SECP and being the first of its kind service in Pakistan, it guides you to make digital investments and allows you to redeem your money instantly and securely through WhatsApp with a few simple steps. As a user, you are no longer required to go through time-consuming manual forms or remember credentials. You can tend to your small urgent matters such as cash needs or balance checks by simply starting a chat with NBP Funds’ official WhatsApp number: 021 111 111 632

NBP Funds WhatsApp Self Service: A Closer Look

The WhatsApp self-service was launched earlier this year to facilitate investors quickly and securely access information regarding their funds. Alongside transactions, a complete list of services is available through the WhatsApp self-service portal.

- Account Balance and Statement

- Online Investment and E-Transactions

- Products and Services

- Fund Manager Report

- Account Services and Certificates

- Complain or Feedback

- Talk to an Agent

Performing Transactions

Eligible investors can either invest (invest in funds) or redeem (cash out their investments) using WhatsApp.

Withdrawing money into Bank Account

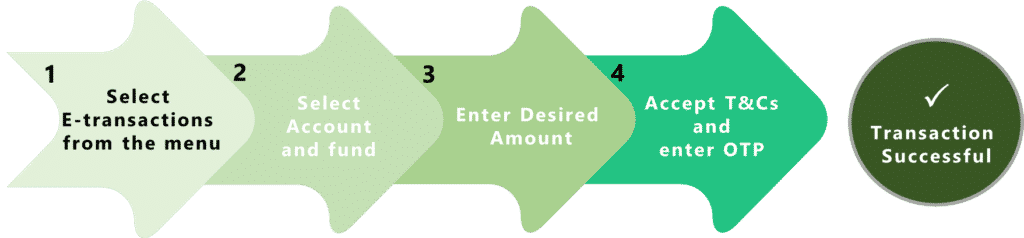

An investor can make redemptions by following these steps and safely withdrawing funds into their registered bank account:

Investments: Adding More Money

NBP Funds Official WhatsApp Self-service guides you to make investments and start your wealth-building journey. This is possible either through Bank Transfer or through Bill Generation.

Investing through Bank Transfer generates a unique IBAN that you can then use through any mobile banking application to transfer any amount.

Whereas the Bill Generation method requires you to specify how much you intend to invest and then get an investment voucher number. You can then use any banking application to pay against the investment-generated voucher.

WhatsApp Self Service: Paperless and Hassle-free

WhatsApp Self Service is designed to provide easy and secure access to investment facilities. One significant benefit of using WhatsApp Self Service is that you do not need to remember your credentials. Whenever you need to access basic information regarding your investments or take out cash for urgent needs, you can open your WhatsApp and, in a few simple taps, get the job done in a paperless, hassle-free way.

NBP Funds: Journey So Far

NBP Fund Management Limited (NBP Funds) is one of the leading Asset Management Company (AMC) of Pakistan, managing over 18,100 Crores of investors’ in various investment solutions as of 31st Dec 2021. The main sponsors of the company are the National Bank of Pakistan (NBP) and the Baltoro Growth Fund.

PACRA has awarded the company the highest achievable investment management rating of AM1 (Very High Quality). This rating is based on the company’s professional management team, the sound quality of systems and processes, sponsors’ strength, and the performance of funds under management.

NBP Funds plays a vital role in promoting investment opportunities in Pakistan by utilizing its financial engineering expertise. The company provides a comprehensive range of investment products and services tailored to its investors’ requirements.

In 2020, NBP Funds became the first AMC to launch its debit card and, keeping up the streak, has now become the first company to launch Transactions through WhatsApp self-service.

Discalimer: All investments in mutual funds are subject to market risk. Past performance is not necessarily indicative of future results. Please read the Offering Documents to understand the investment policies and the risks involved. The use of the name and logo of National Bank of Pakistan does not mean it is responsible for the liabilities/ obligations of the Company (NBP Fund Management Limited) or any investment scheme managed by it.