Coronavirus arose as the greatest humanitarian and monetary emergencies. Lockdown and closure have carried the monetary movement to a crushing end. Each part of the economy and society has been affected by the Pandemic with a more antagonistic impact on everyday bets, casual specialists, and existing organizations.

As the earning limit after the effect of COVID-19 on organizations and lives, the Government of Punjab is zeroing in on such exercises and projects that assist/support social areas and reestablish monetary movement to give businesses valuable open doors across the region.

The worldwide economy has been seriously impacted by the original infection and Pakistan is the same in such a manner. Regardless of whether it is a huge business or a little one, everybody has endured because of the pandemic similarly. The reason for the work program is to give monetary help to both limited scope organizations and new businesses.

Introduction of Punjab Rozgar

Punjab Small Industries Corporation (PSIC) is a sculpture body corporate set up under PSIC Act. 1973 and working under the regulatory control of Industries, Commerce, Investment and Skills Development Department (ICI&SDD), Government of Punjab with the order to advance the limited scope and house ventures in the area.

They will do this by giving credit, issuance of credit assurance to the planned banks, admittance to foster foundation, business warning administrations, showcasing channels, normal offices, building up craftsman’s settlements, the plan focuses, studios, and organizations for advancements and improvement of handiworks with its principle capacities.

Punjab Rozgar Scheme is a drive by the common government that means to work with and improve the extent of the bungalow business and various kinds of miniature, little, and fair-sized undertakings (MSMEs). Albeit the plan is under the leader of the Punjab Government, it is additionally directed by Punjab Small Industries Corporation (PSIC)

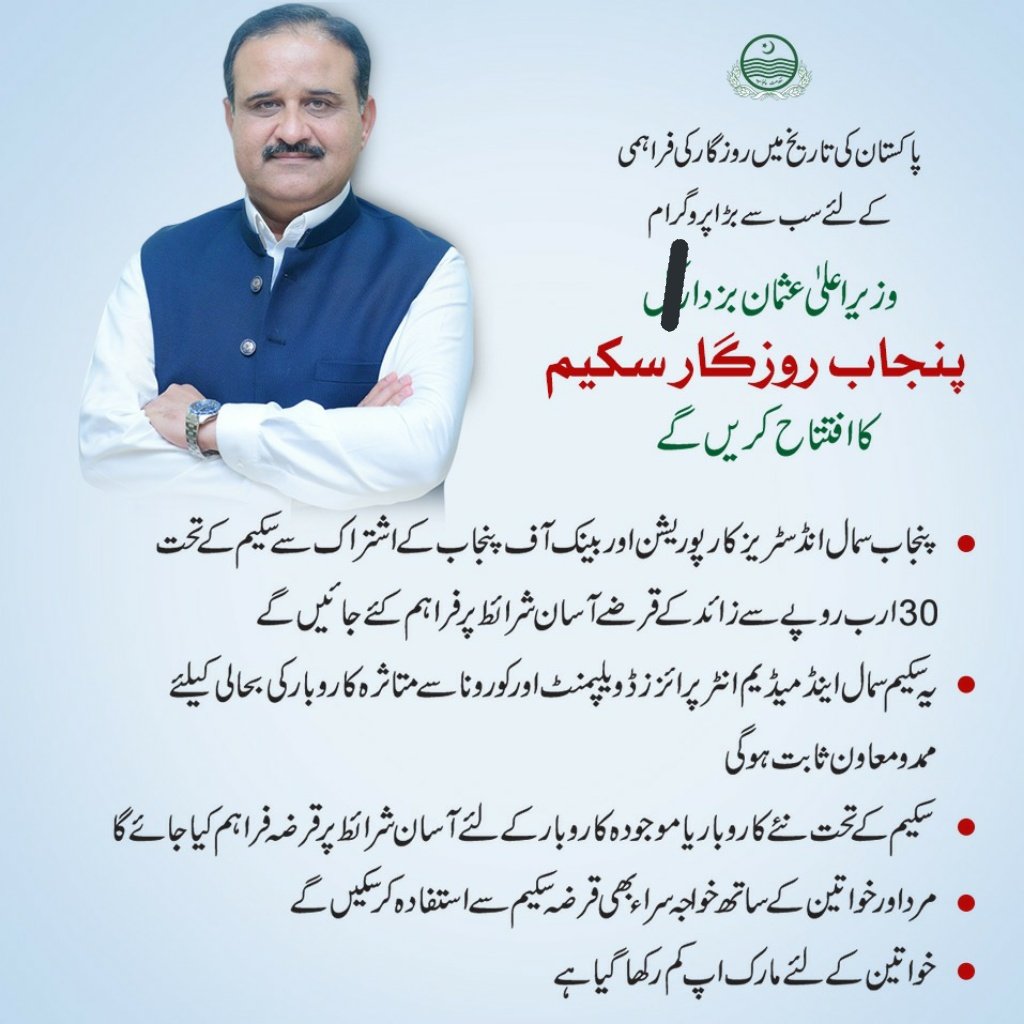

Punjab Rozgar Scheme 2020 has been sent off by the Chief Minister of Punjab Usman Buzdar to offer monetary help to independent ventures and enthusiastic business people. It is a gainful drive by the Government of Punjab in this pandemic. The principal reason for this Scheme is to set out work open doors by setting up independent companies.

Moreover, the public authority intends to give up to PKR 30 million as advances to finance acknowledge offices in cooperation for nearby banks of the territory. The sums that are destined to be allowed in this program would go from PKR 1 lakh to PKR 10 lakh.

Who Can Apply For Punjab Rozgar Scheme?

- The candidate should be College/college graduate with enterprising abilities.

- Testament/Diploma holder from TVET having professional degree/specialized.

- Talented laborers, Artisans, or people having a beneficial plan of the business

- Micro and different ventures that apply for a loan to embrace asset proficient and cleaner creation innovations or any climate green intercession to work on the climate by their activities.

- Existing organizations.

Qualification Criteria For Punjab Rozgar Scheme 2020

There are a couple of necessities that you want to meet before you begin applying for the plan. Here are the qualification rules for the program:

- You should be in the age section of 20 to 50 years.

- The candidate should be a resident of Pakistan, and an occupant of Punjab which will be confirmed through their CNIC.

- Business profiting credit offices in Lahore ought to be Lahore-based.

- The business types that are qualified for the program include sole ownership, organizations, or any business satisfying the qualification measures.

- The candidate ought to have a decent record as a consumer.

- Strategies should incorporate manageability aims to keep the business durability after the COVID 19 Pandemic.

Instructions To Apply For Punjab Rozgar

- As you access the Punjab rozgar scheme official website, the homepage will show up and you will tap on the “Candidate Signup” button to continue further.

- After clicking this button another window will show up requiring information of the candidates, including name, CNIC, and so on after filling the form, click the “Register” button.

- As you are getting enrolled, the landing page will show up again where you will enter your Login details

- When you log in, you will arrive on the profile page where you will click the “New Application” button.

- In the following stage, you will be shown a list of records that needs filling the application and the guidelines. Read the complete page carefully and click on “read and agree on instructions” to start the application.

- When you agree to the guidance, a list of inquiries to survey your qualification will show up. Check the perfect choice and then continue.

- At this stage, you will be asked some information about what sort of credit you are applying for. Here you will choose the choice “Punjab Rozgar Loan”.

- In the subsequent stage, the candidate should transfer a copy of his/her power bill. Following transferring, you will click the “save and proceed” button

- After submitting individual details, you will presently need to give business information and the category of organization.

- After this stage, a form will appear requesting security details. You will add insights concerning the individual assurance, including the name of the individual, CNIC, total assets sum, and so forth

- As you complete the security subtleties structure, you should give insights regarding your field-of business strategy.

- After filling in your security-relevant information in the opening, at that point, they will ask for your business strategy. You should give information on month-to-month business pay, cost, and month-to-month family cost.

- At this stage, you will be approached to transfer experience certification and different documentations.

- After presenting the experience authorization, you will enter the third stage of the application where an inquiry concerning your record of loan repayment will show up. You will want to check the “yes” option.

- Now, you will arrive at the fourth stage of the credit application. Here, you will be needed to give relevant information of two references.

- In the following stage, you will be allowed to review the details you have submitted in the application.

- After cautiously reviewing the relevant information provided, you will click the “save and proceed” choice. After the completion f this part, you will arrive in the submission area.

- Now the second confirmation sign will appear again. If you want to make any changes to the details, then click on the sy=submit and proceed button.

- After completing the whole process, you will get an instant message on your mobile phone number confirming your enrolment.

- The message will likewise convey your application number and will request that you have to pay the Rs 2,000 application charge at any Bank of Punjab branch.

- Punjab Rozgar scheme 2022 apply online can also be done through the same steps

Interesting Points Of Punjab Rozgar Scheme

Here is a quota of the prominent foundations of the Punjab Rozgar Scheme:

- loan pay ranges from PKR 1 lakh to PKR 10 lakh

- loan pay is payable in 2 years to 5 years

- The plan offers the least increase rate since the program is sponsored by the public authority

Details Of Loans

Type of loan

The loan will be given according to bank strategy and working capital.

Reason for loan

- Setting up of new business

- Balancing for existing organizations

- Working Capital.

- Trading, Agriculture, and Live Stock

Credit Limit:

- The limit of loan pay in this plan is up to 10 Million Rs

- For Clean loaning from Rs. 100,000/ – to Rs. 1,000,000/ –

- For Secured loaning: from Rs. 1,000,001/ – to Rs. 10,000,000/

- In Punjab Green Development Program, the constraint of an advance will continue as before.

Security Of Credit:

The Guarantee of the borrower alongside something like one. The third underwriter ought to have a general total assets all in all equivalent to the size of the credit applied.

The Guarantee of Government worker of BS-10 or more alongside an individual assurance of the borrower. The assurance of the public authority representative will be obligatory.

The outsider has to have the identity of Pakistan and inhabitant of Punjab having a genuine CNIC. Should not be more experienced than 55 years. E-CIB of an outsider (underwriter) should have to be perfect. He must not have any past due or discount history.

Resource Delineation:

- Business/Residential/Industrial/vehicle/Agricultural Property having the perfect title and clear access (satisfactory to the bank) and respected by banks supported judge according to the bank’s strategy.

- The property has to be for the sake of the borrower or close family member of the individual/owner/accomplices.

- Documentation will be lawful division/according to bank credit strategy/Hypothecation on fixed/outside guidelines/current resources according to inner/Charge

Cost of Capital:

Cost of Capital will be paid by Borrower in a given time:

- 4% for clean loaning

- 5% be unable to summon up loaning

- Obligation Equity:

- For guys (80:20)

- Transsexual, Women, and Differently abled (90:10)

- Accordingly, 20%/10% of the venture cost will be contributed by the borrower

Criteria of Wealth Description

Total assets might be as Property or Vehicle proprietorship and might be surveyed as follows:

- Property valuation might be set up from the Wealth Tax articulation (WTS).

- Assessment by Pakistan Banks Association (PBA) supported specialist/evaluator

- The worth of the property will be assessed at the individual DC rate.

- Valuation of a vehicle will be receipt cost less reduction (10% for each spending year)