Pakistan Telecommunication Firm Ltd., or PTCL, is the country’s national telecommunications company. Despite the arrival of a dozen other telecommunication firms, including Telenor GSM and China Mobile, PTCL provides statewide telephone and internet services and is the backbone of the country’s telecommunication infrastructure.

The company manages and runs around 2000 telephone exchanges across the country, making it its largest fixed-line network. GSM, HSPA+, CDMA, LTE, broadband internet, IPTV, and wholesale are all part of the company’s data and backbone services.

PTCL also provides online services. Now you can download the PTCL withholding certificate online. All PTCL EVO, landline, and CharJi subscribers who would like to create their PTCL Tax Withholding Certificate free on the internet from the comfort of their own homes can now do so by following the simple steps outlined in a comprehensive process for creating a PTCL Tax Certificate.

To obtain a PTCL Withholding tax certificate, you will need to know the area code, mobile number, and account ID. The owner’s MDN number, ESN number, and CNIC number are required for PTCL EVO and CharJi.

What is PTCL withholding tax certificate?

A withholding tax is paid to the government by the income provider, not the income receiver. As a result, the tax is withheld from the recipient’s taxable income or deducted from it. In most countries, withholding tax is applied on employment income.

How to get a PTCL withholding certificate online?

For Popular Telecommunications Services, obtain a PTCL withholding tax statement. For landline phones and EVO / Charji services, the PTCL Withholding Certificate is available. Use the link to obtain your tax certificate. You’ll be sent to the official PTCL website, where you’ll be prompted to choose a service. According to the service, it will be necessary to provide the account ID and the tax payment period.

PTCL withholding tax certificate for landline

Follow the following steps to get your PTCL withholding tax certificate for landline:

Step number 1

The first is to turn on your mobile. Go to google. On google, visit the website of PTCL.

Step number 2

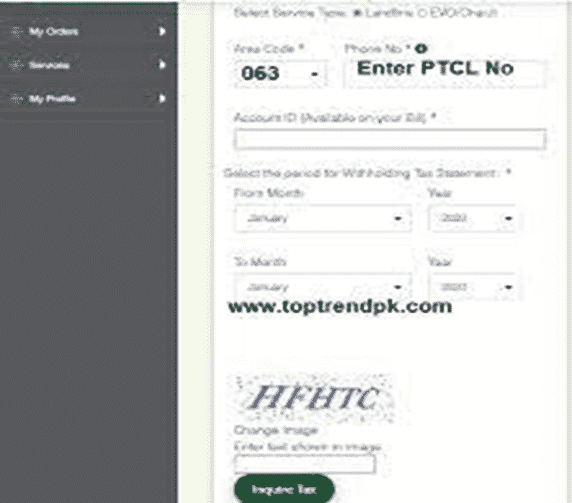

Now, you will receive a form of PTCL withholding tax certificate. Fill out that form according to the following instructions given below:

- Now choose “Landline” as your service type.

- Choose your zip code.

- Type in your phone number

- Now type in your account ID.

- The next step is to choose a time frame.

- Complete the Captcha puzzle.

- Select “Inquire Tax” from the drop-down menu.

- Your tax certificate will show on the next page.

PTCL withholding tax certificate for EVO/Charji

Here’s the case for EVO & CharJi devices after you’ve found the Withholding Tax Certificate. The second approach is fairly straightforward and uses the same URL; however, the needed fields have changed. Follow the following steps to download the tax certificate for EVO/Charji:

Step 1:

Select the URL or link from the drop-down menu.

Step 2:

Choose the “EVO/CharJi” service type.

Step 3:

Now, remove the 92 from the MDN number.

Step 4:

The ESN number must be entered in the second step.

Step 5:

The ESN number is also known as the ICCID number (present on the device).

Step 6:

Enter the CNIC of the user who has completed the registration process.

Step 7:

Please set the tax date to be held until the expiry date.

Step 8:

Click “inquire tax” after solving the captcha.

Conclusion

Now, taxpayers are ready to update their certificates from the comfort of their own homes. All certificates are now free to download from the PTCL official website. If you still have an issue, you may go to your local PTCL office or phone the support operator at 1260 for information and solutions to commonly asked problems.