In this article, you will get to know about Jazz cash account and how to make Jazz cash account. If you are unfamiliar with the procedure for opening a Jazz Cash account, then don’t worry, just read the article thoroughly. Once you have established a Jazz Cash account, you will be able to transfer funds to any other account other than those used for paying bills and getting payments.

About Jazz Cash

This naïve, consumer population is using mobile data at a higher rate than ever before. In Pakistan, two-thirds of the population has not yet purchased a smartphone. However, this trend is shifting at a rapid and continual pace. Indeed, younger generations in the present era of technology are making communication more accessible and faster than previous generations.

Jazz Telecom is the largest mobile provider in the country, operating the largest data and voice network and attracting the greatest number of subscribers. That it became the country’s first GSM operator, the firm made history in Pakistan.

Jazz is still at the vanguard of the country’s rapidly expanding digital scene, thanks to the enormous investments it has made in 2G, 3G, and now 4G technologies. Jazz Cash, the company’s digital financial services platform, is also the most extensively utilised digital vault in the world. It offers mobile-based services, such as transfer of funds and bill payment, besides online payment gateways for e-commerce transactions.

About Jazz Cash Mobile App

Jazz Cash has reached yet another milestone with the addition of 4 million active mobile users to its record. In addition, the value of transactions increased by PKR 350 billion over the first six months of this year, representing a significant increase over the same period last year. Compared to the same period last year, this is an 85 percent increase in revenue.

The Jazz Cash mobile accounts processed over 190 million transactions in the first six months of this year, the company announced today. They completed 115 million transactions during the same period last year, representing a 65 percent growth over the previous year.

In order to deliver state-of-the-art financial services, Jazz Cash has always sought to respond as quickly as possible to the increasing demand of its loyal consumers. Further evidence of this reality can be found in the enormous increase in mobile account transaction volume. Customers have a high level of trust in the services they provide.

Jazz Cash also updated its mobile application and launched a brand-new online banking facility for its users during the years. The mobile app’s interface is based on global best practises,Customers and it includes additional features that will further improve the entire user experience.

User registration for their mobile account is now possible using the new mobile app, which allows users of any mobile network to access all services such as Sand Money, Pay Bills and Mobile Load Payments, Demand Money, Request Friends, & Fast Pay QR Payouts.

Jazz Cash Mobile App features:

It is one of the most useful features developed by Jazz’s mobile network provider, and it is called the Jazz Cash mobile account. They will associate the account you would open with your mobile phone number. Your mobile phone can also access your mobile account. The Mobile Account menu is accessible to all mobile phone models and operating systems.

There is no requirement for a smartphone. A bank account can not travel. You will have full freedom to access financial services from any location with this portable account.

Its prominent features are:

- You can immediately buy and activate.

- Pay no fees every month or every year!

- Merchants recognized over than 50,000 online and retail visas, both in person and online.

- Over 12,000 ATMs are spread across Pakistan, You can get your cash from them.

- Every purchase comes with a free SMS alert.

Procedure to Open Jazz Cash Mobile Account:

Step no 1

In the first step, you will have to do registration of your mobile account. You can set Jazz Cash mobile accounts on any network’s mobile number. Users of Jazz and Warid mobile accounts who have been biometrically confirmed can register their mobile accounts by dialing *786#.

Any other network users who wish to create a mobile account through biometric verification can do so at their local Jazz Cash Agent, Jazz Franchise, or Experience Center.

Step no 2

Following successful registration, you have to do one of the following mentioned task:

- Users of Jazz and Warid can create a 4-digit MPIN by dialing *786# or by using the mobile app on their smartphones. While Other networks users can generate their own MPINs by using the mobile app, which is available for free download.

- A 4-digit MPIN that is required for each transaction protected all mobile account activities. For whatever reason, you might lose track of your MPIN. Dial 4444 from Jazz or Warid or 051-111-124-444 to have it reset.

Step no 3

You will make a free deposit into your mobile account after your mobile account registration is complete. To locate your closest Jazz Cash Agent, please send an SMS with the letter ‘M’ to 2179 (which is free).

If you have a bank account, you can use the online banking or ATM transfer option to move funds from your bank account to another account in an instant. All that is required is that you choose Mobilink Microfinance Bank (previously Resource Microfinance Bank) as the receiver of your donation. They should use your mobile number as an account number.

You will receive your money instantly, regardless of whether you deposit through a Jazz Cash agent or a financial institution such as a bank. You will also receive an automated SMS from the number 8558.

Step no 4

Customers of Jazz and Warid can finish any transaction by dialing *786# and following the on-screen instructions. Users of Jazz and Warid can also access their mobile account via smartphone application.

Access to their mobile account by other network users is only possible through the mobile application. You will receive a digital receipt for each transaction that is processed through the number 8558.

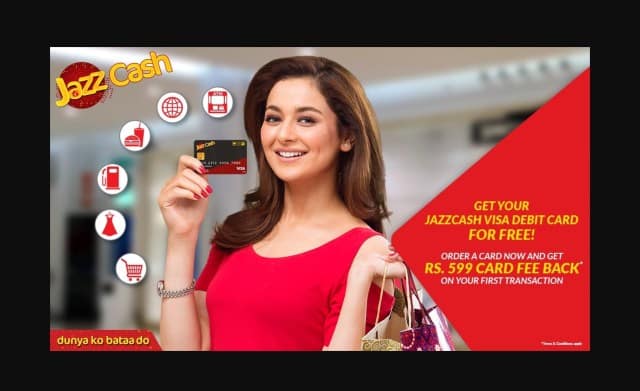

Jazz Cash ATM Card facility

It is possible to get a Jazz Cash Visa Debit Card for Mobile Account at any Jazz Point, Jazz Experience Center, or Mobilink Microfinance Bank branch location. Getting and activating a Visa Debit Card is a straightforward process. All that is required is that you provide your mobile phone number. And confirm that they have linked the card to your MPIN.

When you link your card to your mobile account, they will deduct fee of Rs.299 from your account. The agent will not be charged any additional fees in this situation. Once your card has been linked, all you have to do is go to “Manage ATM” under “My Account” and enter the four-digit MPI of your Visa Debit Card using your mobile account MPIN. Make it happen.

To put it another way, your card has already been activated! You can also use your Visa Debit Card to withdraw money from any bank’s ATM anywhere in the country, as well as to make simple purchases at more than 50,000 Visa merchant locations in stores and online.

Wrapping Up

This article was all about Jazz Cash, the Jazz Cash account, and the prominent features of the Jazz Cash account. I hope you find this article to be of guidance. If you have questions, feel free to post them in the comments section. Do spread the word about this article among your family and friends.