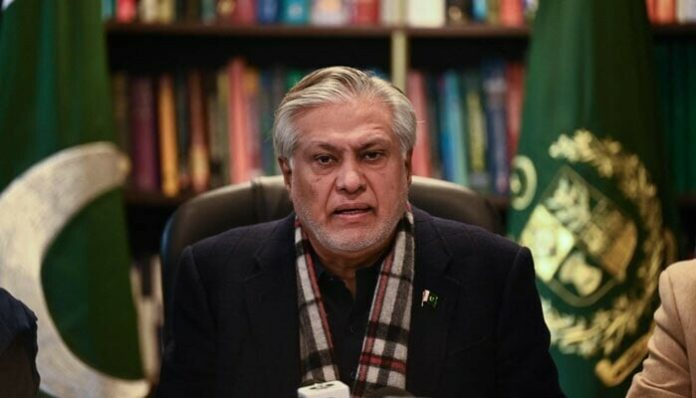

Finance Minister Senator Muhammad Ishaq Dar has presented a new budget of Rs.14.7 trillion in the National Assembly for the fiscal year 2023-24. In this budget, the government has projected a fiscal deficit of around 7 percent of the GDP.

The government has set targets for tax collection and non-tax revenue for the Federal Board of Revenue. The tax collection target for 2023-24 is Rs.9.2 trillion, while the non-tax revenue collection target is Rs.2.7 trillion.

The total revenues are expected to be Rs.11.9 trillion. To achieve the non-tax revenue target, the federal government is making amendments to the finance bill by increasing the petroleum development levy (PDL) from the existing Rs.50 per litre to Rs.55-60 per litre.

This change will enable the government to generate a massive non-tax revenue of Rs.870 billion from the PDL in the 2023-24 budget, starting from July this year. The revised estimate for PDL collection in the outgoing fiscal year is Rs.550 billion.

Therefore, in 2023-24, the government aims to raise an additional revenue of Rs.320 billion through an increase in the PDL rate. The lack of credibility in the budgetary numbers will continue to be a concern for the economic managers as they may change throughout the financial year.