Whenever we talk about online transactions and gateway’s understanding, the first question that usually arises is that.

What Is a Payment Gateway?

Payment gateways are the advancements in technology used by sellers to accept debit/credit card payments from their customers and, on the contrary, by buyers to send debit/credit card payments to their sellers.

This not only refers to the card reading devices often found in traditional street-side stores but also points to the online systems that help the transfer of consumer’s money in the seller’s vault through the internet.

For your convenience, we can metaphorically think of the gateway as a cash register in an electronic transaction, and like any cash register, it needs to prove itself on the stages of security and how convenient it is to use.

Most payment gateways accomplish their goal of security and user-friendly structure in a few seconds with the following steps:

Encryption: Between the server of the distributor and the client’s Internet service provider, a payment gateway will encrypt and compute data for specific use between the buyer and seller.

Request: The request for authorisation occurs when the payment processor gets approval from a financial institute or any credit card company to head forward with the transaction.

Completion: When the payment gateway gets the authorization, it allows the website to move forward with its next action.

The payment gateway also serves a few following other functions:

• Screening orders.

• Calculation of tax costs.

• Use of geolocation for location-specific actions.

How Does a Payment Gateway Work?

Payment gateways, particularly the on-net payment gateways, are front line technologies that transfer the client’s financial information to the distributor’s bank, where the payment transaction then takes place.

Payment gateways in Pakistan

Payment gateways in Pakistan are placed at a noteworthy place and are a remarkable impact holder when it comes to the digitalization of the country.

Businesses offering to sell their products or services on the net face a major challenge when it comes to finding the trusted and accurate payment gateways in Pakistan.

Here we’ll dive deep into the best options of the payment gateways available in the market, some of which you weren’t even aware were present.

Voila, we now have a good understanding of how a payment gateway works and what a payment gateway is and how its working structure connects a financial model between the buyer and the seller.

The question now is, what are some of the best payment gateways in Pakistan. Let’s solve this query by dividing the six best payment gateways available in Pakistan into two major categories (three each).

Best Payment Gateways in Pakistan – Banks

Talking of money, transactions, and selling/buying, the very first thing that comes to mind are banks.

The transactional journey of payment, even when accelerated through online technology, always ends with someone’s bank account.

So, let’s start with the banks that are providing the country with online payment gateways.

- United Bank Limited

- Habib Bank Limited

- Muslim Commercial Bank Limited

United Bank Limited

United Bank Limited is a big player in the Pakistani banking industry; United Bank Limited (UBL) has a customer base of 4 million.

United Bank Limited is considered one of the widest banking networks across the country, having around 44,000 customer touchpoints and around 1,400 branches count nationwide

Pros: No transaction fee is required.

Cons: You receive no SMS alerts via UBL Wiz card on shopping/purchasing online.

Habib Bank Limited

Habib Bank Pakistan, also known as HBL, is a remarkable and noteworthy commercial bank in Pakistan with a jaw-dropping customer base of 27 million.

When it comes to online payment gateways in Pakistan, Habib bank provides its clients with a simple and easy transactional method no matter if you’re using a website, a mobile app, an eCommerce store, or social platforms like Facebook, Instagram shop.

Pros: HBL is a remarkable and renowned payment gateway, and it offers protection from fraudulent transactions.

Cons: Charges for internet payments are higher as compared to other banking options.

Muslim Commercial Bank Limited

Muslim Commercial Bank Limited has a remarkable and noteworthy name in the banking space of Pakistan; MCB has a customer base of a whopping 7 million. There are 1550 branches of MCB in Pakistan.

Pros: MCB offers enhanced security to its clients.

Cons: Over the years, MCB has failed to achieve a good customer service reputation among its customers.

Best Payment Gateways in Pakistan – Fin-Tech Companies

We’ve had a look at some of the leading names in the banking industry, which were making a route between buyer/seller easier to access through the internet. Let’s now put an eye on some modern-day fin-tech companies (financial technology) built with the only motive of making transactions easy.

- JazzCash

- Payoneer

- EasyPaisa

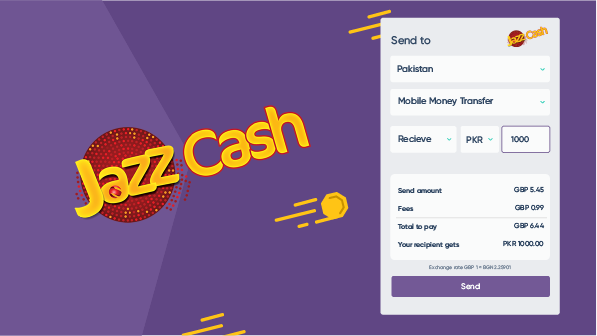

JazzCash

JazzCash is a mobile money transferring service provided by a leading telecommunication company called Jazz in Pakistan with a user count of over 9 million.

Jazz gateway lets users send money to CNIC, bank account, or JazzCash mobile account in a matter of seconds.

Pros: JazzCash offers Quick money transfer and is easy to understand. It offers a simple flow of finance, can be connected with your Payoneer account

Cons: In JazzCash, there is no sign in option after installation of the app. The application’s fingerprint’s pin can be problematic sometimes.

JazzCash is not a fin-tech company, but it plays a similar role; it is an actual bank account that is connected with your mobile number, offering you the transferring/receiving of money anywhere, anytime.

JazzCash can be used for loan payments, insurance, saving plans and online payments.

You can send/revive money through JazzCash via:

- CNIC

- Bank account

- Mobile number

Payoneer

Payoneer is a renowned payment platform founded in 2005, which makes online money transfer easier and provides its clients with digital payment services for business, freelancers, SMEs and corporates.

Pros: Payoneer offers payment’s transfer directly to your local bank. It provides less transaction amount for a cross-border application.

Cons: International transfers must include a purchase of a service. Payoneer’s annual fee ($29.95) is comparatively much higher.

In Pakistan, Payoneer is being used at a usage scale of another renowned payment platform, PayPal, in other countries.

Payoneer has revolutionized the financial space greatly when it comes to freelancing platforms like UpWork and Fiverr, to eCommerce markets like Amazon and finally, to big companies like Google & Airbnb,

• Transfer Options: Online, Telephone.

• Withdrawal Options: Bank.

• Payment Options: Bank Transfer, Credit/Debit Card.

EasyPaisa

EasyPaisa was the first mobile banking service launched in Pakistan. It was first launched in 2009 by a well-known telecommunication company, Telenor. According to analysis, in 2020, EasyPaisa had over 7.4 million users and has seek more growth in the present year.

Pros: Easypaisa has a Low transaction charge of 2-3 percent for distributors. Its Mobile Application is designed in a very user-friendly way and is very easy to operate.

Cons: In Easypaisa, when correcting failed transactions, occasional problems occur.

When it comes to online payment gateways, EasyPaisa offers the following advantages;

Easypaisa payment gateway has grown massively and is serving the following companies with its offerings:

• Hummart

• Bykea

• Uber

• Daraz

Conclusion

Finding the best payment gateway in Pakistan can be a tricky job, especially when there are so many banks and fin-tech options available. However, you can still manage to do so by considering a few factors before choosing your online payment gateway in Pakistan.

• A simple and easy to understand payment flow.

• The integration process should be easy.

• Service fee should be low

• Transaction’s nature should be effective.

• Singing in/Singing out should be easy on the application.

Keeping in view the six discussed payment gateways options in Pakistan, there is no perfect payment gateway; each has its own pros and cons. For selecting the one that fits you best, you just have to pick one that aligns with your business needs nearest.