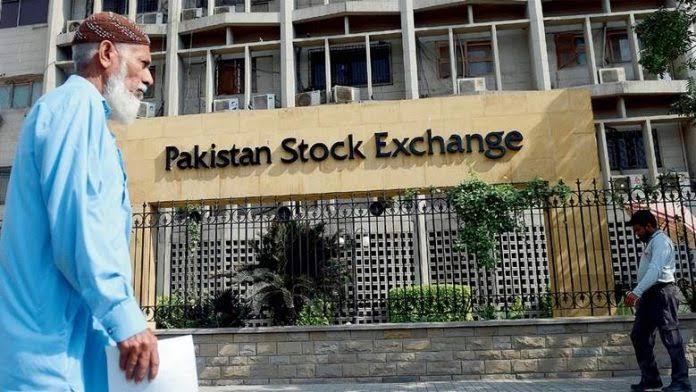

The Pakistan Stock Exchange (PSX) recently experienced a notable comeback, rebounding just days after a correction. The resurgence was attributed to positive cues that instilled confidence among local investors, prompting increased stock purchases. This renewed enthusiasm was reflected in the market’s performance, particularly the benchmark KSE-100 Index, which exhibited a substantial 1.50% surge on Thursday.

On Wednesday, the KSE-100 had closed at 60,863 points, but the following day saw a remarkable turnaround. The index gained an impressive 1,271 points, crossing the significant 62,000 mark. This upswing in the money market is seen as a positive sign, with expectations that the market will conclude the year on a high note.

Experts have linked this resurgence to positive traction in the money market, which has now advanced for the second consecutive day. Interestingly, the experts also note that the money market tends to come forward amid fears related to political instability. This suggests that despite political concerns, the positive market sentiment has overridden apprehensions, at least for the time being.

In a broader global context, Asian shares reached 5-month highs, aligning with a trend where markets worldwide were anticipating increasingly aggressive rate cuts. This trend was particularly notable in the United States, where a significant rally in both stocks and bonds was observed. The surge in Asian shares is indicative of the interconnectedness of global financial markets, with developments in one region influencing others.

In conclusion, the recent rebound in the Pakistan Stock Exchange, driven by positive cues and local investor confidence, aligns with broader global trends of market optimism. The resilience of the market despite political concerns underscores the impact of economic factors and investor sentiment. As the year approaches its end, the positive trajectory in the money market and the benchmark index’s performance may contribute to a favorable closing for the financial year.