According to the central bank’s auction calendar released on Monday, the government planned to borrow Rs5 trillion from banks over three months (May-July) to bridge the revenue and spending imbalance.

By the end of May, the government hoped to raise Rs4.1 trillion from market treasury bills and Rs900 billion from Pakistan investment bonds (PIBs).

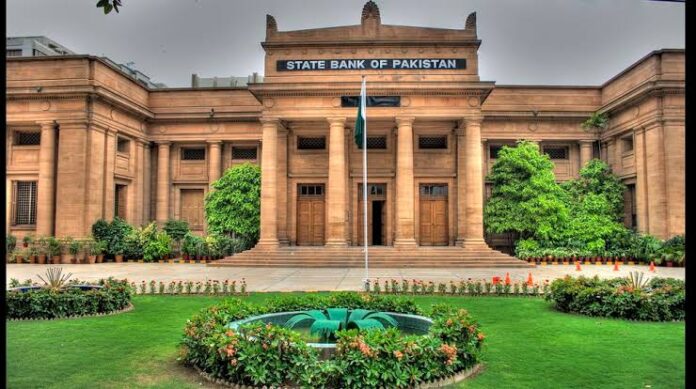

The State Bank of Pakistan would sell Rs375 billion in three-, five-, ten-, fifteen-, twenty-, and thirty-year fixed rate PIBs and Rs210 billion in five- and three-year floating rate PIBs. During the same time period, it would auction Rs105 billion in two-year floating rate PIBs. The government’s last auction schedule indicated that it wishes to enhance the supply of long-term papers to satisfy its funding needs, as evidenced by the fact that the auction targets (amount) for floating rate PIBs have been increased.

Banks meet a major portion of the government’s domestic finance needs. To finance the budget deficit, the government sticks to its goal of zero borrowing from the central bank and mobilises funds through commercial banks and the National Savings Scheme.

In the first half of the current fiscal year (July-December), the government raised Rs1.4 trillion in net finance. Privatization, external donations, and borrowings helped it raise Rs450 billion.

In July-February 2021, the budget deficit as a proportion of GDP was 3.5 percent (Rs1.603 trillion), down from 3.7 percent (Rs1.613 trillion) the previous fiscal year.

The budget deficit is expected to remain high this fiscal year, at 8.3 percent of GDP, according to the World Bank. The International Monetary Fund (IMF) forecasted that Pakistan’s fiscal situation would worsen this fiscal year, with the budget and primary deficits at 7.1 percent and 1% of GDP, respectively, and debt levels at 87.7%.

The GFN is likely to fall even more in FY2021 as a result of the DSSI extension and the government’ effective attempts to stretch the maturity profile of domestic debt, according to the report.

“With SBP financing no longer accessible, the government has been able to acquire enough funding, largely from domestic commercial banks, through the issuance of short-term T-Bills and long-term PIBs denominated in domestic currency,” the government noted in a recent report.