Pakistan is one of the nations on the planet with the least duty to-GDP proportions. The assessment of GDP proportion tells about country advancement in a year. With higher the Gross Domestic Product (GDP) of a country, the more the income of a nation will be. Thusly, the public authority will attempt to expand the expense base. This is the thing that the public authority of Pakistan is attempting to do.

As per a measurement from the Federal Board of Revenue (FBR) Pakistan, just 1% of the absolute populace are dynamic citizens. It’s humiliating for a nation of 220 million populace. In any case, the Government of Pakistan is attempting to address this region. With changes being made in the Federal Board of Revenue (FBR), we can anticipate an increment in the level of the dynamic citizens.

The overseeing body FBR flourishes to guarantee that Pakistan residents push ahead and become citizens. Laws and strategies are set up to drive individuals to submit burdens and become charge filers. Instructions to turn into a Tax Filer is a typical inquiry. Because of the absence of data, individuals will more often than not become alarmed.

Pakistan has one of the most reduced duties to GDP proportions. Thus, the government will in general make cycles and laws to help and persuade non-citizens to become citizens. To make a worth position and motivating force plan for the residents, the public authority makes two gatherings.

One gathering is known as the filer and the other is known as the non-filer. Filers get more impetuses when contrasted with non-filers. With more tax breaks, the public authority will in general relocate an ever-increasing number of individuals to the assessment section of filers and empower them to present their expenses.

Non-filers deteriorate charges joined onto them. Likewise, the public authority is currently working with organizations to additionally work with the assessment filers. So you may even improve administrations in government and public regions.

2018 is the year when new policies are being made. For 2019 and past charge filers will be seeing an ever-increasing number of advantages coming to them. 2020 is challenging also

What Is A Filer In FBR Terms

Before we document, let us initially get what is a “filer”. A record is an individual or organization that is a piece of the Active Taxpayers List (ATL). ATL is an itemized list that the Federal Bureau of Revenue (FBR) keeps up with. Rundown refreshes each Monday. Expense Lawyers work on refreshing their clients accurately and right away. Furthermore, stand by a couple of days so ATL can be refreshed.

Presently the public authority has given specific advantages to filers. Also, thus the need to get filer status. Without being a filer, you are not given specific advantages. You get limits on buying a vehicle and there are no covers as far as buying houses. For instance, if you purchase a plot esteemed at Rs.8.00 million, you should pay an assessment of Rs.320,000 on the off chance that you have not recorded your expense form, however in case you are a filer, you need to pay just Rs.160,000. Likewise, on the acquisition of a vehicle, the assessment for a non-filer is twofold that paid by a filer.

This makes it more worth the while to turn into a filer and that too on a quick premise. Furthermore, if you don’t have turned into a filer, you cannot get expense forms.

Step by Step Guide To become a Tax Filer

Here are the fundamental advances needed to come to an expense filer. This means answering how to turn into a duty filer in Pakistan. These are the fundamental advances that charge specialists will proceed also. This will tell you how to become a filer in Pakistan.

- Obtain an NTN Number. NTN represents National Tax Number. Number required.

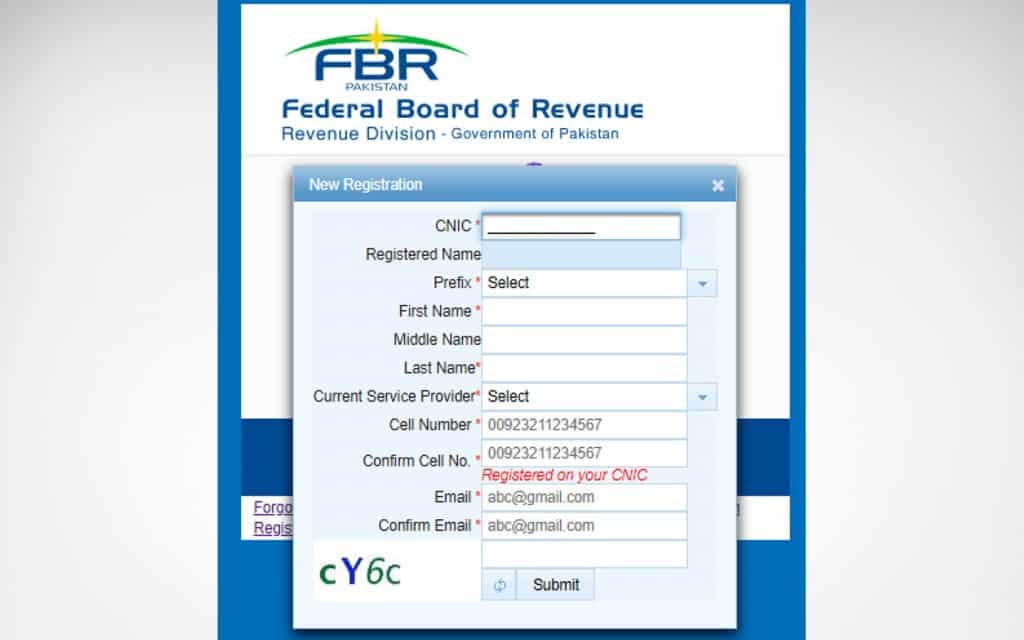

- You can without much of a stretch acquire an NTN number by essentially visiting a middle and applying or going to https://iris.fbr.gov.pk/infosys/public/txplogin.xhtml and making a solicitation. Go to the site and afterward go to the Registration for Unregistered Person tab. It is a basic structure. After filling it, NTN produces.

- NTN number requires roughly a couple of hours and you will have a remarkable NTN number available to you.

- IRIS Registration. Go to the fbr site and go to the IRIS tab. From that point register yourself for e-enlistment.

- Once enlisted you will get an affirmation on your email indicated.

- Then sign onto IRIS and electronically fill in the information. You want to have all the applicable assessment content accessible.

- Once you present every one of the information, IRIS will affirm that you have now submitted.

- After fruitful accommodation, you receive an email affirmation. Later you are dynamic on the ATL posting.

- You can approve that by signing on and entering your NTN or CNIC.

How To Become A Tax Filer

The only way to become an active taxpayer and filer is to timely submit your last income tax returns. This is a mandatory step. Typically, if you are not paying to submit your tax returns for any fiscal year, the system automatically takes you from filer status to non-filer status.

There are currently two ways of filing. One is the manual filing and the other is the online filing. We highly recommend using the online version. An online version is faster and more convenient. The government takes too much time in processing the data and uploading it from the manual end.

There are many cases where people make their returns manually and they still do not see their tax forms and returns updated. This causes multiple visits to the office and pain in the neck. Always using a certified tax lawyer to get you set and online immediately is the best practice.

Benefits Of Filer In Pakistan

Need to begin recording expense forms? Do it immediately. Citizens in Pakistan appreciate more help on charges contrasted with the non-filers. In this way, how about we investigate the rundown of benefits of being a duty filer in Pakistan.

- Taxpayers are simply needed to pay half of the keeping charge in contrast with the duty paid by the non-filers.

- A non-filer is banned from claiming a property worth over PKR 50 lakh while individuals who routinely document assessment forms can buy any property.

- Non-filer shippers of natural substances would need to pay 8% on the all-out import while citizen merchants are needed to pay 5.5% on unrefined substance imports.

- filer in pakistan Pakistan. Then again, the citizens are simply expected to pay 6% obligation on their business sends out.

- An absolute of 20% expense is responsible for the profits (organization’s benefit) of non-filers against the 15% duty rate set for charge filers.

- Coming to the duties demanded on benefits of banks and saving plans, a non-filer needs to pay 15% expense against the 10% duty paid by dynamic citizens in Pakistan.

- Tax filers just compensation 15% duty after winning prize cash through prize bond when contrasted with the 25% expense paid by the non-filers.

- People who ordinary record personal expense forms need to just 1% on property move charge against 2% assessment paid by landowners who are non-filers.

- Whether it’s the selling by the government or some other private substance, charge filers pay just 10% expense against 15% duty paid by non-filers in Pakistan.

There are two different ways to check FBR status. One is on the web and another is through SMS this article will inform you concerning really looking at your filer status in Income Tax (WHT) which is important for pretty much every resident over 18 years old and who procures an available pay or does any business. Each salaried individual, financial specialist, organization, and different elements should be a filer in Income charge.

FBR has made things simple these days with improvements as of late. Presently you can check your filer status effect on the web or through SMS. Here are basic advances you want to do to check in case you are a filer or a no filer:

How To Check Filer Status Online In Pakistan

You may check your filer status online by going to this link:

https://e.fbr.gov.pk/esbn/Verification

Stage 1 Under Parameter type select NTN in case citizen is Business or AOP. In case a citizen is an individual you should choose CNIC choice. Enter CNIC no or NTN in Registration No. field as indicated by boundary choice. (The worth should be added without dash).

Stage 2: Under the Date field, you can choose any past date to take a look at your ATL status for the wanted date

Stage 3: Enter manual human test code under the entering code field.

After giving all subtleties, click on the Verify button to see the outcomes. After effective confirmation, the result will be shown on your screen. There, you’ll track down your Registration Status: Active or Inactive

Personal Tax implies you are just enlisted for Income Tax and not really for Sales Tax. Generally, business people and organizations are enlisted in Sales Tax too. Salaried people need to enroll themselves in Income Tax as it were.

Checking Status Through Text:

All you need to do is to type “ATL (space) 13 digits CNIC number” and send it to 9966.

In case you are a company or AOP, Type “ATL (space) 7 digits National Tax Number (NTN)” and send it to 9966. You will receive an SMS confirming your status as Active or Inactive

In case you belong to AJ&K then you need to do the following. For individuals send it to 9966.