In this article you will get to know details about NTN number, what is basically NTN number is, How to get ntn number in Pakistan? How to get ntn number from cnic? why you need NTN number? and much more. This post will be extremely beneficial to anyone who lives in Pakistan and has a reliable source of income, as well as anyone who owns or operates a business that is profitable and generates profits. Make sure you read this article all the way through.

If you’ve a source of money in Pakistan, you must pay taxes. A NTN is required to pay the tax . The FBR has made it mandatory for all employed and corporate people to pay their taxes on time. In order to pay these taxes in Pakistan, you must first register with the Federal Board of Revenue (FBR).

What is NTN Number?

So, what basically an NTN number is? Ntn number Pakistan is number issued by FBR to every registered taxpayer.

People often confuse between CNIC and NTN number and ask Is CNIC a NTN number? Here the answer is NO. A CNIC number is different than NTN number.

It is required to always have a National Tax Number (NTN) issued by the Federal Board of Revenue in order to conduct taxable transactions if you want to be considered a registered taxpayer. It is possible to obtain a National Tax Number (NTN) for the purposes of income tax, sales tax, and federal excise. It is also possible to use this NTN for the exports and imports of commodities.

In Pakistan, the National Tax Number (also known as NTN) is a unique number provided by the Federal Board of Revenue, which is the country’s primary tax authority and issues the NTN. Anyone who is subject to taxation under the Income Tax Ordinance 2001 is required to register with the Federal Bureau of Registration. Section 114(1) of the ITO 2001 specifies the categorization of a person who is needed to be registered with the Federal Bureau of Registration.

Need of NTN number:

In Pakistan, are you liable for paying tax, property tax, or sales tax? If so, what are your options? Then make certain that you have a National Tax Id Number (NTN). There are certain advantages to being a tax filer as well, such as having to pay less car token tax. You will, however, be subject to a higher tax rate on financial transactions, real estate transactions, and car tokens if you are a non-filer. To be on the safe side, it is preferable to become a tax filer in order to avoid having to pay additional taxes on a variety of items.

How to get NTN number in Pakistan:

The Federal Board of Revenue (FBR) has made the NTN registration procedure far more convenient for everyone who want to get Fbr ntn number. Personal appearance before the Federal Bureau of Investigation is no longer required under any circumstances. In recent years, NTN registration and getting NTN number has now become incredibly simple.

If your earnings meet the requirement of taxable income, you must obtain NTN from the Federal Bureau of Revenue. In the event that your annual income exceeds Rs. 6 lacs, you would be required to pay income tax. NTN is required in order to file tax returns.

So, if you are the one who asks How can I get my NTN number online? And search for it then you are at right place, read the given below method of getting NTN number.

What documents are required for NTN?

The most important and foremost step in getting NTN number from FBR is that you should have all the required documents with you. Ensure that you have all of the essential documentation before submitting your application to the FBR for an NTN number.

we will here tell you about the needed documents in both the cases i.e., for salaried person and for businesses.

For salaried Persons:

Following are the documents required for a salaried person to get his/her NTN number from FBR:

- Copy of personal CNIC (valid one).

- Photocopy of a freshly paid power bill for the residence (the bill should not be older than 3 months).

- Current pay slip.

- Valid mobile and landline numbers and personal email address.

- Employer NTN, office address along with email address.

For businesses:

Following are the documents required for business to get their NTN number from FBR:

- Print of a valid CNIC is required.

- The latest electricity bill that you have paid for the business location.

- Blank Business Letter Head.

- Properties papers or a rental agreement (a rental contract imprinted on Rs. 200/- stamp paper) are both acceptable options.

- The Nature of your business.

- Valid mobile and landline numbers and email address.

Methods to get an NTN number:

You can obtain your NTN number from the FBR in one of two ways, which are as follows:

By visiting FBR office/Offline method:

You can request for an NTN number by visiting the FBR office in person with all of the necessary documentation. Complete the registration process to the best of your ability. You will need to employ a tax expert if you want to apply for an NTN number from the FBR using the offline system.

Through FBR official website/Online method:

The FBR has launched an online e-portal to enable people to obtain their NTN number online, which is far more convenient than the previous offline procedure. The IRIS FBR system, which is simple to use, is responsible for the online registration of NTN numbers. This straightforward step-by-step guide will walk you through the process of obtaining an NTN number online from the IRIS FBR system. If you are wondering and think, How can I get my NTN number online? How can I get my NTN number from CNIC?, how to obtain an NTN number in Pakistan, or how to obtain an NTN number from FBR, then read on further.

Step no 1:

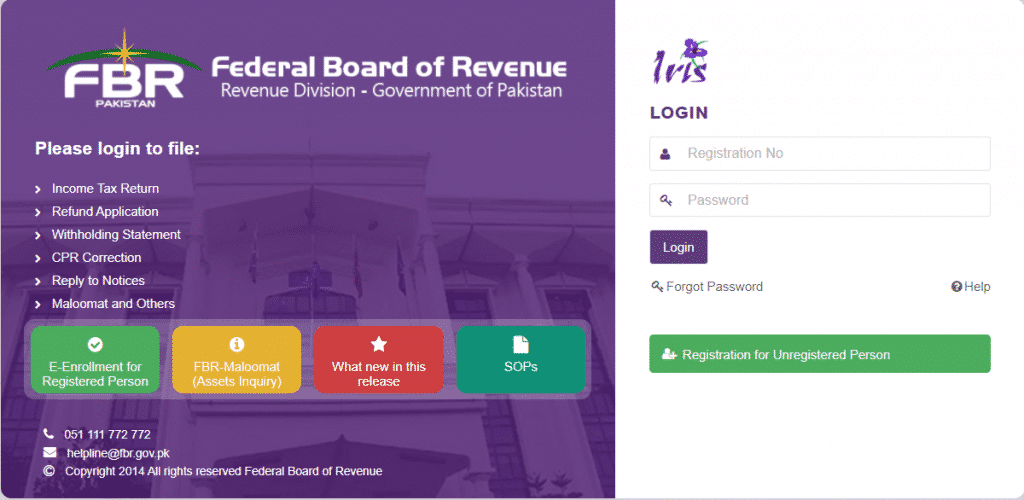

To begin the NTN Registration procedure, you must first access an online IRIS PORTAL, which is available on the official website of the Federal Board of Revenue by clicking on the following link:

https://IRIS.fbr.gov.pk/public/txplogin.xhtml

A window similar to the one below will emerge, with numerous options displayed in different colors, as shown:

Step no 2:

Second step is to Select the relevant registration option from the menu.

- Please click on the green tab written “E-Enrollment for Registered Person” to the right if you are a registered person and wish to be enrolled in the IRIS Portal of the FBR (FEDERAL BOARD OF REVENUE) for the purpose of online transmission of Tax Filings and levies.

- Second option is the NTN Registration for Unregistered Person. For those who have not yet registered with the FBR (Federal Board of Revenue), the first step is to click on the blue tax icon located in the top center of the selection.:

Step no 3:

The 3rd step is the form filling step. You have to fill the appropriate form accordingly:

E-Enrollment for Registered Person:

In this case you will need to enter the following requirements in the form:

- CNIC

- NAME(pop up automatically)

- PHONE/MOBILE NUMBER

- VALID EMAIL ADDRESS

Then you have to fill CAPTCHA code and click on the submit button.

Now If you have entered your cell phone number and email address above, then will get two separate passcodes from the FBR online system within 5 to 10 minutes. Insert these credentials in the appropriate areas and click “Submit” once again.

Your account online on the IRIS Website of the FBR (FEDERAL BOARD OF REVENUE) will be formed, and that you will get the CNIC (Login ID), Passwords, and Pin code on your cell device by SMS and email, as well as on your desktop computer.

Registration for Unregistered Person:

In this case, you will need to enter the following requirements in the form:

- CNIC NO

- FULL NAME (first, middle & last)

- CELL PHONE NUMBER

- VALID EMAIL ADDRESS

Rest of the process is same as above.

Step no 4:

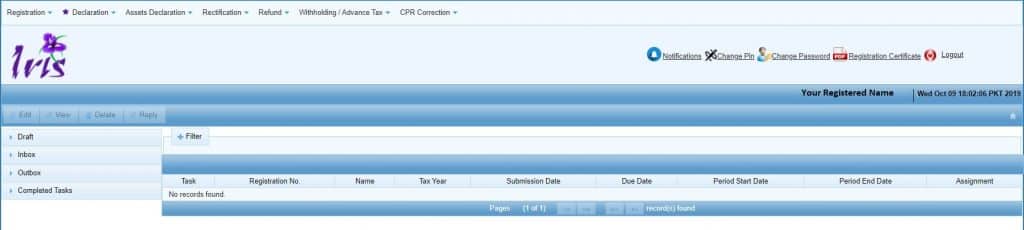

The FBR IRIS Online Portal is now available for you to access by click on the following link to login: IRIS Online Portal (FBR).

https://IRIS.fbr.gov.pk/public/txplogin.xhtml

Insert your CNIC id in the “Registration No” area and passcode in the particular field (take excellent care about the uppercase and lowercase letter) and press login. A window like below will display.

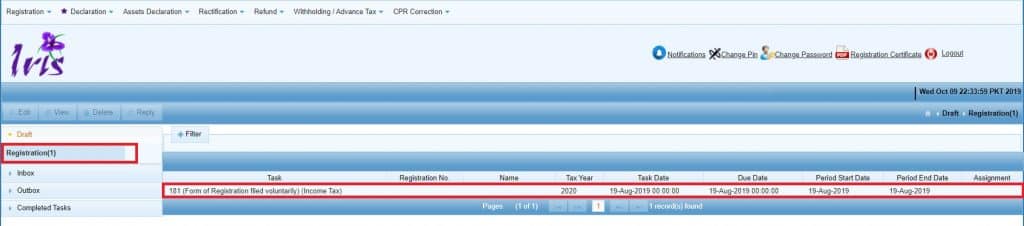

Step no 5:

Now, select “Registration(1)” from the “Draft” drop-down option on the left side of the screen. A window similar to the one below would appear:

Choose draft from the drop-down menu You will be presented with an 181 application form to complete. When you click on the edit button, you will be presented with a number of different tabs, including the Personal Tab, the Business Tab, the Property Tab, the Link Tab, the Attachment Tab, and the Bank Account Tab.

Step no 6:

Fill up the blanks on the registration form with the necessary information. If you are employed by a company, you must enter the employer NTN in the Link tab of the application. You are not required to fill out any information on the Business Tab or the Bank Tab. To finish the registration process, click Submit. Please double-check all the information you entered into the registration form. You must include all the documents listed above in the body of the article.

Wrapping Up:

These are the steps to take in order to obtain a National Tax Number (NTN) from the Federal Board of Revenue (FBR) of Pakistan. If you are utilizing the offline system, you can obtain the NTN. To obtain NTN from the FBR, you must, however, retain the services of a tax counselor. You must have the necessary documentation in order to receive NTN from FBR. People in Pakistan will find it easier to register and obtain a National Tax Number as a result of the implementation of this online system (NTN).