EOBI Employment advanced age Benefit foundation is heavily influenced by the Ministry of abroad Pakistanis, and HR improvement is an administration organization for government representatives. It framed EOBI in 1976 for the public authority workers to give a benefit at their advanced age.

How To Apply For Eobi Pension

In this program, a registered employee contributes some part of their monthly salary during the period of their employment. The government sets the percentage for each employee, and they return this money at their old age as a pension in their retirement.

When an individual is enrolled in EOBI, he stays a piece of it until he leaves the work and joins another business. EOBI guaranteed the representative that their cash is saved and will help in their advanced age period.

The benefits are typically presented at 60 years old and following 15 to 20 years of administration, and that representative who doesn’t work as a result of ailment and cases an annuity. This foundation guarantees administration for those who do government occupations in Pakistan.

- This plan is worked under the Employees’ Old-Age Benefits Act, 1976, and covers representatives working in modern, business, and different associations. The Employees Old-Age benefits foundation (EOBI) works with the arrangement of this advantage by playing out the accompanying capacities.

- Identification and Registration of Institutions as well as Businesses.

- Documents as well as Recording of Assured individuals

- Group of Contributions

- EOB Fund Management

- The facility of Assistances according to Laws

The EOBI remains the Government organization that works under the Ministry of Overseas Pakistanis and Human Resource Development. EOBI was framed in 1976, to give annuity, advanced age advantages, and social protection to enlisted representatives.

The enlisted representative and the business of the enrolled individual need to contribute some level of compensation to EOBI during the time of insurable work. Businesses need to pay 5% of the base wages set by the public authority. Then again, the guaranteed representative needs to pay 1% of the base wages.

Eligibility Criteria:

EOBI has qualification models for government workers to guarantee benefits from the public authority. Hence, know qualification measures before applying for benefits in EOBI.

- All organizations, rather than industry, can add to this plan except representatives of the state, police faculty, military, neighborhood bodies, and other nearby specialists.

- The organization has more than five workers who can enroll their representatives for an annuity.

- The individual should be an administration worker since private-area representatives are not qualified for benefits.

Advantages of Eobi

Above we examine How to Apply for EOBI Pension and presently in the accompanying, you’ll have its advantages. Business advanced age benefits establishments give a few advantages to safeguarded or enlisted workers at their advanced age. These are the accompanying advantages of EOBI to government representatives.

The public authority of Pakistan likewise gives assets to EOBI. It likewise puts resources into productive tasks to create pay which is utilized for giving annuity to the safeguarded people. The base annuity of a safeguarded individual is Rs. 6500. In any case, Exceptional Associate to PM for Out of the country Pakistanis as well as Human Resource Development, Zulfiqar Bukhari declared last year that base benefits presented by EOBI will be expanded from 6500 to 8500 Pkr.

- Advanced (old) age benefits:

EOBI offers benefits to representatives at their advanced age, which is beneficial for them. The representatives who complete their 15-year administration and age limit are qualified for benefits. An individual gets an annuity after retirement and within a half year of asserting the benefits.

- Deficiency benefits

If the representative is debilitated for a brief time frame or for all time, he is given shortcoming benefits. They began these benefits within a half year of the case dependent on a clinical report. Notwithstanding, on the off chance that the representative cripples for a lifetime, they convert this shortcoming benefits into a lifetime deficiency annuity for a worker.

- Survivor’s annuity

Survivor’s annuity is given to the representative’s folks and widow after his demise. According to the EOBI rule, the matured guardians and widows are qualified for a survivor annuity. The guardians take the benefits for around five years, and the widow takes it for a lifetime. For instance, if the representative completes three years of work, the widow gives lifetime benefits. Regardless of whether the widow gets a subsequent marriage, they will give benefits to their youngsters’ lifetime.

- Advanced age award:

Advanced age awards are for the individuals who complete their administrations and get resigned yet don’t meet the benefits prerequisites. This award pays in a solitary portion and contains a month’s normal wages duplicated by their long stretches of government work in Pakistan.

I trust the above-if directions concerning how to apply for EOBI benefits will help you, on the off chance that you have any inquiries, let us know in the remark area.

Step By Step Instructions To Guarantee A Benefits In EOBI:

EOBI digitalized its information base and records online to make it simpler for representatives to get their benefits or assets. For instance, government occupations in Pakistan who arrive at 55 or 60 can apply for their annuity by the accompanying techniques.

- Click individual data, add EOBI number and get all data about enlistment or archives.

- All necessities are referenced in your information base to guarantee the benefits.

- Collect all keep and send your necessary archives to the closest EOBI office.

- They validate reports required CNIC duplicates, identification photographs, EOBI enlistment card, evidence of work, and so forth

- EOBI checked your archive and sent you a case structure.

- Fill the structure with every single required detail and send this structure to the provincial EOBI office.

- EOBI began dealing with your structure and, straightaway, without a doubt your benefits.

- Once the interaction finishes, you will get a benefits book/card within 30 days.

- Once the guarantee of a benefit is finished, you can get an annuity in your ideal bank

Documents Required For EOBI Claiming Pension And Pension Rules

- EOBI registration pass

- Demonstrated duplicate of CNIC (retirement pension claimer in addition to his or her significant other)

- Double up-to-date verified pictures of the indemnified individual

- Previous year’s remuneration documentation from the company. individuals can give in to the previous month’s earnings documentation in addition.

- A shred of evidence from the company that the listed individual has not once surrender to the annuity entitlement form previously.

- In the circumstance of departed indemnified personalities, their other half can prerogative the retirement pension. Their significant other has to stand up to the NADRA delivered passing away documentation, Household Registering Official document (FRC) as well as Nikkah Nama.

Company Accountability For EOBI Pension Payments

- The company stands guaranteed to compensation of five percent of least possible period scale remuneration professed by the administration for every single wage earner one or the other stable otherwise predetermined.

- The company is Accountable to decrease by one percent involvement of the least possible period scale remuneration from wage earner earnings in addition to credit inappropriate method.

- The company is allowed to expedite EOBI as well as workers for issuance of EOBI Identification card.

- The company is allowed to preserve the involvement declarations, periodic as well as per annum in addition to being responsible for the aspect to EOBI constituent part.

- The company is Accountable to keep up the records in addition to illustration to EOBI Authorized on request

Employees Accountability for EOBI pension payments

- The company’s Wage earner stands guaranteed to one percent of the least possible period scale income to EOBI as his portion of involvement.

- The employee should recollect the EOBI Identification card in not dangerous guardianship

- Categorizer the EOBI Entitlement when appropriate

How To Get An EOBI Sahulat Card Online?

To spontaneously get an EOBI Sahulat Card, you have to be registered with the EOBI catalog.

- Go to the EOBI website at www.eobi.gov.pk.

- Tick “Individual Information” in addition to crisscross your EOBI Registering number through your identity card number.

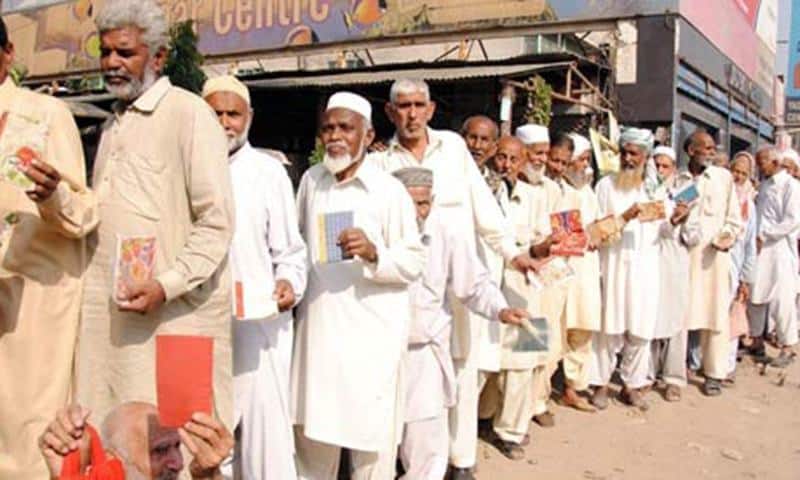

EOBI retired persons are a great amount of elder inhabitants who have superannuated from numerous systems of government. This general public, on the other hand, can hardly shield their regular expenditures with their present continuing retirement pension of rs 7000

The retirement pension hardly assistances them in recompense convenience beaks. At this time, pensioned off workers are facing severe post-retirement monetary poverties owing to an unexpected outpouring in the charges of indispensable merchandise as well as medications in addition to additional increasing expenditures. Retired people wanted eobi pension increase.

The mandatory administration remains demanded to upsurge the volume of retirement pension. EOBI pension increase should be made for all people. Even though the administration proclaimed intensification in the incomes of centralized management organizations a small number of months before, it didn’t make available any kind of monetary advantage to senior citizens.

Meanwhile, numerous retired people are older inhabitants the superannuation age in the nation-state remains 50 or else beyond. They are incapable of either one discover an occupation otherwise took to the roads to request an increase in their retirement pension.

In December 2021 the PTI leader announced that there would be an increase in the EOBI pension rates the least possible EOBI retirement pension aggregate would be Rs10, 000 each month. However, no such policy has been updated until now. People are still waiting for the miracle to happen.