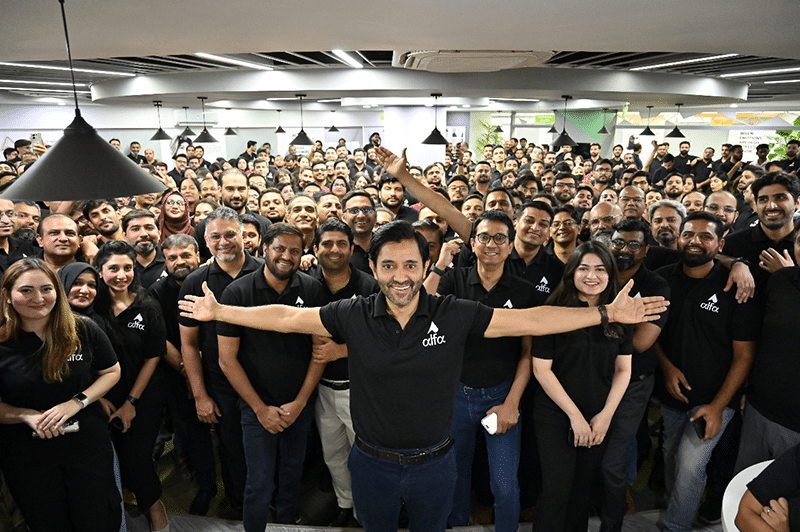

Bank Alfalah, a leading commercial bank in Pakistan and the incumbent Best Bank for Digital Banking, announced the launch of its new mobile banking application, Alfa. New Alfa is purposely curated to promote financial inclusion by departing from a mere transactional banking app and moving to a digital lifestyle app. People can now experience Alfa’s advanced new features of savings, investment, and borrowings across a wide range of choices, alongside its new user interface design, which integrates banking into people’s lifestyles.

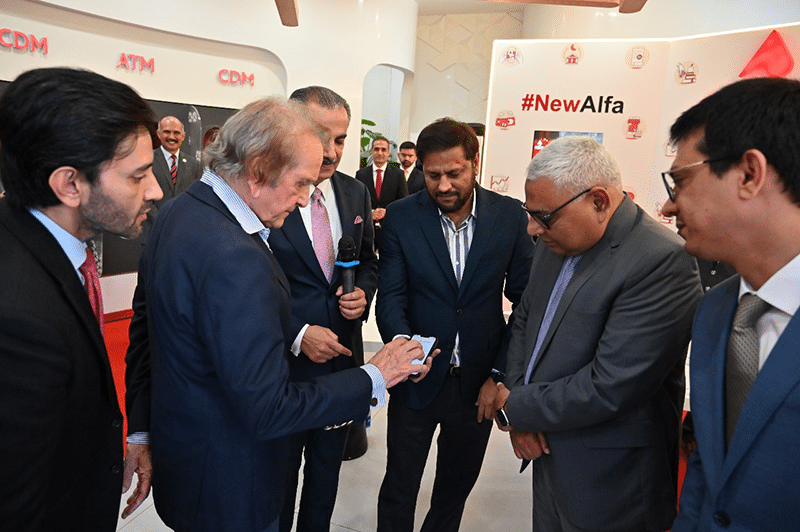

The Alfa app launch event was held at Bank Alfalah’s Digital Lifestyle Branch inaugurated by Mr. Syed Sohail Jawaad, Executive Director of the State Bank of Pakistan and Mr. Syed Salim Raza, Former Governor of State Bank of Pakistan. Also present at the launch was the senior leadership from Bank Alfalah along with key opinion leaders from the digital world, marking a significant milestone in the bank’s commitment to digital innovation. Muhammad Yahya Khan, the Chief Digital Officer of Bank Alfalah, delivered a comprehensive presentation on the new Alfa App, highlighting its numerous innovative features, which included:

Save and Invest:

- Obtain a comprehensive net worth view, including savings, deposits, investments, and borrowings.

- Save and invest funds into term deposit receipts via the Alfa App, offering conventional and Islamic banking options to earn profit from balances.

- Invest in mutual funds, securities, Pakistan Investment Bonds, and treasury bills instantly.

- Create personal financial goals and activate an automated scheduler with insurance.

- Open digital accounts in PKR (conventional or Islamic, saving or current) USD, GBP, EUR, and AED, and seamlessly convert currencies online between the accounts.

Borrow:

- Access quick loans up to PKR 750,000 instantly

- Purchase products with a payment plan of Buy Now Pay Later via AlfaMall.

- Get a credit card instantly.

- Instant access to the overdraft facility on account

- Availability of digital agriculture financing

- Access to digital automobile loans

Digital Onboarding:

- Simplified onboarding based on the user’s CNIC

- Block or unblock debit-credit cards across multiple channels (point-of-sale, e-commerce, ATM- locally and internationally)

- Increase or decrease Alfa App limits depending on the user segment.

- Allows a daily limit of up to Rs. 10 million depending upon user segment

- Get statements that show the names of people who sent or received money instead of account numbers.

- Log in to internet banking via Alfa. This eliminates the need for users to remember separate login credentials for Internet banking.

- Personalise the home screen with preferred widgets

- Choose the language of choice.

Payments:

- Schedule automated bill payments for utilities, school fees, loan payments and so on without ever missing a due date.

- Avail a virtual debit card with personal spending limits and expiration dates for secure e-commerce transactions.

- Use secure tokenisation to make seamless, contactless payments directly without carrying a physical card.

- Use the app to scan and make payments to any merchant QR

- Split payments across multiple funding sources such as accounts, credit cards or orbit points.

At the curtain raiser event, the bank also launched Pakistan’s first fully digital, instant-processing Cheque Deposit Kiosk (CDK). This innovation enables customers to access a real-time cheque-clearing solution. Developed indigenously by the bank’s technologists and data scientists, the CDK leverages advanced technologies such as Optical Character Recognition (OCR), biometrics, cryptography, and machine learning to accept, read, and process cheques digitally on a 24/7 basis for Bank Alfalah accounts.

Through this innovation, the bank aims to migrate significant manual teller transaction traffic to a secure, automated digital platform available around the clock. Small businesses are expected to adopt this innovation as they previously embraced the bank’s Cash Deposit Machines, which now generate over PKR 500 billion in annual volumes.