According to the finance minister, Islamic finance will aid in poverty alleviation and financial sector development. He directed that Shariah-compliant products be issued by the National Savings Bank. On public demand, safe investment facilities will be made available.

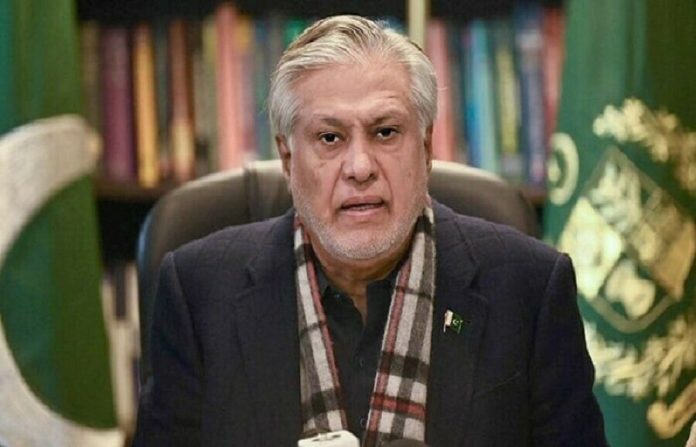

While speaking at the Islamic Capital Markets Conference, Federal Finance Minister Ishaq Dar stated that Islamic finance can play an important role in economic development. Assets were $4 trillion in 2016, and are expected to grow to $5.9 trillion by 2026, with global Islamic finance assets growing at a 17 percent annual rate.

He claims that Pakistan has two of the ten largest Islamic banks in South Asia, that the volume of Islamic finance in Pakistan is 42 billion dollars, that the volume of Islamic banking assets in Pakistan is 7200 billion rupees, and that Pakistan has six full Islamic banks. Islamic deposits total 5200 billion rupees, and 16 conventional banks have Islamic branches as well.

Ishaq Dar stated that the Governor of the State Bank has worked hard to promote Islamic finance, that the National Savings Institute has been directed to issue Shariah Compliant products, and that safe investment facilities will be made available on public demand for one to five years. For investment, savings and term accounts can be opened.

According to the Federal Minister of Finance, Islamic finance will aid in the abolition of poverty and the development of the financial sector. will help to improve, and Islamic financing can also help to alleviate poverty.

He stated that economic challenges can be overcome with the cooperation of all Islamic countries, that Pakistan’s banking system is transitioning to Islamic financing, and that Pakistan has a comprehensive system for collecting and distributing Zakat.

.